Stocks remained little changed after a thin post-Labor Day trading session. No significant catalysts moved the market on Wednesday. However, investors are awaiting the Labor Department’s closely watched Job Openings and Labor Turnover Survey. The much-scrutinized Fed will also publish its periodic “Beige Book” activity survey across its 12 districts. After the Dow Jones’s 260 point drop on Tuesday, the Dow Jones dipped another 80 points or so. The S&P 500 was also flat, and the Nasdaq

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

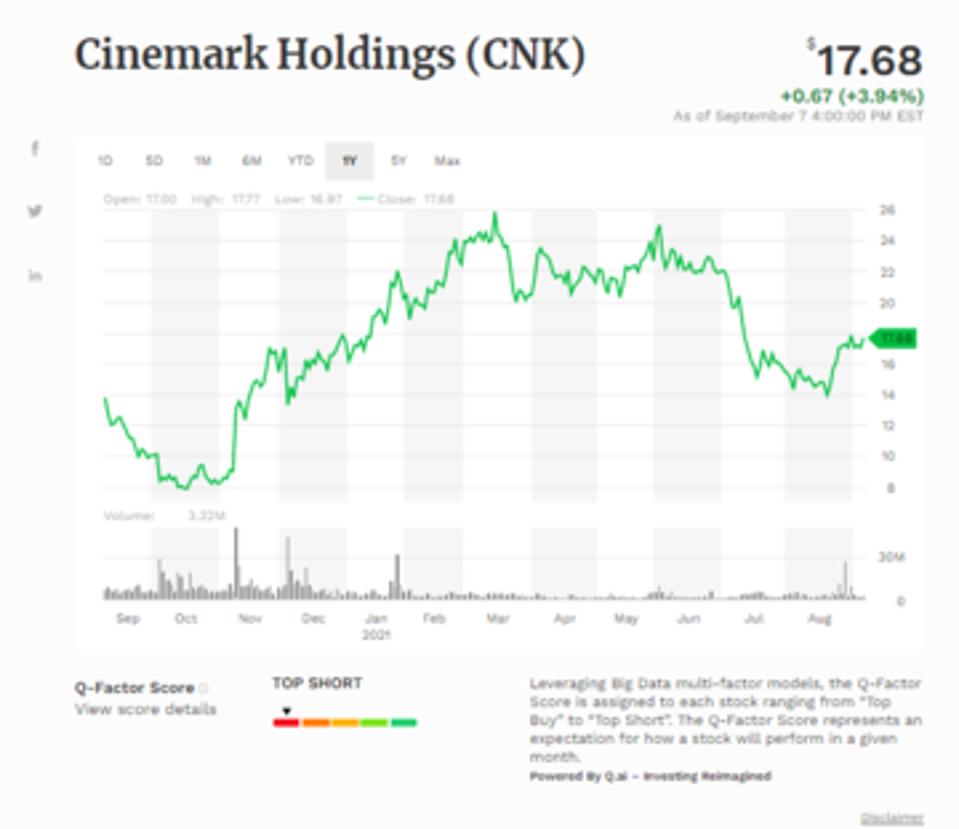

Cinemark Holdings Inc (CNK)

Cinemark Holdings is our first Top Short for the day. The Texas-based Cinemark owns and operates a chain of movie theatres. With the future of movie theatres in question, our AI systems rated Cinemark D in Technicals, D in Growth, D in Low Volatility Momentum, and D in Quality Value. The stock closed up 3.94% to $17.68 on volume of 3,319,685 vs its 10-day price average of $17.13 and its 22-day price average of $15.88, and is up 9.41% for the year. Revenue was $686.31M in the last fiscal year compared to $3221.74 three years ago, Operating Income was $(590.82)M in the last fiscal year compared to $459.42M three years ago, EPS was $(5.25) in the last fiscal year compared to $1.83 three years ago, and ROE was (54.99%) in the last year compared to 15.3% three years ago. Forward 12M Revenue is also expected to grow by 69.57% over the next 12 months.

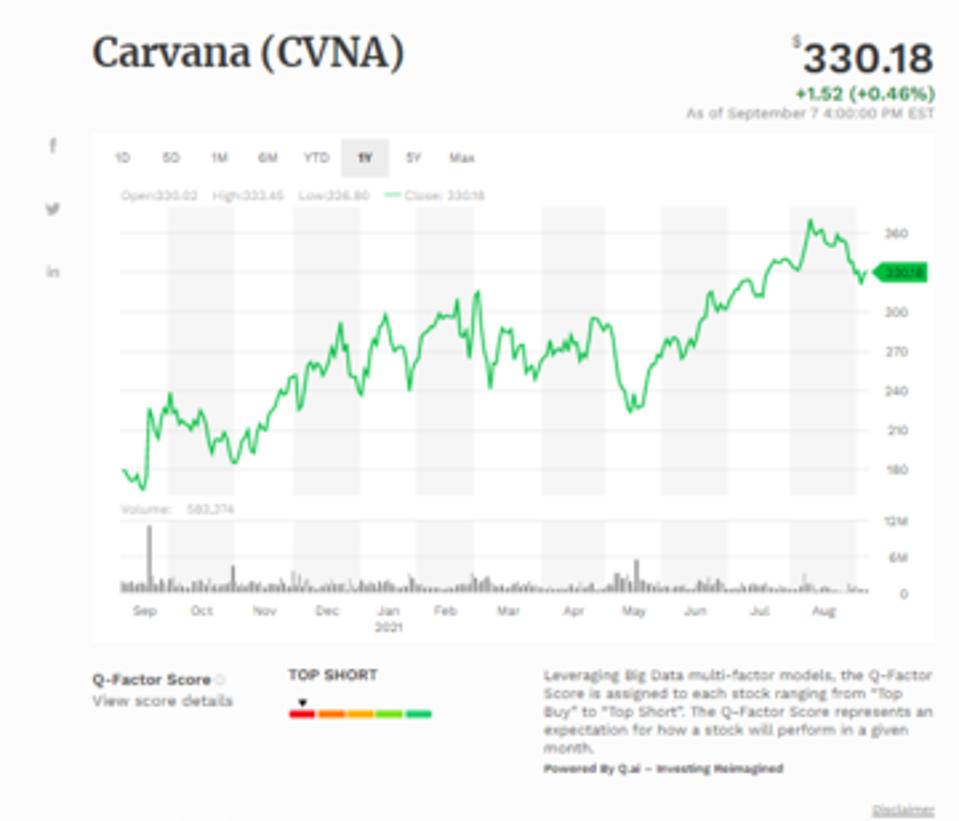

Carvana Co (CVNA)

Back on our list of Top Shorts is Carvana Co. The company is a major innovator and disruptor in the car industry, and is a robust online used car dealer. Our AI systems rated Carvana C in Technicals, F in Growth, D in Low Volatility Momentum, and F in Quality Value. The stock closed up 0.46% to $330.18 on volume of 583,625 vs its 10-day price average of $337.22 and its 22-day price average of $347.54, and is up 39.75% for the year. Revenue grew by 60.23% in the last fiscal year and grew by 357.77% over the last three fiscal years, Operating Income grew by -75.21% in the last fiscal year and grew by -62.67% over the last three fiscal years, and EPS grew by -57.59% in the last fiscal year and grew by -45.04% over the last three fiscal years. Revenue was $5586.56M in the last fiscal year compared to $1955.47M three years ago, Operating Income was $(332.4)M in the last fiscal year compared to $(220.73)M three years ago, EPS was $(2.63) in the last fiscal year compared to $(2.03) three years ago, and ROE was (93.05%) in the last year compared to (100.5%) three years ago. Forward 12M Revenue is also expected to grow by 11.83% over the next 12 months.

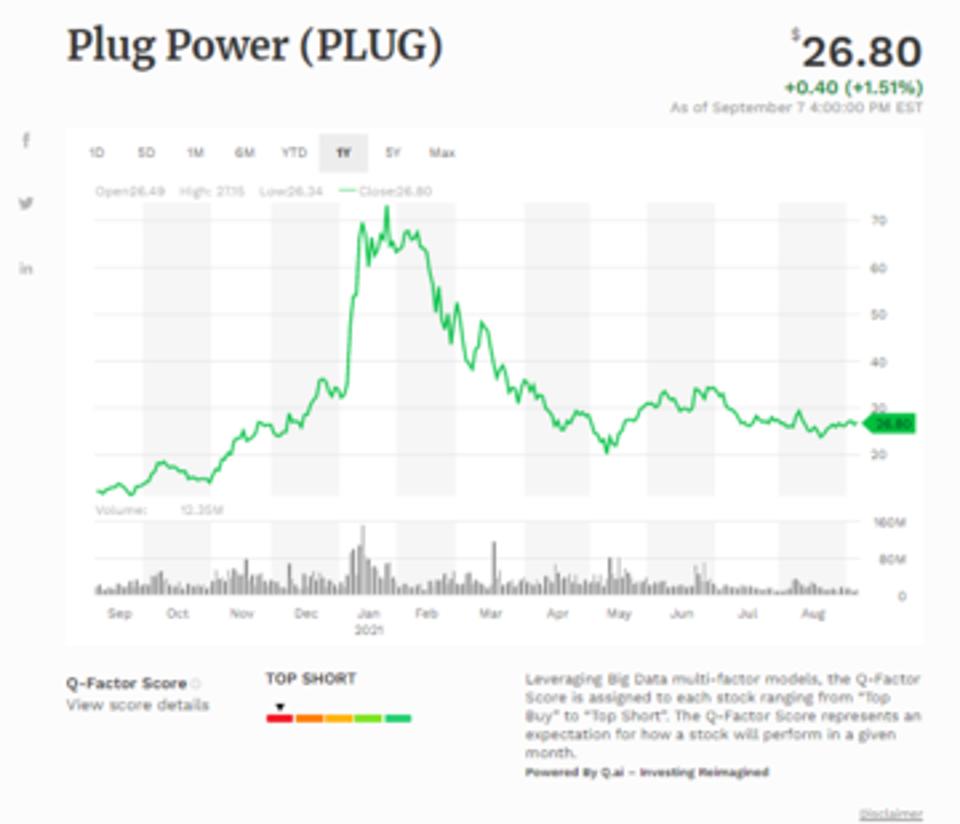

Plug Power Inc (PLUG)

Our third Top Short is no stranger to this list-Plug Power Inc. Plug Power is a company at the forefront of automotive innovation with its development of hydrogen fuel cell systems. The goal of this company is to develop mechanisms to eventually replace conventional batteries in equipment and vehicles powered by electricity. Our AI systems rated Plug Power F in Technicals, F in Growth, D in Low Volatility Momentum, and F in Quality Value. The stock closed up 1.52% to $26.8 on volume of 12,472,380 vs its 10-day price average of $26.42 and its 22-day price average of $26.16, and is down 16.69% for the year. Revenue grew by -94.06% in the last fiscal year, while EPS grew by -10.05% in the last fiscal year. Revenue was $-93.24M in the last fiscal year compared to $174.22M three years ago, Operating Income was $(576.61)M in the last fiscal year compared to $(76.44)M three years ago, EPS was $(1.68) in the last fiscal year compared to $(0.39) three years ago, and ROE was (74.61%) in the last year compared to (157.5%) three years ago. Forward 12M Revenue is also expected to grow by 19.11% over the next 12 months.

Redfin Corp (RDFN)

Our fourth Top Short for the day is Redfin Corp. Redfin is a Seattle-based real estate brokerage and operates with a unique business model. With Redfin’s business model, sellers pay Redfin a small fee to list the seller's home, in addition to another small fee charged to the seller to compensate the brokerage representing the buyer. Customers who buy with Redfin are only charged 1% to list their home, and also receive a portion of the brokerage's commission back (called the Redfin Refund). Our AI systems rated Redfin C in Technicals, F in Growth, D in Low Volatility Momentum, and F in Quality Value. The stock closed up 0.29% to $51.56 on volume of 750,641 vs its 10-day price average of $50.65 and its 22-day price average of $51.06, and is down 23.32% for the year. Revenue grew by 37.8% in the last fiscal year and grew by 150.77% over the last three fiscal years, Operating Income grew by -109.87% over the last three fiscal years, and EPS grew by -4.37% in the last fiscal year and grew by -54.5% over the last three fiscal years. Revenue was $886.09M in the last fiscal year compared to $486.92M three years ago, Operating Income was $7.31M in the last fiscal year compared to $(43.93)M three years ago, EPS was $(0.23) in the last fiscal year, compared to $(0.49) three years ago, and ROE was (3.85%) in the last year compared to (13.82%) three years ago. Forward 12M Revenue is also expected to grow by 17.12% over the next 12 months.

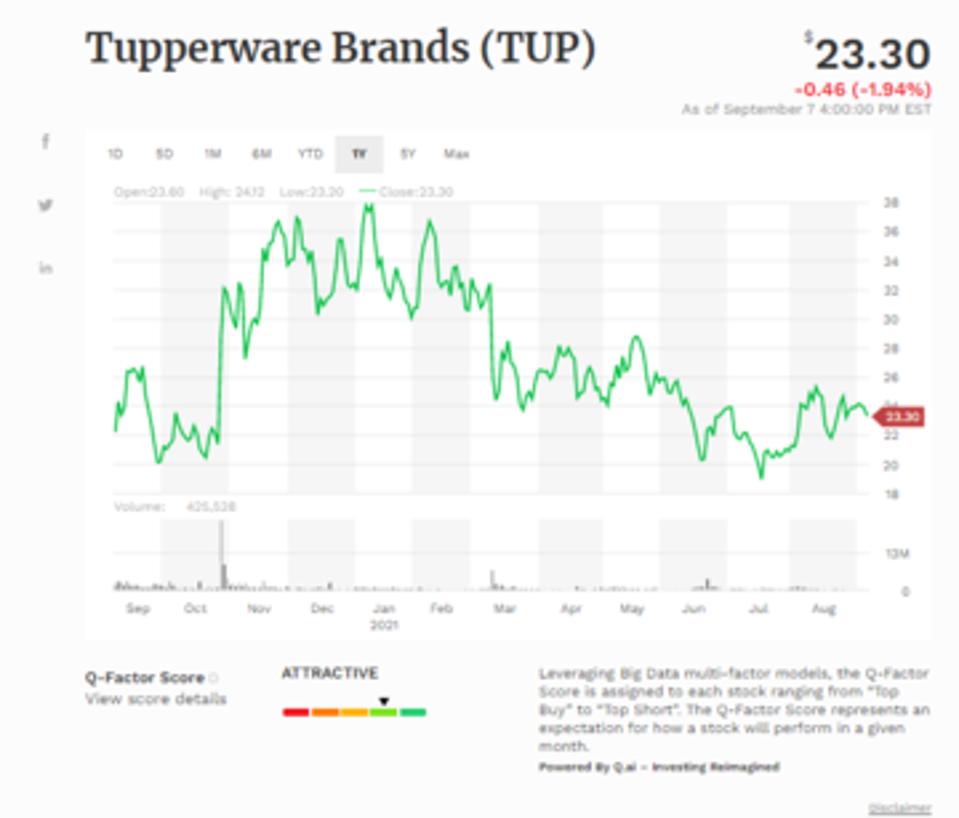

Tupperware Brands Corp (TUP)

Tupperware Brands is our final Top Short today. Tupperware is a global direct seller of innovative, premium products across multiple brands and categories. Its brands and categories include design-centric preparation, storage and serving solutions for the kitchen and home, and more. Our AI systems rated the company F in Technicals, D in Growth, F in Low Volatility Momentum, and C in Quality Value. The stock closed down 1.94% to $23.3 on volume of 425,528 vs its 10-day price average of $23.86 and its 22-day price average of $23.75, and is down 27.1% for the year. Revenue grew by 8.72% in the last fiscal year, Operating Income grew by 43.57% in the last fiscal year, and EPS grew by 18.05% in the last fiscal year. Revenue was $1740.1M in the last fiscal year compared to $2069.7M three years ago, Operating Income was $216.9M in the last fiscal year compared to $314.9M three years ago, and EPS was $2.14 in the last fiscal year compared to $3.11 three years ago. Forward 12M Revenue is expected to grow by 6.11% over the next 12 months, and the stock is trading with a Forward 12M P/E of 6.7.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.