China is expected to maintain its lending benchmark Loan Prime Rates (LPRs) unchanged in April, according to recent reports. This decision comes as the country aims to stabilize its economy amid ongoing global uncertainties.

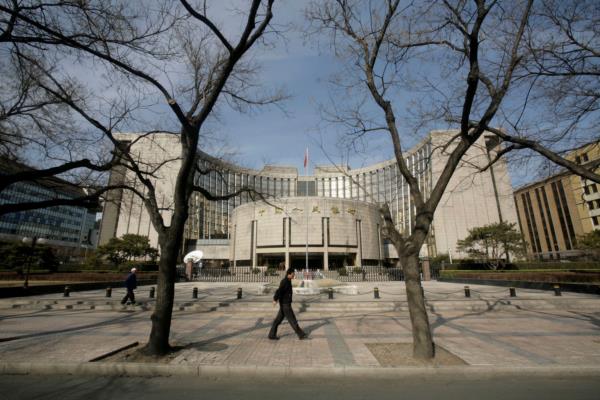

The LPRs, which serve as a reference for banks to set their lending rates, have been a key tool for China's central bank to manage monetary policy. By keeping the rates steady, the People's Bank of China hopes to provide stability and support to businesses and consumers.

China's economy has been showing signs of recovery following the impact of the COVID-19 pandemic. The government has implemented various measures to stimulate growth, including targeted monetary easing and fiscal support.

Analysts believe that maintaining the LPRs unchanged is a strategic move to ensure that businesses have access to affordable credit, which is crucial for sustaining economic momentum. By keeping borrowing costs low, the central bank aims to encourage investment and consumption, driving overall economic activity.

While global economic conditions remain uncertain due to factors such as trade tensions and the ongoing pandemic, China's decision to keep the LPRs stable reflects its commitment to supporting economic growth and financial stability.

Overall, the decision to maintain the lending benchmark LPRs unchanged in April underscores China's proactive approach to managing its economy and ensuring a favorable environment for businesses and consumers.