/Cigna%20Group%20HQ%20phone%20-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $80.6 billion, The Cigna Group (CI) is a global health services and insurance company based in Bloomfield, Connecticut. It provides medical, pharmacy, dental, behavioral health, and supplemental insurance solutions, along with pharmacy benefit management, care delivery, and health management services. The company is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 30.

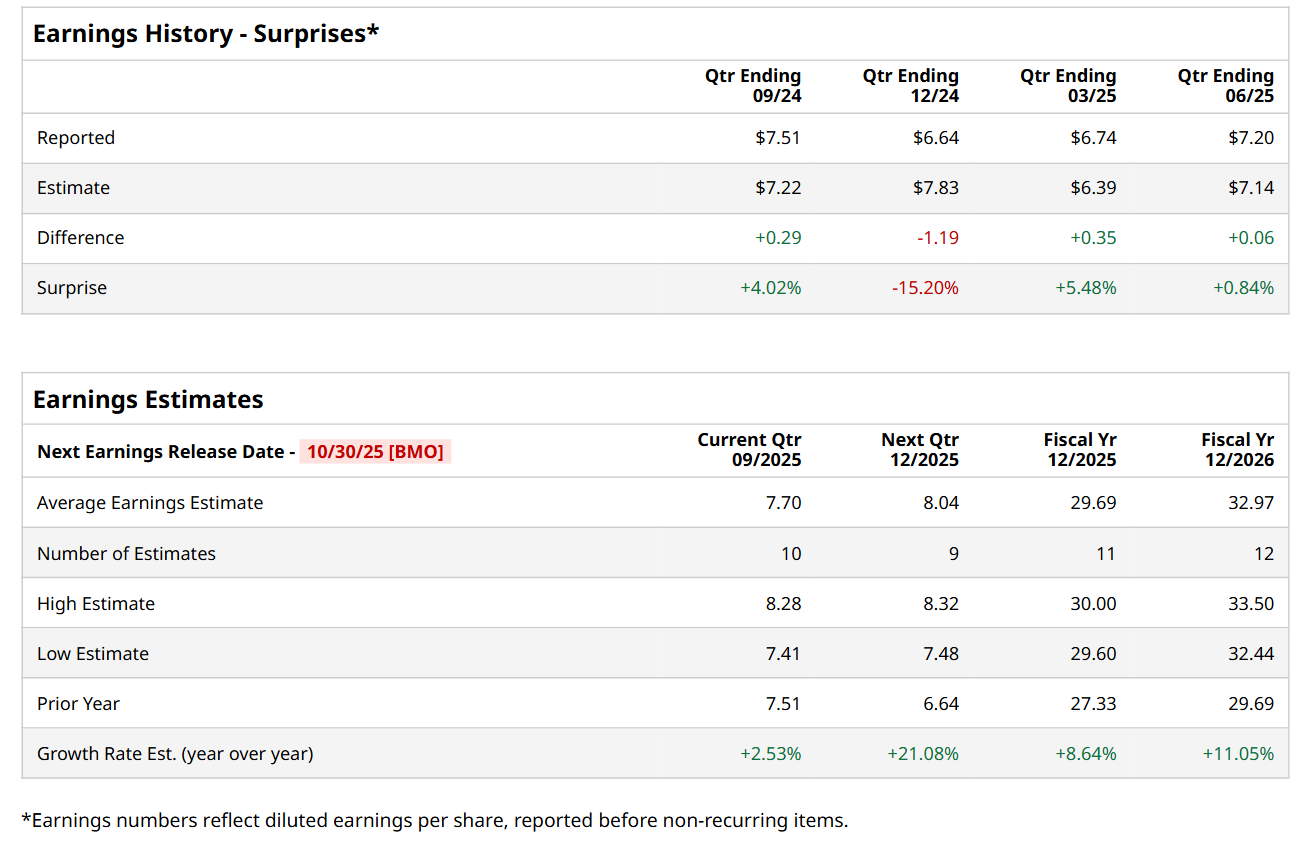

Ahead of this event, analysts expect this health insurance company to report a profit of $7.70 per share, up 2.5% from $7.51 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. In Q2, CI’s EPS of $7.20 exceeded the forecasted figure by a slight margin.

For the current fiscal year, ending in December, analysts expect CI to report a profit of $29.69 per share, up 8.6% from $27.33 per share in fiscal 2024. Furthermore, its EPS is expected to grow 11.1% year-over-year to $32.97 in fiscal 2026.

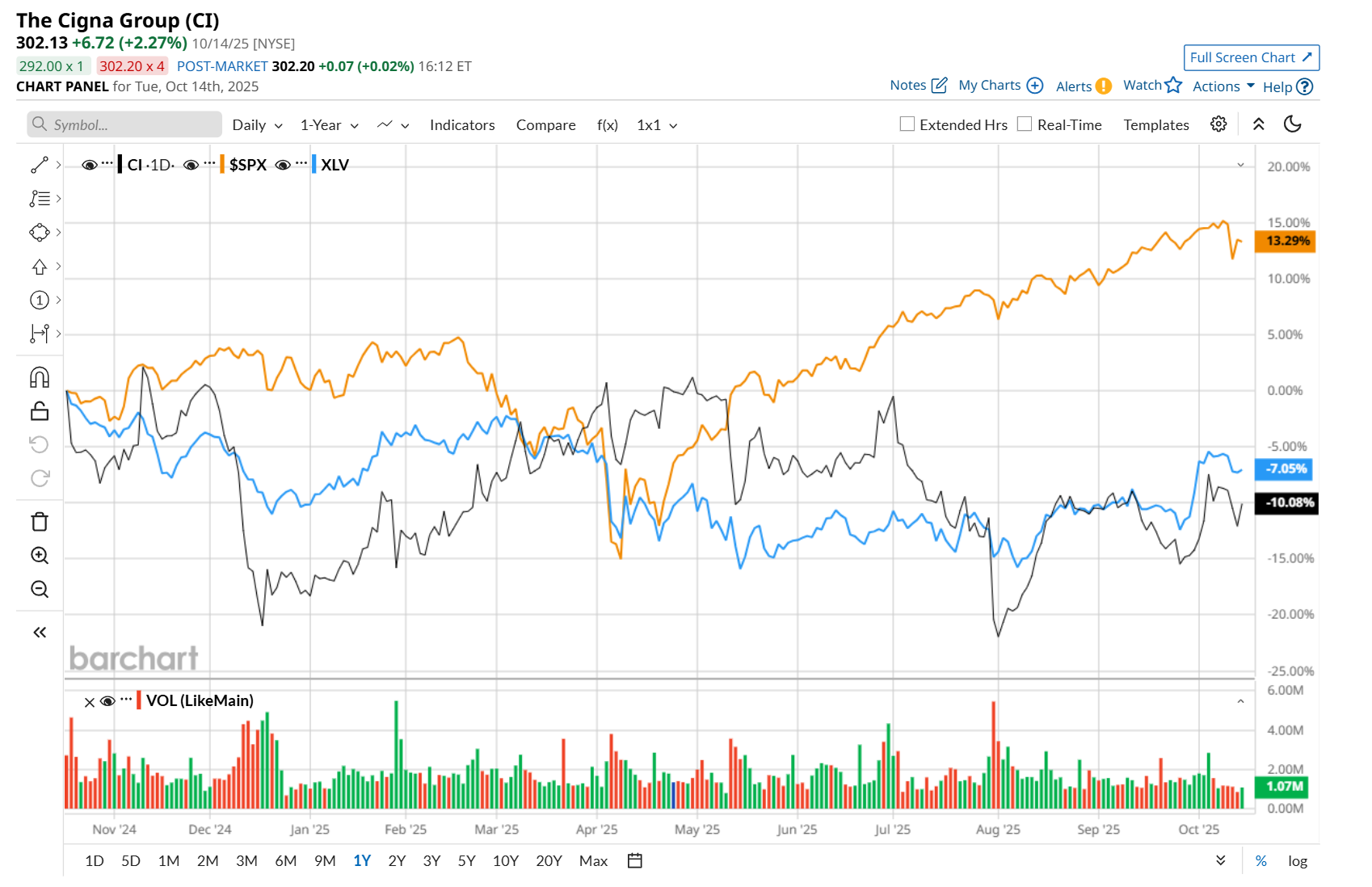

CI has declined 13.4% over the past 52 weeks, trailing behind both the S&P 500 Index's ($SPX) 13.4% return and the Health Care Select Sector SPDR Fund’s (XLV) 7% drop over the same time frame.

On Jul. 31, CI posted better-than-expected Q2 adjusted revenue of $67.1 billion and adjusted income from operations of $7.20 per share. Moreover, compared to the year-ago quarter, its top line improved 11%, while its bottom line grew 7.1%. However, despite these positives, its shares tumbled 10.2% after the announcement, likely reflecting investor concerns over a 2.1% decline in total customer relationships. Both its pharmacy and medical customer segments saw year-over-year decreases, which may have weighed on investor sentiment.

Wall Street analysts are highly optimistic about CI’s stock, with an overall "Strong Buy" rating. Among 24 analysts covering the stock, 17 recommend "Strong Buy," two indicate "Moderate Buy," and five suggest "Hold.” The mean price target for CI is $369.90, implying a 22.4% potential upside from the current levels.