/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

Cisco Systems, Inc. (CSCO) delivered strong free cash flow, despite significantly higher capex spending in its fiscal year ending July 31. That could propel CSCO stock at least 14% higher over the next 12 months using its average FCF margins.

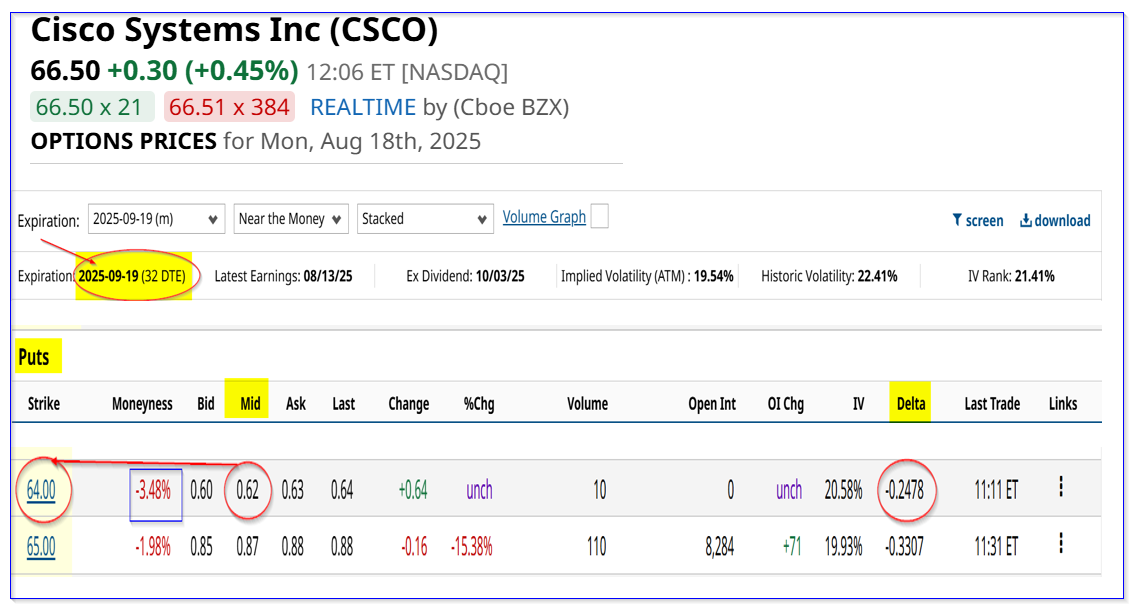

CSCO is at $66.50 in morning trading on Monday, Aug. 18. That's down from its price on Aug. 13 of $70.40 just before the release of its latest results.

But it could be worth $75.75 per share using its historical FCF margins and revenue forecasts. Moreover, the average analyst price target is close to this. This article will delve into these points and explore a strategy for playing short out-of-the-money (OTM) puts.

Strong Results for FY 2025

Cisco is one of the beneficiaries of the huge artificial intelligence (AI) spending boom. It provides networking equipment, cloud software, and security solutions used by data centers and companies involved in AI-related activities.

As a result, its Q4 revenue rose 8% year-over-year (Y/Y) to $14.3 billion, and its fiscal year (ending July 31) sales were up 5% to $56.7 billion.

However, its AI infrastructure division took in over $2 billion in orders in FY 25, higher than its goal of $1 billion. That included over $800 million in orders in Q4 alone.

This is a strong growth driver for the company going forward.

Moreover, Cisco reported that its operating cash flow was very strong and its free cash flow (FCF) - i.e., OCF less capex spending - was also high.

For example, in the latest fiscal Q4 ending July 31, the company generated $4.234 billion in OCF, representing 28.9% of its $14.67 billion Q4 revenue. That was +13.5% higher than last year, and the prior OCF margin was lower at 27.3%.

Moreover, even with +9.5% higher capex spending in Q4, its FCF margins improved as well. For example, Cisco generated $4.017 billion in FCF, which was 27.4% of revenue. That was higher than the 25.89% FCF margin last year. Moreover, it beat the $13.288 FCF for the year was just 23.4% of its full-year revenue of $56.7 billion.

This implies that Cisco's FCF margins will rise over the next year with higher sales.

Forecasting FCF

For example, analysts are now projecting about $60 billion in sales for the next fiscal year ending July 2026. That is also the upper end of management's guidance for FY 26.

As a result, if we assume the company can generate at least 25% FCF margins (higher than the 23.4% in FY 25, but lower than the 27.4% Q4 margin), its FCF could be:

$60b x 0.25 FCF margin= $15 billion FCF target

That would be an increase of 12.9% over last year's $13.288 billion in FCF. Moreover, it could push up the value of CSCO stock at least that amount.

Target Prices for CSCO Stock

Last year, the company paid out $12.4 billion in dividends and buybacks to shareholders. That represented 93.3% of its $13.3 billion in FCF.

As CSCO's market cap is $262.726 billion today, according to Yahoo! Finance, that means its historical FCF yield is about 5%:

$13.288 b FCF FY 25/$262.725 = 0.05058 = 5.06% FCF yield

So, using a similar 5.0% FCF yield and applying this to our forecast of $15 billion:

$15b FY 26 FCF / 0.05 = $300 billion market cap

In other words, if the market gives the stock a 5% FCF yield in the future, and if Cisco generates $15 billion in FCF, its market cap will rise 14.2% to $300 billion.

That means its stock price will be worth 14% more, or

$1.14 x $66.50 = $75.81 per share target price

This is about the same as the average of 26 analysts surveyed by Yahoo! Finance ($75.58 per share). Similarly, Barchart's mean survey price is $75.06, and Stock Analysis says 18 analysts have an average price target of $74.94.

Moreover, AnaChart.com, which tracks recent analyst recommendations, writes that 21 analysts have an average of $77.17 per share as their price targets.

The bottom line is that CSCO stock looks undervalued here. One way to play this, setting a lower buy-in price, is to sell short out-of-the-money (OTM) put options in nearby expiry periods.

Shorting OTM Puts

For example, look at the Sept. 19 expiry period, one month away. It shows that the $64.00 strike price put option contract has a midpoint premium of 62 cents.

That represents an immediate short-put yield of about 1% (i.e., $0.62/$64.00 = 0.96875%) for a strike price that is about 3.5% below today's trading price.

The point is that an investor who does this play can set a potential lower buy-in point and get paid while waiting.

Moreover, even if CSCO falls to $64.00, the investor's breakeven point is $63.38 per share ($64-$0.62), which is 4.7% below today's price. So, the investor potentially gets to buy in at a significantly lower price using this play.

However, it could still result in an unrealized capital loss, if CSCO stays below the $63.38 breakeven. Investors should study the risks here. One way to do that is to research Barchart's Options Education Center and the Profit and Loss charts on any options contract.

The bottom line is that CSCO stock is cheap here, and OTM selling short OTM puts is one way to play short puts.