Shares of Bitcoin (CRYPTO: BTC) miner Cipher Mining Inc (NASDAQ:CIFR) are moving Wednesday after Arete Research initiated coverage with a Buy rating, suggesting significant upside from the stock’s current price.

What To Know: Arete Research initiated coverage on Cipher Mining with a Buy rating and set a bullish price target of $24. Cipher shares hit new 52-week highs on Wednesday before pulling back.

The positive analyst rating adds to the stock’s recent, powerful momentum, which has seen it rally 120% over the past month. Investor confidence appears strong, as the stock recently gained despite a $33 million insider sale by a major stakeholder.

Recent resilience is supported by strong operational fundamentals. In the company’s August update, Cipher reported mining 241 BTC and said it’s on track to significantly expand its total hashrate by the end of the third quarter.

Cipher meanwhile sold approximately 42 BTC in August for treasury management, closing the month with a total holding of roughly 1,414 BTC.

The new analyst coverage on Wednesday highlights growing optimism around Cipher’s expansion strategy and its core Bitcoin mining operations, fueling the stock’s recent surge.

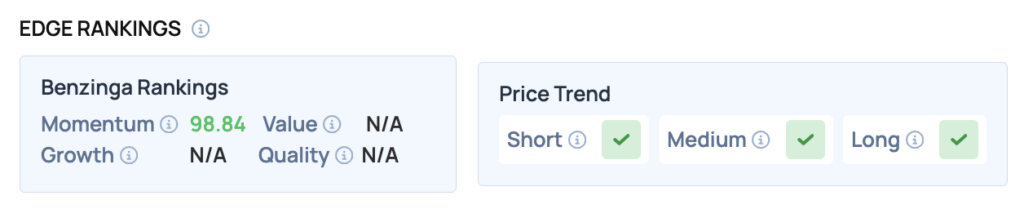

Benzinga Edge Rankings: The stock’s recent rally is reflected in its Benzinga Edge Momentum score, which stands at an impressive 98.84.

Technical Momentum: CIFR is currently trading at $14.41, reflecting a daily increase of 1.84%. The stock is significantly above its 50-day ($7.34), 100-day ($5.67) and 200-day ($5.03) moving averages, indicating a robust upward trend.

The recent price action suggests that $14.73 may serve as a resistance level, while the 50-day moving average could act as a support.

Cipher shares initially surged above $15.50 on Wednesday before pulling back. The stock was up 0.35% at $14.19 at the time of publication, according to Benzinga Pro.

How To Buy CIFR Stock

By now you're likely curious about how to participate in the market for Cipher Mining – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock