/Cognizant%20Technology%20Solutions%20Corp_%20Plano%2C%20TX%20office-by%20JHVEPhoto%20via%20iStock.jpg)

Cognizant Technology Solutions Corporation (CTSH), headquartered in Teaneck, New Jersey, is a professional services company that provides consulting, technology, and outsourcing services. With a market cap of $32.1 billion, the company focuses on technology strategy consulting, complex systems development, enterprise software package implementation and maintenance, data warehousing, and business intelligence. The outsourcing and technology giant is expected to announce its fiscal third-quarter earnings for 2025 in the near term.

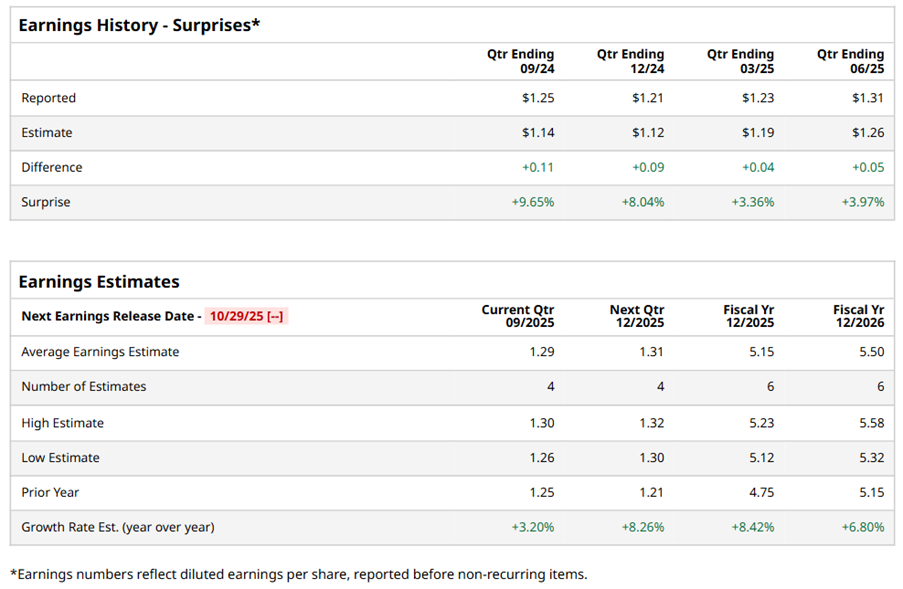

Ahead of the event, analysts expect CTSH to report a profit of $1.29 per share on a diluted basis, up 3.2% from $1.25 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CTSH to report EPS of $5.15, up 8.4% from $4.75 in fiscal 2024. Its EPS is expected to rise 6.8% year over year to $5.50 in fiscal 2026.

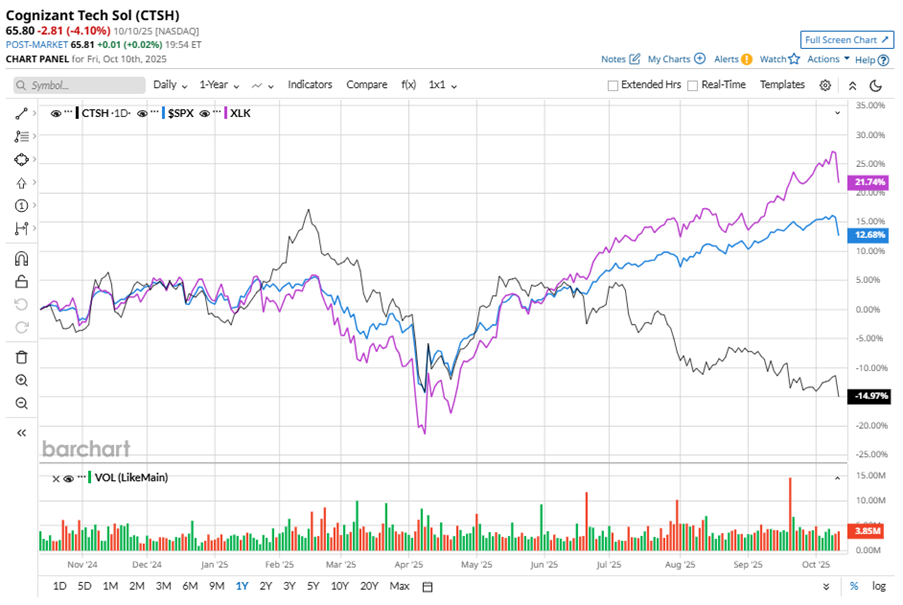

CTSH stock has considerably underperformed the S&P 500 Index’s ($SPX) 13.4% gains over the past 52 weeks, with shares down 11.7% during this period. Similarly, it significantly underperformed the Technology Select Sector SPDR Fund’s (XLK) 20.8% gains over the same time frame.

On Jul. 30, CTSH shares closed down by 1.8% after reporting its Q2 results. Its adjusted EPS of $1.31 beat Wall Street expectations of $1.26. The company’s revenue was $5.3 billion, exceeding Wall Street's $5.2 billion forecast. The company expects full-year adjusted EPS in the range of $5.08 to $5.22, and expects revenue to be between $20.7 billion and $21.1 billion.

Analysts’ consensus opinion on CTSH stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, six advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 16 give a “Hold.” CTSH’s average analyst price target is $87.47, indicating an ambitious potential upside of 32.9% from the current levels.

.jpg?w=600)