Chewy Inc. (CHWY) stock is down after reporting strong Q2 revenue and free cash flow (FCF) growth and FCF margins on Sept. 10. As a result, CHWY looks undervalued here by at least 15%-16%. One way to play it is to short out-of-the-money put options.

CHWY is down to $35.13 in midday trading on Friday, September 12. This is after it peaked at $42.33 on September 5, before its results were released.

However, after reviewing Chewy's strong free cash flow (FCF) and FCF margins, it's evident that CHWY stock is worth at least $40.68 per share. This article will show why.

Strong Revenue and FCF

Chewy, Inc., which sells pet food, products, and services online, said its Q2 revenue ending Aug. 3 rose 8.6% Y/Y and its adjusted net income was up $36.4 million or +34.8% to $141.1 million.

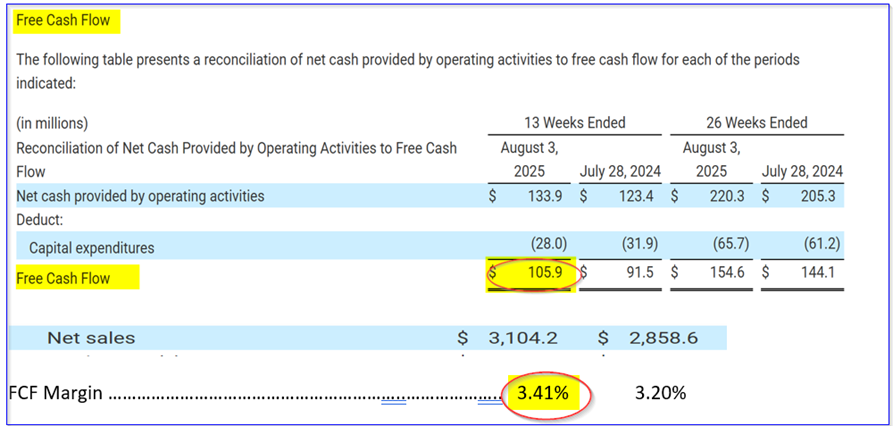

More importantly, its free cash flow (FCF) was positive and rose from $91.5 million last year Q2 to $105.9 million, a gain of +15.7%. In other words, even though net sales were up 8.6% its FCF rose 82.5% more, or up +15.7%.

That implies the company is generating more cash flow from operations as its sales increase. In other words, the FCF margin (i.e., % of sales) rose from 3.20% last year to $3.41% this year.

This can be seen in Stock Analysis's quarterly FCF margin analysis, as well as the table provided by management in the earnings release showing its FCF calculation:

Moreover, over the past year, according to Stock Analysis, its FCF margin has been 3.75%. We can use that to forecast the company's FCF over the next 12 months (NTM).

Forecasting FCF

For example, analysts now expect sales this year ending Jan. 2026 will reach $12.56 billion and $13.58 billion for the year ending Jan. 2027.

That implies that its NTM net sales will be $13.07 billion. As a result, after applying at least a 3.75% FCF margin, its FCF could rise to over $490 million:

$13.07 billion x 0.0375 = $490.15 million FCF

That is significantly higher than its run-rate FCF. For example, this is 15.7% higher than the $105.9 million Q2 FCF on a run rate basis:

$105.9 x 4 = $423.6 million run rate FCF

$490.15 m NTM FCF / $423.6 = 1.157 -1 = +15.7% potential FCF growth

Target Prices

Moreover, it could lead to at least a 15.7% higher stock price.

For example, right now the stock has a run rate 2.889% FCF yield based on its market cap today of $14.674 billion (i.e., $423.6 / $14,674 million mkt cap = 0.028867).

So, applying that FCF yield metric to the NTM forecast:

$490.15 million NTM FCF / 0.0289 = $16.96 billion mkt cap

That is 15.58% higher than today's mkt cap. In other words, CHWY stock is worth 15.8% more:

$35.13 x 1.158 = $40.68 target price

Analysts are even more bullish. Yahoo! Finance says that the average price target of 28 analysts is $45.27 per share. AnaChart's survey of 23 analysts is $45.10.

The bottom line is that CHWY stock looks deeply undervalued here.

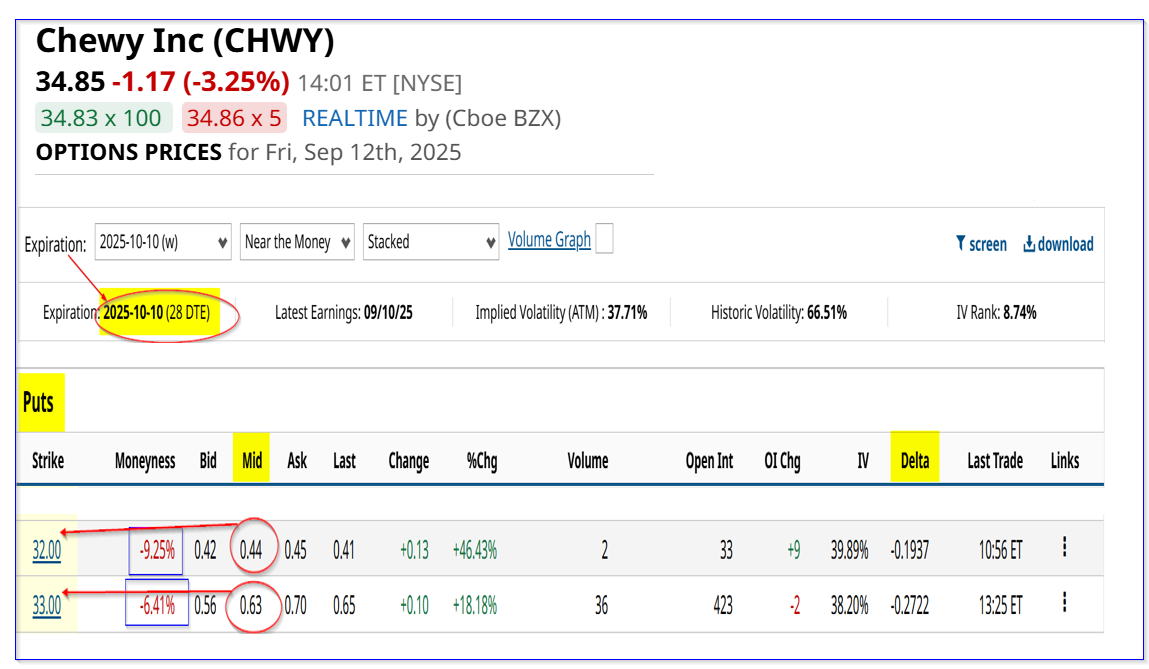

One way to play it, to set a lower buy-in price and get paid while waiting, is to sell short out-of-the-money (OTM) put options.

Shorting OTM CHWY Puts

For example, look at the Oct. 10 expiration period. It shows that the $33.00 strike price, over 6% below today's price, has a midpoint premium of $0.63, and the $32.00 strike price, 9% lower than today, has a $0.44 premium.

That means that short sellers of the $33.00 premium can make an immediate yield of 1.909% (i.e., $0.63/$33.00) and the $32.00 short-seller can make a 1.375% yield (i.e., $0.44/$32.00).

These are one-month yields. The investor has to secure $3,330 with their brokerage firm to short the $33.00 put and $3,200 to do the $32.00 put short-sale.

In return, their account will immediately receive $63 and $44, respectively.

This obligates the investor to buy 100 shares if the stock falls to $33.00, or $32.00 anytime over the next month to Oct. 10. However, the investor still gets to keep the income already collected in their account.

As a result, the breakeven point is lower (assuming the account is assigned to buy shares if CHWY falls to $33.00 or $32.00):

$33.00 -$0.63 = $32.37 breakeven point = 7.1% below today's price of $34.85

$32.00 - $0.44 = $31.56 breakeven = 9.44% below today's price

The idea here is that you can make a good yield, set a lower buy-in price, and have good downside protection, just in case CHWY stock keeps falling.

But remember, it's always possible that the stock could fall below the breakeven point. That might result in an unrealized loss. But, at least the investor knows that the potential upside is even greater than my calculations above.

The bottom line here is that CHWY is generating strong FCF and FCF margins. That sets its price target even higher, given analysts' higher revenue estimates. One way to play this is to short OTM puts.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.