Renowned financial services holding company Citigroup Inc. (C) provides a variety of financial products and services to consumers, corporations, governments, and institutions in North America, Latin America, Asia, Europe, the Middle East, and Africa.

The company operates in two segments, Global Consumer Banking (GCB) and Institutional Clients Group (ICG).

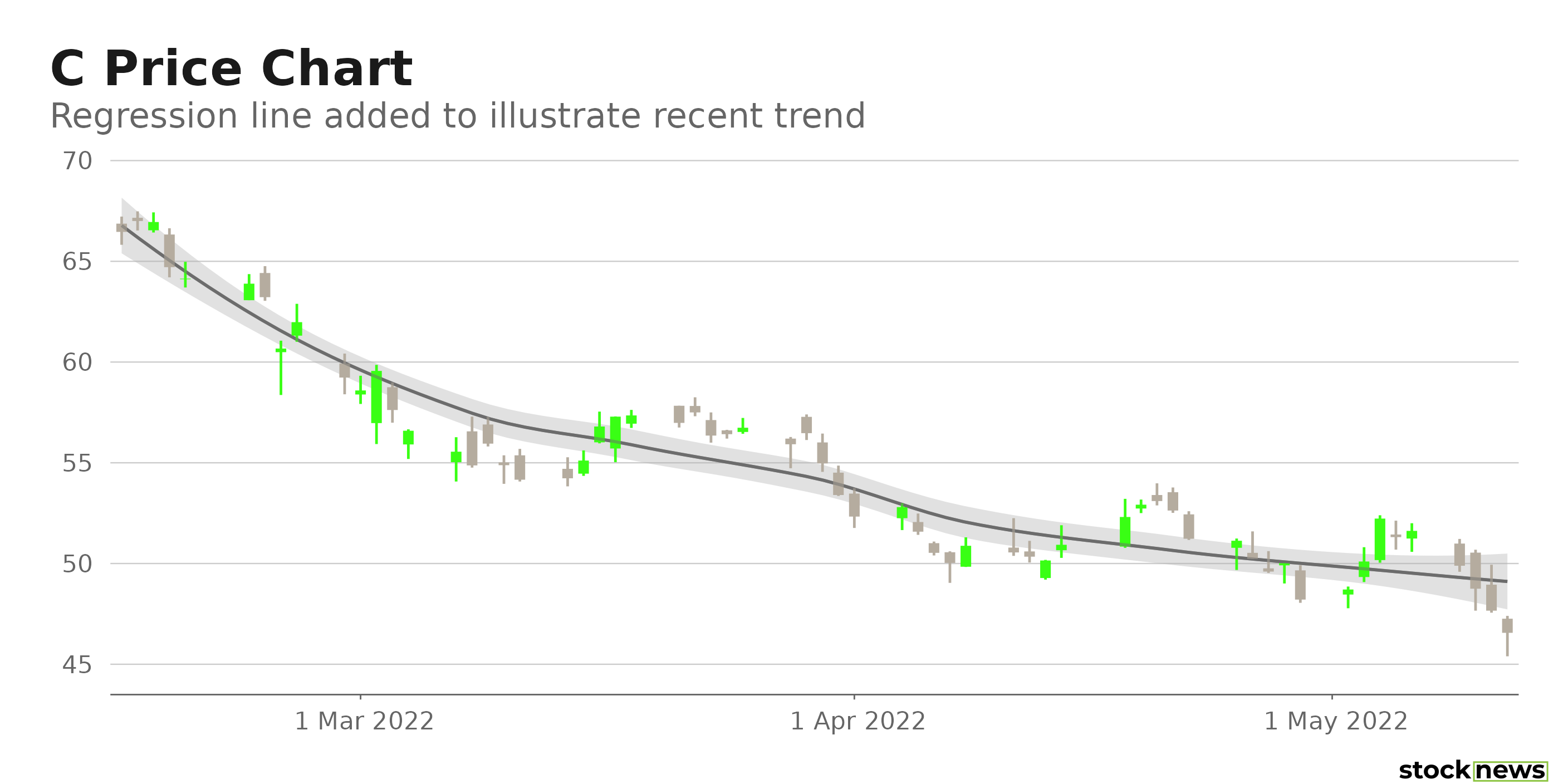

Shares of the megabank have declined 37.3% in price over the past year and 32.7% over the past six months to close yesterday’s trading session at $46.56. The stock has slumped 22.9% year-to-date. Moreover, it is currently trading below its 50-day and 200-day moving averages.

Here is what could shape C’s performance in the near term:

Restructuring Plans

Last year, Citigroup announced its plan to shut down its consumer banking operations in 13 markets, Australia, Bahrain, China, India, Indonesia, South Korea, Malaysia, the Philippines, Poland, Russia, Taiwan, Thailand, and Vietnam, as a part of chief executive Jane Fraser’s strategy to simplify Citigroup by exiting non-core businesses and bring its profitability and share price performance in line with its peers. The company has already moved ahead with its exit plans in many of these regions over the last year.

C’s Russian consumer banking franchise, which has been put up for sale, had been hurt by sanctions against Russia, the bank’s decision not to open new accounts, and a reduction in investment sales. Investors have been worried about the execution of the deal amid the economic sanctions. However, “C has commenced sale discussions with a number of potential buyers,” Citi CEO Jane Fraser stated, while noting that C wants to sell its Russian commercial banking business, which caters to smaller firms.

Also, C is set to exit its Citibanamex consumer banking business in Mexico, ending its 20-year retail presence in the country. Although the Mexican exit was not part of the announced plan, it is consistent with that “strategy refresh,” Fraser said.

The Geopolitical Issues Could Hamper Prospects

C has significant exposure to the Russian economy, and it had earlier warned of a potential hit to its business from escalated tensions following Russia’s invasion of Ukraine. “Citi continues to monitor the current Russia–Ukraine geopolitical situation and economic conditions and will mitigate its exposures and risks as appropriate,” the bank said.

Furthermore, Wall Street sees the risk of default by major banks, with the cost to insure bonds of Goldman Sachs, Morgan Stanley, and Citigroup against default hitting two-year highs earlier this month on growing recession fears. Furthermore, credit risks have worsened since the war as some big U.S. banks took a hit to their mainstay businesses, with capital market activity coming to a standstill and lending expected to remain lackluster.

Bleak Bottom Line

For its fiscal first quarter, ended March 31, 2022, C’s total revenues declined 2.4% year-over-year to $19.19 billion. The company’s cost of credit was $755 million in the quarter compared to negative $2.06 billion in the prior-year period, as lower net credit losses were more than offset by a lower net release in the allowance for credit losses (ACL). Its net income came in at $ $4.31 billion, reflecting a 45.8% decrease from the prior-year period, driven by the higher cost of credit, higher expenses, and lower revenues, while its EPS declined 44.2% year-over-year to $2.02.

Mixed Growth Prospects

The Street expects C’s revenues to be $18.24 billion in its fiscal second quarter ending June 30, 2022, indicating an increase of 4.4% year-over-year. Also, its revenue is expected to grow 5.4% in the following quarter and marginally in its fiscal year ending Dec. 31, 2022. However, its EPS is expected to decline 42.3% in the current quarter and 25.5% in the next quarter. The $6.88 consensus EPS estimate for the current year indicates a 32.2% decrease year-over-year. Furthermore, the company’s EPS is expected to decline by 9.8% per annum over the next five years.

POWR Ratings Reflect Uncertainty

Citigroup has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a D grade for Growth, which is consistent with its lackluster performance in its last reported quarter.

Citigroup has a C grade for Sentiment. Mixed analyst sentiment about the stock justifies this grade.

Among the 12 stocks in the D-rated Money Center Banks group, C is ranked #6.

Beyond what I have stated above, you can also view C’s grades for Quality, Value, Momentum, and Stability here.

View the top-rated stocks in the Money Center Banks group here.

Bottom Line

Given the company’s global presence, it has significant exposure to the Ukraine conflict. And it could be wise to wait and understand the impacts of geopolitical issues on the firm, including its planned sale of its consumer banking operations in Russia. Furthermore, considering Wall Street’s warning signals of the near-term headwinds and its bottom-line positioning, I think it would be best to wait for a better entry point in the stock.

C shares rose $0.44 (+0.95%) in premarket trading Friday. Year-to-date, C has declined -21.49%, versus a -17.14% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Citigroup: Buy, Sell, or Hold? StockNews.com