Chinese Premier Li Keqiang warned of a “complicated and grave” employment situation as Beijing and Shanghai tightened curbs on residents in a bid to contain Covid outbreaks in the country’s most important cities.

Li instructed all government departments and regions to prioritize measures aimed at helping businesses retain jobs and weather the current difficulties, according to a late Saturday statement, which cited the premier’s comments in a nationwide teleconference on employment.

“Stabilizing employment matters to people’s livelihoods, it is also a key support for the economy to operate within a reasonable range,” Li said, urging businesses to resume production with Covid-fighting measures in place, while reiterating the government’s policy to promote the healthy development of internet platform companies to support employment.

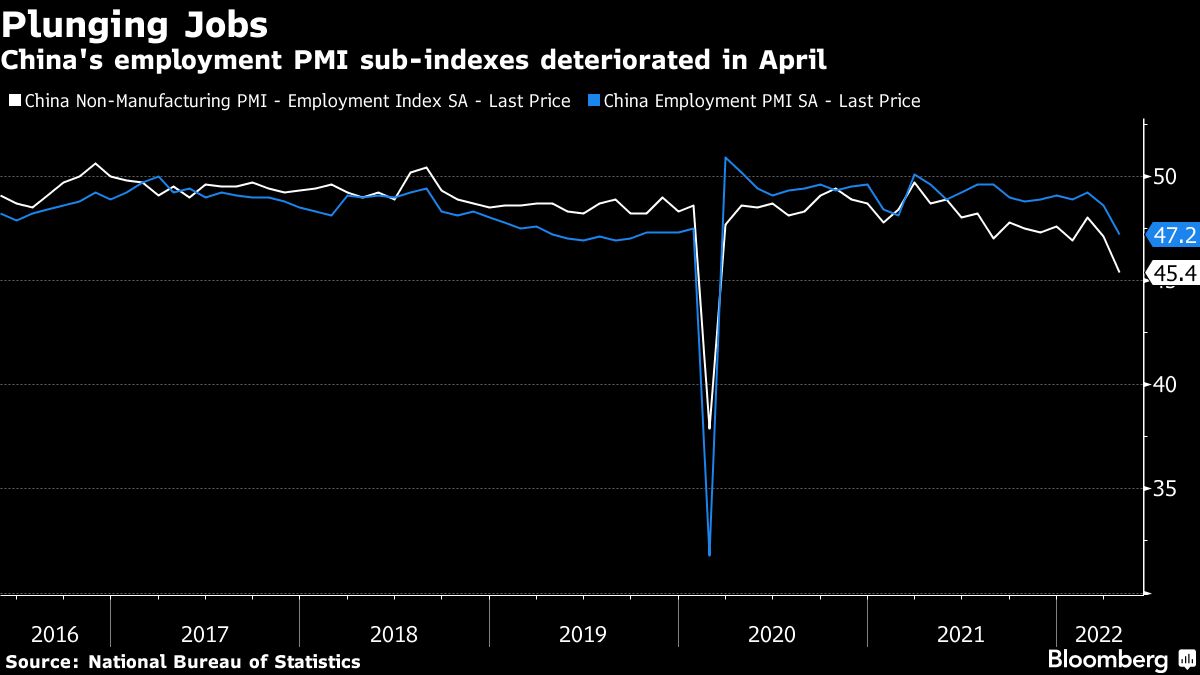

The premier’s warning on employment came after the nation’s surveyed jobless rate climbed to 5.8% in March, the highest since May 2020, according to data released by the National Bureau of Statistics. High-frequency indicators tracking jobs suggest a further deterioration in the labor market in April.

China’s top leaders last week warned against attempts to question the country’s Covid Zero strategy as newly released data for April showed the lockdown-dependent approach taking a heavy toll on the economy. The rolling out of even more intense restrictions over the weekend in Shanghai and Beijing adds further to the challenges facing policymakers seeking to shore up growth.

China reported 4,384 new Covid-19 cases for May 7. Shanghai, which has been under some form of lockdown for weeks, recorded 3,975 new infections, down from 4,000-plus daily infections earlier. Beijing logged 62 new cases as authorities in the capital scramble to contain a wider spread.

More Restrictions

Both Shanghai and Beijing increased restrictions on their residents Sunday to achieve the Covid Zero goal, with authorities in the financial hub stepping up efforts to quarantine close contacts of people testing positive for the virus.

People living in the same building of confirmed cases now also risk being transported to designated quarantine facilities, according to local residents and widely circulated social media posts about the subject. Previously, only people living in the same apartment or the same floor of positive cases would likely be considered close contacts and put under central quarantine.

In a residential compound of Pudong New District in the east of Shanghai, a few residents living on the same floor, as well as upper and lower floors of a household with four confirmed positive cases were ordered to be transferred to a quarantine hotel, according to a weekend notice from the neighborhood committee of the compound.

Top Shanghai officials including party secretary Li Qiang have vowed repeatedly to “win the war” against the outbreak and hit the goal of achieving zero community spread in the city of 25 million residents as soon as possible. Of the nearly 4,000 cases reported for Shanghai Saturday, 11 were still found outside quarantine areas.

In Beijing, authorities on Sunday required all residents in its eastern district of Chaoyang -- home to embassies and offices of multinationals including Apple Inc. and Alibaba Group Holding Ltd. -- to start working from home. This followed an order to shut down some businesses providing non-essential services such as gyms and movie theaters in the district to minimize infections.

Jobs Slump

Relentless lockdown measures in China’s two most important cities and elsewhere are already weighing on the world’s second-largest economy, disrupting the global supply chain and stoking inflationary risks. The measures have snarled operations at the world’s largest port in Shanghai and stalled activity in major cities, affecting the supply chains of businesses from Tesla Inc. to Apple.

The employment sub-gauges of the official manufacturing and non-manufacturing purchasing managers’ indexes both dropped sharply in April, plunging to levels well below the 50-point mark that indicated worsening job prospects in the sectors. The Baidu Index, which measures the frequency of searches for keywords, also shows a spike in searches for the word “layoff” since the beginning of March that surpassed the previous peak in February 2020.

Trade data on Monday will provide clues to the extent of the damage. Chinese export growth likely slowed to its weakest pace since June 2020, while imports probably contracted for a second month, a sign of weak consumer spending as millions of residents in Shanghai and elsewhere were confined to their homes.

China’s Covid Lockdowns Disrupt Global Supply Chains: Eco Week

Chen Yulu, vice governor of the People’s Bank of China, said the central bank would put a greater focus on stabilizing growth and increase support for the real economy. In a Xinhua interview published Saturday, Chen also said authorities will help smaller banks increase their lending capability through the sale of perpetual bonds.

Shanghai government has been scrambling to push key enterprises to resume production, but many foreign businesses say they’re still unable to restart operations.

Financial regulators in Shanghai on Sunday called on local banks to boost credit support for residents with “flexible employment” such as online-shop owners and truck drivers.

Financial institutions in the city have lent 72.3 billion yuan ($10.8 billion) to sectors including retail, catering and tourism and 33.5 billion yuan to materials suppliers and logistics companies since March when the latest outbreak started in the city, Yu Wenjian, an official with the central bank’s Shanghai head office, said at a regular briefing on Sunday. He also urged banks to allow Shanghai home buyers to delay mortgage payments or adjust payment plans to help them weather the Covid impact.

©2022 Bloomberg L.P.