Cleveland-Cliffs Inc. (NYSE:CLF) is gaining renewed confidence from Wall Street after posting better-than-expected results for the second quarter of 2025, prompting KeyBanc Capital Markets analyst Philip Gibbs to upgrade the stock to Overweight and set a price forecast of $14.

The move reflects a more favorable risk-reward outlook for the steelmaker, which is capitalizing on robust domestic demand, aggressive cost-cutting, and strategic shifts amid a supportive policy environment.

Cleveland-Cliffs reported a narrower second-quarter 2025 adjusted loss of $0.50 per share, beating expectations, with revenue of $4.93 billion.

Also Read: Steel Dynamics Sees Q2 Rebound From Q1 But Still Trails Street Forecast

Steel shipments reached a record 4.3 million net tons, though the average selling price declined. Cost-cutting efforts, including the idling of six facilities, reduced steel unit costs by $15 per ton.

Adjusted EBITDA turned positive at $97 million. The company lowered its 2025 capital expenditure and SG&A guidance and expects further cost improvements in the second half.

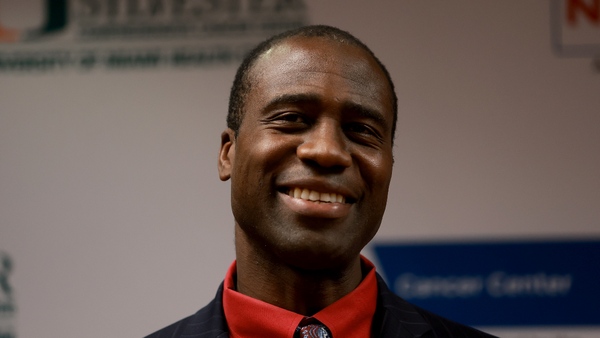

CEO Lourenco Goncalves emphasized strong domestic steel demand, a healthy order book, and policy support from the Trump administration. He noted that a loss-making slab supply deal will end soon, further supporting margins and accelerating free cash flow and debt reduction.

Gibbs stated that the upgrade reflects his increased confidence in Cleveland-Cliffs’ cost-cutting efforts and operational efficiencies, especially within its high-margin automotive segment. He also pointed to trade protections and reshoring trends as favorable tailwinds that position the company to gain market share.

The analyst revised his 2025 outlook, narrowing projected losses due to improved margins and lower production costs. He now forecasts 2025 EBITDA of $419 million, more than double his previous estimate. For the third quarter of 2025, he raised EBITDA expectations to $197 million from $123 million, aided by an additional $20 per ton in cost savings.

Looking ahead to 2026, Gibbs raised his EPS forecast to $0.42 and EBITDA to $1.86 billion, citing a stronger production base, contract repricing, and the elimination of a $250 million drag from the slab agreement with ArcelorMittal. If U.S. and Canadian steel prices outperform expectations, 2026 EBITDA could exceed $2 billion.

According to Gibbs, valuation remains attractive, with shares trading at about 7x 2026 EV/EBITDA, within historical norms. The $14 price forecast reflects a multiple toward the higher end of that range, factoring in potential asset sales and upside from stronger steel pricing.

He also highlighted the growing likelihood of non-core asset divestitures. Cleveland-Cliffs recently engaged J.P. Morgan to lead the sales process for idle properties such as Riverdale and Steelton, which could appeal to data center developers. Management believes these assets could yield “billions of dollars,” enhancing financial flexibility and shareholder returns.

Key risks include volatility in steel prices, shifts in trade policy, fluctuations in automotive demand, interest rate impacts, and the threat of new domestic competitors.

Recent analyst updates:

- Citigroup analyst Alexander Hacking maintained a Neutral rating and raised the price forecast from $7.50 to $11.

- Morgan Stanley’s analyst Carlos De Alba reiterated an Equal-Weight rating and lifted the price forecast from $8 to $10.50.

- JP Morgan analyst Bill Peterson reinstated coverage with a Neutral rating and issued a price forecast of $7.50.

Price Action: CLF shares are trading higher by 6.01% to $11.30 at last check Tuesday.

Read Next:

Photo by JHVEPhoto via Shutterstock