/Cintas%20Corporation%20logo%20on%20building-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $80.8 billion, Cintas Corporation (CTAS) provides uniforms and a wide range of business services that help over one million companies maintain a clean, safe, and professional workplace. Operating across the U.S., Canada, and Latin America, Cintas offers solutions including uniform rental, facility services, first aid and safety products, fire protection, and compliance training.

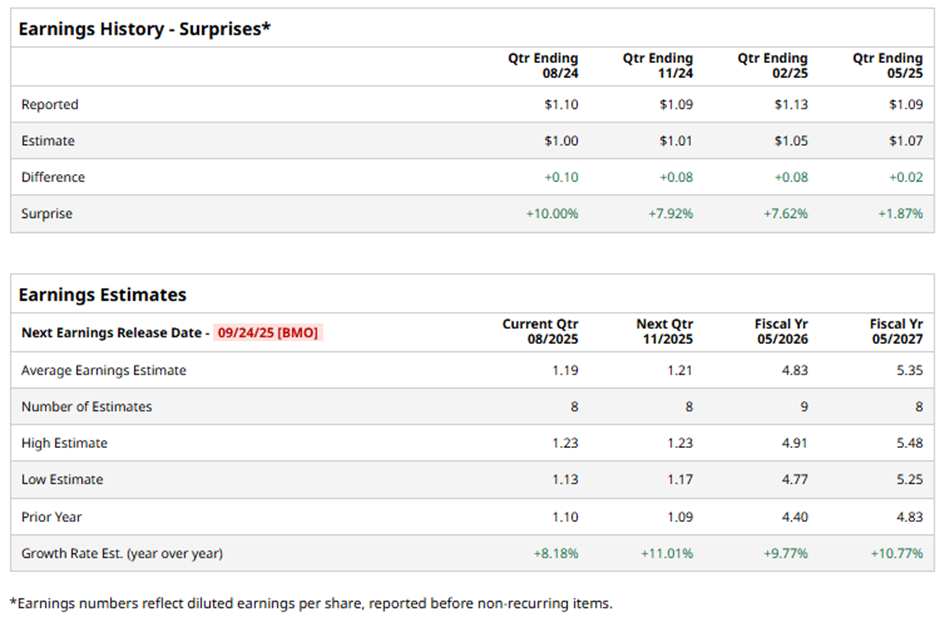

The Cincinnati, Ohio-based company is expected to announce its Q1 2026 results before the market opens on Wednesday, Sept. 24. Ahead of this event, analysts expect Cintas to report an EPS of $1.19, up 8.2% from $1.10 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts predict the uniform rental company to report an EPS of $4.83, representing a 9.8% growth from $4.40 in fiscal 2025. Moreover, EPS is anticipated to increase 10.8% year-over-year to $5.35 in fiscal 2027.

Shares of Cintas have declined 1.7% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.4% gain and the Industrial Select Sector SPDR Fund's (XLI) 14.5% return over the same period.

Shares of Cintas soared 3.7% on Jul. 17 after the company reported Q4 2025 earnings of $1.09 per share, topping Wall Street’s estimate. Revenue also came in stronger than expected at $2.67 billion, driven by resilient demand for uniform rentals, facility cleaning, and first-aid services. The company issued a strong fiscal 2026 outlook, projecting revenue of $11 billion - $11.15 billion and earnings of $4.71 per share - $4.85 per share versus $4.40 per share in fiscal 2025.

Analysts' consensus view on CTAS stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, seven suggest a "Strong Buy," 10 give a "Hold," one recommends a "Moderate Sell," and two "Strong Sells."

The average analyst price target for Cintas is $224.88, indicating a potential upside of 12.1% from the current levels.