Atlanta, Georgia-based The Coca-Cola Company (KO) is the world’s largest non-alcoholic beverages brand. It offers sparkling soft drinks, water, coffee, value-added dairy, plant-based beverages, and more. With a market cap of $287.4 billion, Coca-Cola’s operations span all across the globe.

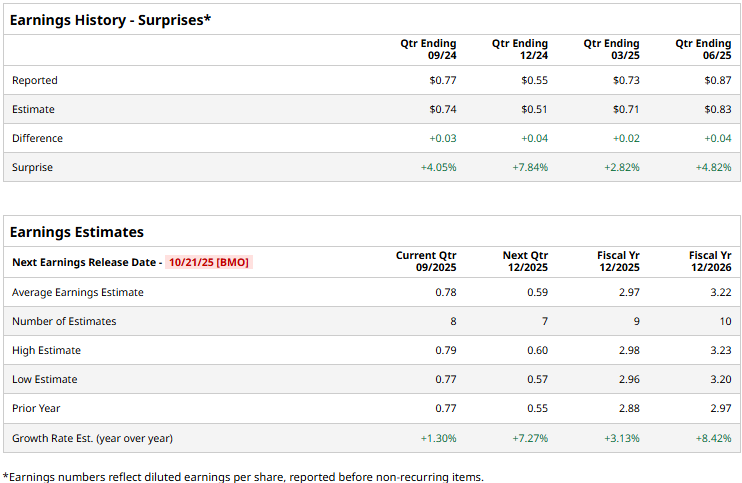

The soft drinks giant is gearing up to announce its third-quarter results on Tuesday, Oct. 21. Ahead of the event, analysts expect Coca-Cola to deliver a non-GAAP profit of $0.78 per share, up a modest 1.3% from $0.77 per share reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect Coca-Cola to report an adjusted EPS of $2.97, up 3.1% from $2.88 reported in 2024. While in fiscal 2026, its earnings are expected to surge 8.4% year-over-year to $3.22 per share.

KO stock prices have declined 6.9% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.6% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 5% dip during the same time frame.

Coca-Cola’s stock prices observed a marginal dip in the trading session following the release of its mixed Q2 results on Jul. 22. The company’s organic revenues grew by a solid 5%. However, its overall topline was negatively impacted by a drop in sales in Indo-Pacific and Latin America. Its net operating revenues came in at $12.5 billion, up a modest 1.4% year-over-year, missing the Street’s expectations by 43 bps. Nonetheless, driven by a slight decline in cost of goods sold, Coca-Cola’s adjusted EPS inched up 4% year-over-year to $0.87, beating the consensus estimates by 4.8%.

Analysts remain bullish on the stock’s prospects. KO has a consensus “Strong Buy” rating overall. Of the 24 analysts covering the stock, opinions include 20 “Strong Buys,” two “Moderate Buys,” and two “Holds.” KO’s mean price target of $79.26 suggests a 19.9% upside potential from current price levels.