/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)

Clear Secure (YOU) is piquing investors' interests with the installation of biometric eGates in large U.S. airports, marking a highlight in its public–private partnership involving the TSA. The technology comes as the company grows its membership base while providing consistent revenue growth and returning value to shareholders in the form of dividends and buybacks. With the FIFA World Cup bringing over 20 million foreign visitors to the U.S. in 2026, the modernization of checkpoints could provide a significant catalyst for YOU stock.

Broader market tailwinds also favor the thesis. Air passenger levels are trending at near pre-pandemic levels, and airports are stressed to accommodate increasing crowds. With international events pending, Clear’s technology-based identity solution makes it an indispensable participant in enhancing both the ease of travel and security.

About Clear Secure Stock

Clear Secure is a secure identity and access solutions provider headquartered in New York, operating across 59 U.S. airports with over 7.6 million active CLEAR+ members. With a market capitalization of $4.8 billion, the company has built a brand synonymous with faster, frictionless airport passage and continues to diversify into broader identity verification services.

Shares of YOU have climbed from a 52-week low of $21.67 to as high as $38.88, recently trading near $36.36. That marks a strong rebound, with the stock advancing roughly 67% over the past year, outpacing the S&P 500 Index’s ($SPX) approximately 25% gain in the same period.

Valuation appears fair in light of profitability. The stock trades at approximately 28x trailing earnings and 6x sales, roughly in tandem with fast-growing security and infrastructure peers. With adjusted EBITDA margins above 27%, the firm's blend of growth and profitability has becomes superior. Notably, Clear isn't simply a growth tale-it also has been returning capital to shareholders.

YOU stock offers a quarterly dividend of $0.125 per share, or roughly a 1.4% yield, alongside an active buyback program. In Q2 alone, the company repurchased $24.6 million worth of stock, highlighting management’s confidence in long-term value creation.

Clear Secure Beats on Earnings

Clear's most recent quarterly results again bolstered the growth storyline. Q2 revenue totaled $219.5 million, up 17.5% year-over-year (YoY), while net income hit $37.9 million at a 17.3% margin. EPS was $0.26, well ahead of Wall Street’s $0.20 estimate. Adjusted EBITDA totaled $60.1 million, reflecting a 27.4% margin, highlighting operating leverage in the business.

Looking ahead, management guided Q3 revenue to $223–226 million, up ~13% YoY, and reaffirmed full-year free cash flow expectations of at least $310 million. Margin expansion remains a priority, as investments in eGates and international expansion are designed to scale membership without incurring significant additional costs.

Aside from the numbers, there are strategic initiatives worth mentioning. Clear introduced its high-end Concierge service in July, will introduce CLEAR ID as a compliant REAL ID, and will offer CLEAR+ access to international consumers from the U.K., Canada, Australia, and New Zealand. All these strengthen the revenue base while fortifying the moat developed around secure identity.

Most importantly, the catalyst has been the eGate roll-out. With the arrival in Washington D.C., Seattle, and Atlanta airports, and going national by 2026, Clear is assisting the TSA's modernization agenda without American taxpayers footing the bill. With World Cup crowds expected to reach an all-time high, the gates can increase Clear’s U.S. travel ecosystem stature.

What are Analyst Estimates for YOU Stock?

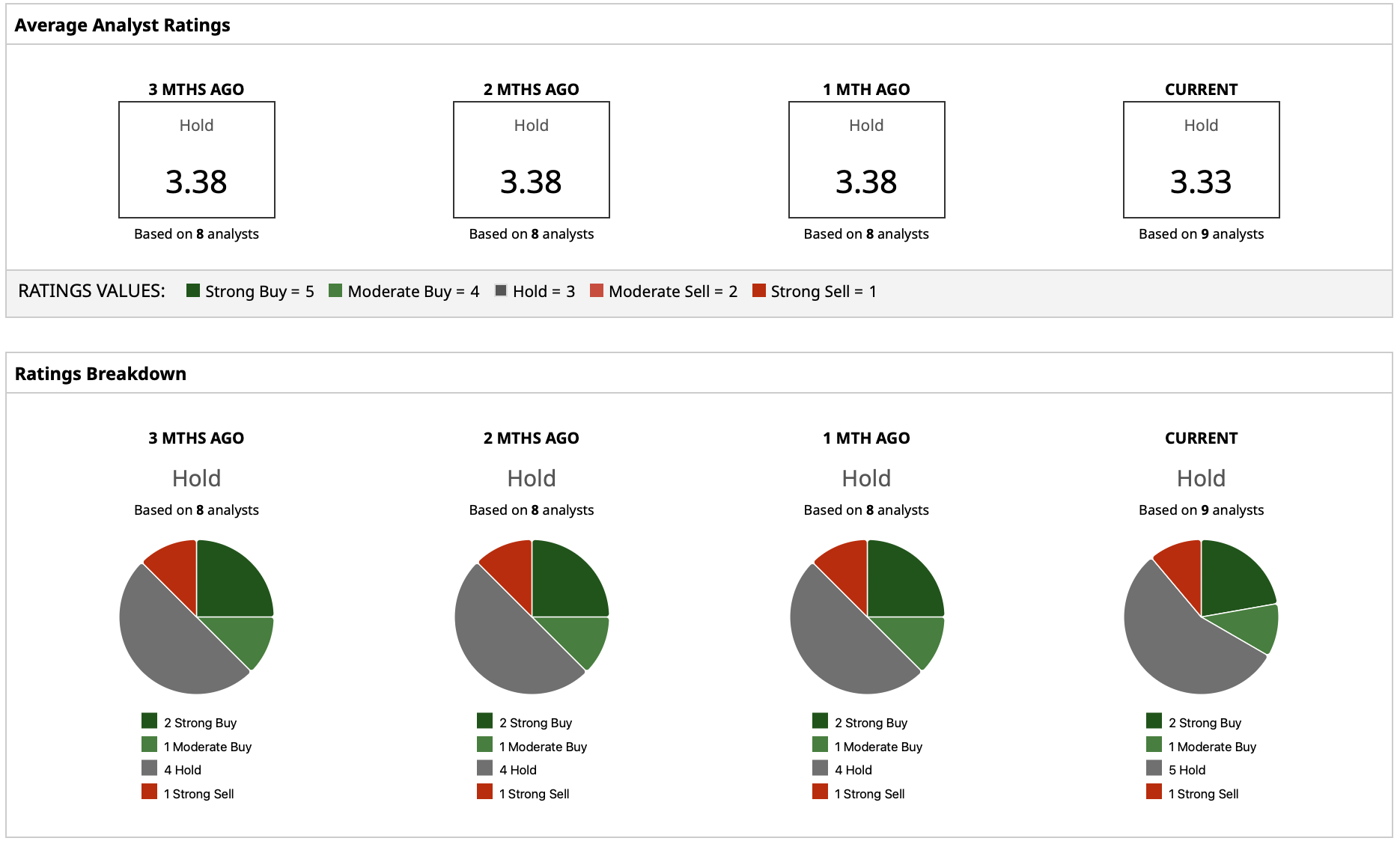

The Street keeps mixed but overall positive on YOU stock. Of covering analysts, the stock has a consensus “Hold” rating. Two analysts out of nine give it a “Strong Buy” recommendation, one a “Moderate Buy” recommendation, five a “Hold” recommendation, and one a “Sell” recommendation, showing a split but active opinion.

Clear's mean price target stands at $33.62, less than the current price of $36.04, representing a modest 6.7% downside. The Street-high price target of $45, however, envisages 25% upside, while the low price target at $25 allows for a subdued forecast.

That huge range sets the parameters for the debate: the naysayers wonder if the growth will be able to match the competition from TSA PreCheck and biometrics peers, while the bulls translate the scale advantages and shareholder distributions as triggers for further retreat.