/Cincinnati%20Financial%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $25.4 billion, Cincinnati Financial Corporation (CINF) is a provider of property and casualty insurance products. The company operates through five key segments, offering a wide range of commercial, personal, excess and surplus, life insurance, and investment services.

Companies valued at more than $10 billion are generally considered "large-cap" stocks, and Cincinnati Financial fits this criterion perfectly. In addition to insurance solutions, it also provides commercial leasing, financing, and brokerage services.

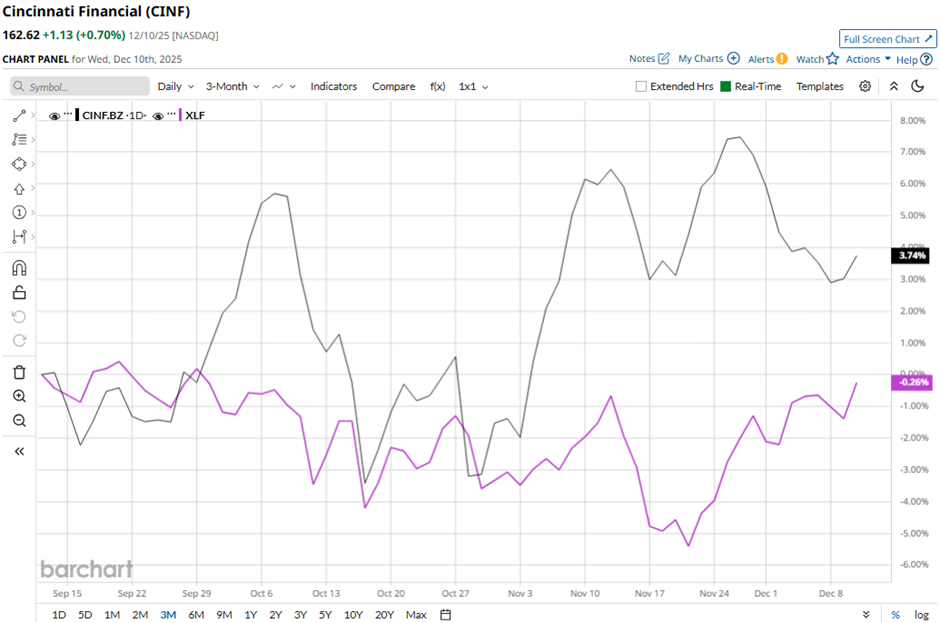

Despite this, shares of the Fairfield, Ohio-based company have declined 4.3% from its 52-week high of $169.86. CINF stock has increased 6.8% over the past three months, outpacing the Financial Select Sector SPDR Fund’s (XLF) marginal decrease over the same time frame.

In the longer term, CINF stock is up 13.2% on a YTD basis, outperforming XLF’s 11.5% gain. Moreover, shares of the Insurance firm have soared 8.5% over the past 52 weeks, compared to XLF’s 8.2% return over the same time frame.

The stock has been trading above its 200-day moving average since last year.

Cincinnati Financial delivered a stronger-than-expected Q3 2025 adjusted EPS of $2.85 on Oct. 27. Net income surged to $1.12 billion, boosted by a $675 million after-tax increase in the fair value of equity securities and a $152 million decrease in after-tax catastrophe losses. However, the stock fell 3.7% the next day.

In comparison, rival Loews Corporation (L) has outpaced CINF stock. Loews stock has soared 21.2% on a YTD basis and 22.2% over the past 52 weeks.

Despite the stock’s strong performance relative to the sector, analysts remain cautiously optimistic on CINF. The stock has a consensus rating of “Moderate Buy” from 10 analysts in coverage, and the mean price target of $172.67 is a premium of 6.2% to current levels.