Due to regulatory approval challenges in China, Intel Corporation and Tower Semiconductor have jointly chosen to halt their acquisition discussions. As a result, Intel will compensate Tower with a $353 million termination fee. Despite this setback, Intel remains committed to its foundry initiatives, Intel Foundry Services (IFS), and has expressed interest in potential future collaborations with Tower.

When Intel announced plans to take over Tower Semiconductor in February 2022, the deal made great strategic sense for its Intel Foundry Services division. Firstly, the company would gain seven fabs tailored to build products on specialized nodes. Secondly, IFS would gain dozens of specialty process technologies. Thirdly, IFS would acquire tens or hundreds of customers with long-term contracts. Fourthly, Intel would get many seasoned foundry industry veterans with vast experience in contract manufacturing of chips, something the company does not have. Finally, IFS would immediately find itself in the Top 10 foundries list should it absorb Tower Semiconductor.

Some would argue that without 150-mm and 200-mm mature process technologies, clients with long-term contracts, and management with vast experience in the foundry business, it will be considerably harder for IFS to grow and become the world's second-largest foundry by 2030. Furthermore, after failing to acquire GlobalFoundries in 2021 and Tower Semiconductor in 2023, Intel will have to focus entirely on serving customers who need leading-edge production nodes, at least until its own technologies mature, which means cut-throat head-to-head competition against mighty TSMC and Samsung Foundry. But Intel remains quite optimistic about its foundry division future primarily because it is the only company that can offer vertically integrated services, from wafer-in to product-out.

"Since its launch in 2021, Intel Foundry Services has gained traction with customers and partners, and we have made significant advancements toward our goal of becoming the second-largest global external foundry by the end of the decade," said Stuart Pann, senior vice president and general manager of Intel Foundry Services (IFS). "We are building a differentiated customer value proposition as the world's first open system foundry, with the technology portfolio and manufacturing expertise that includes packaging, chiplet standards and software, going beyond traditional wafer manufacturing."

So far, IFS has been having quite a bumpy ride. On the one hand, Intel's collaboration with the U.S. Department of Defense, Arm, and MediaTek showcases its expanding footprint in the industry. Notably, Intel secured a pivotal role in the Department of Defense's RAMP-C initiative. Furthermore, it entered into a comprehensive agreement with Arm to optimize Arm's IP for IFS's upcoming 18A process technology (1.8nm-class). In addition, MediaTek is now committed to using Intel's leading-edge nodes. Perhaps most importantly, the company is now building advanced fabs in three parts of the world: the U.S., Europe, and the Middle East.

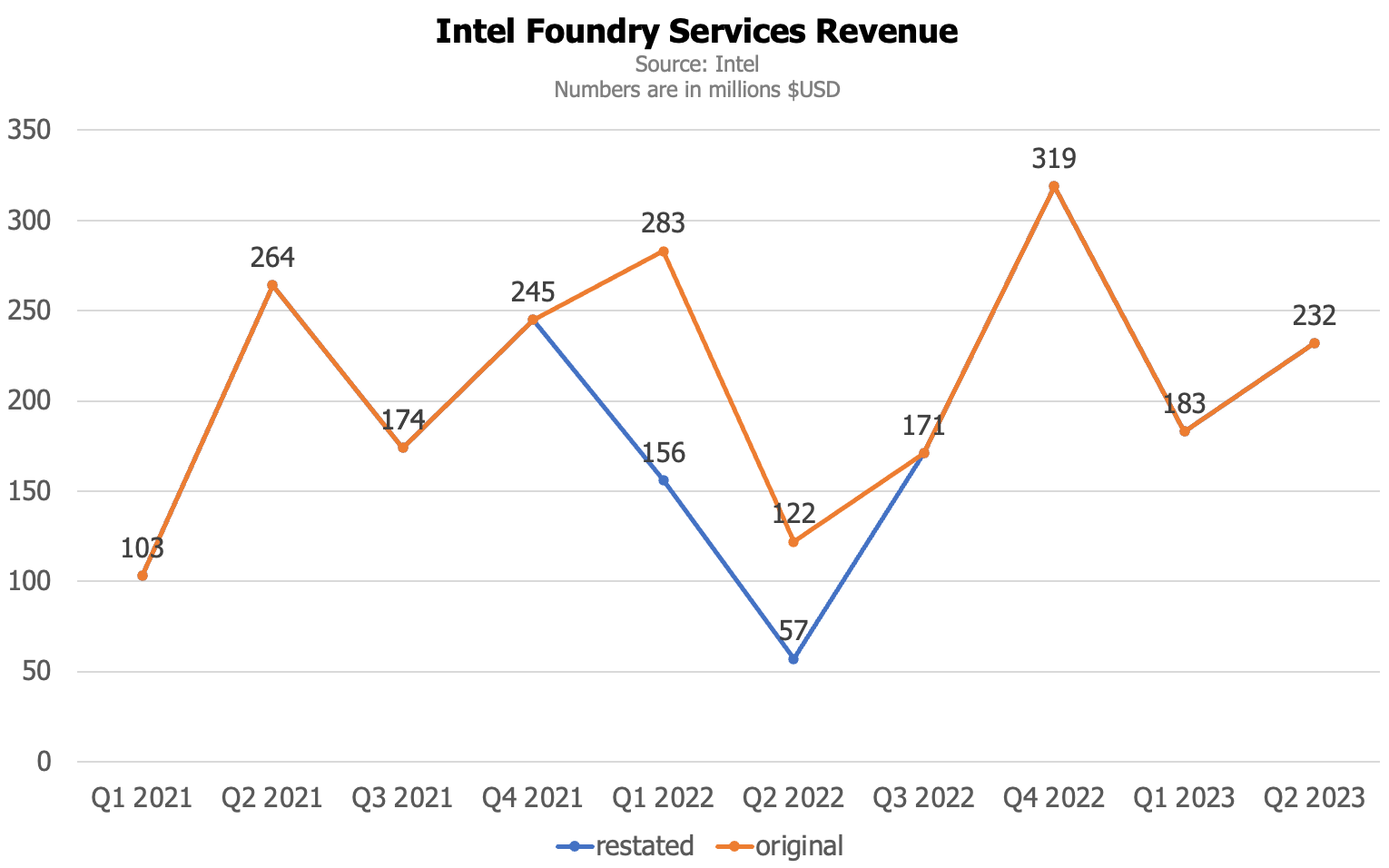

On the other hand, IFS generated $786 million in revenue in 2021 and lost $23 million that year. Still, in 2022 it earned $703 million (after restating its revenue and losses for Q1 and Q2 in 2023) and lost $291 million (after restatements). So far this year, Intel's foundry unit generated $415 million in revenue (up 13% from H1 2021 and up 94% from H1 2022), but lost $283 million. Furthermore, two years after inception, only MediaTek has committed to using IFS's leading-edge fabrication technologies (which is not a big problem per se).

In general, the success of IFS now fully depends on how competitive Intel 20A and Intel 18A nodes are and whether there is enough support from EDA and IP developers to enable flawless usage of these technologies by fabless chip designers.

"We are executing well on our roadmap to regain transistor performance and power performance leadership by 2025, building momentum with customers and the broader ecosystem and investing to deliver the geographically diverse and resilient manufacturing footprint the world needs," said Pat Gelsinger, CEO of Intel. "Our respect for Tower has only grown through this process, and we will continue to look for opportunities to work together in the future."