The Clorox Company (CLX) is a California-based consumer products firm best known for its cleaning, household, and personal care brands. With a market cap of $14.6 billion, it operates in over 100 countries with about 8,000 employees.

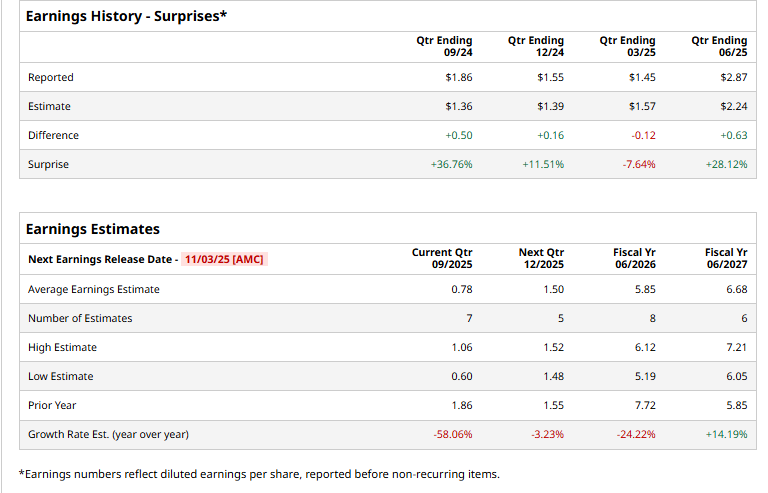

The company is expected to release its Q1 results after the market closes on Monday, Nov. 3. Ahead of the event, analysts expect CLX to report an EPS of $0.78, down 58.1% from $1.86 reported in the year-ago quarter. The company has exceeded Street’s bottom-line estimates in three of the past four quarters, while missing on another occasion.

For fiscal 2026, its EPS is expected to come in at $5.85, falling 24.2% from $7.72 in fiscal 2025. But in fiscal 2027, its earnings are expected to rise 14.2% year over year to $6.68 per share.

CLX stock prices have dipped 26.4% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 14.1% returns and the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.8% uptick during the same time frame.

Despite its grim price action over the past year, Clorox delighted investors on Sept. 16, with CLX shares climbing 1.7% after the company announced a $1.24 quarterly dividend, payable November 6, 2025, reinforcing its reputation for reliable, shareholder-focused returns.

Nevertheless, CLX stock maintains a consensus “Hold” rating overall. Of the 19 analysts covering the stock, opinions include only one “Strong Buy,” 14 “Holds,” and four “Strong Sell” ratings. Its mean price target of $128.44 implies an upswing potential of 7.3% from the prevailing price level.