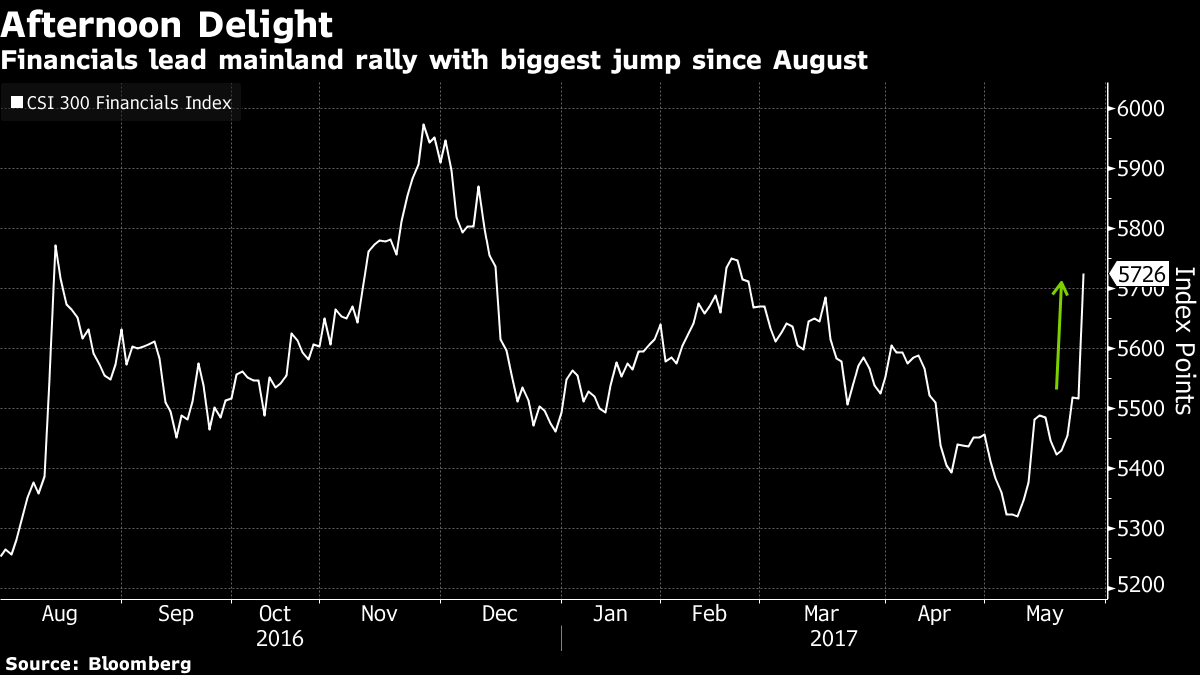

China’s stocks extended gains in afternoon trading, with the steepest rally in financial shares since August spurring speculation that state-backed funds were active in the market.

The Shanghai Composite Index rose 1.4 percent to 3,107.83 at the close. A gauge of financial companies on the CSI 300 Index jumped 3.8 percent, with all but two of its 66 companies gaining. The ChiNext gauge of mostly smaller companies erased a drop of as much as 1.8 percent to end in the black. In Hong Kong, a gauge of Chinese stocks capped the strongest finish in more than two months.

Sudden gains in China’s $6.6 trillion equity market often drive speculation that state-directed funds are intervening to bolster demand for shares. The Shanghai benchmark halted a run of declines before the start of the One Belt One Road summit this month, as people with direct knowledge of the matter said that state-backed funds stood ready to buy shares if needed. The Shanghai Composite on Wednesday erased a decline of 1.3 percent -- brought about by a debt rating downgrade by Moody’s Investors Service -- to end the day in the black.

"Mainland banks and insurers are picking up, lifting Hong Kong and Shanghai indexes higher," said William Wong, head of institutional sales trading at Shenwan Hongyuan Securities HK Ltd. "Investors are speculating that the market is being supported by the national team in the afternoon session" after the Shanghai Composite’s rebound from near the 3,000 level yesterday stoked similar views, he said.

The Hang Seng Index rose 0.8 percent in Hong Kong to the highest close since July 2015. Real-estate stocks accounted for two of the benchmark’s four biggest gainers, with China Resources Land Ltd. advancing 3.7 percent. Analysts pointed to a positive outlook for home sales in China’s smaller cities as a factor driving the gains. Insurance companies rallied, with Ping An Insurance Group Co. rising 3.4 percent and China Life Insurance Co. gaining 2 percent.

- Tongda Group Holdings Ltd., which Tuesday joined a recent string of sudden stock declines in Hong Kong, fell 6.9%. Analysts at Cinda International Holdings Ltd. and Bocom International Holdings Co. cut their price outlooks on the shares, voicing concerns over the company’s business outlook.

- Lenovo Group Ltd. climbed 3.7 percent after reporting quarterly profit that fell less than expected. The world’s second-largest PC maker reported a 41 percent slide in net income to $107 million in the three months ended March 31. That compares with the $97.9 million average of analysts’ estimates compiled by Bloomberg.

- Hong Kong’s Hang Seng Properties Index climbed 1.3 percent to the highest close since September. Property prices in third-tier Chinese cities accelerated gains in April, while those in first-tier cities slowed. Analysts pointed out that developers with greater exposure to smaller cities have been among the biggest gainers. The surge may be driven by speculation that buyers locked out by purchase restrictions in larger cities may be flocking to buy flats elsewhere, according to Jackson Hui, an analyst at China Merchants Securities Co. in Hong Kong. China Evergrande Group and Country Garden Holdings Co. are among biggest beneficiaries of rising home sales in smaller cities in China, he said.

- The Hang Seng China Enterprises Index added 1.7%, while the Shenzhen Composite Index climbed 0.7%.

--With assistance from Amy Li Ron Harui Sree Vidya Bhaktavatsalam Emma Dong Philip Glamann and Ryan Lovdahl

To contact Bloomberg News staff for this story: Emma Dai in Hong Kong at edai8@bloomberg.net, Jeanny Yu in Hong Kong at jyu107@bloomberg.net, Amanda Wang in Shanghai at twang234@bloomberg.net, Cindy Wang in Taipei at hwang61@bloomberg.net.

To contact the editors responsible for this story: Richard Frost at rfrost4@bloomberg.net, Robin Ganguly, Sarah McDonald

©2017 Bloomberg L.P.