/A%20hand%20holding%20a%20phone%20with%20the%20Reddit%20logo_%20Mamun_Sheikh%20via%20Shutterstock_.jpg)

Reddit (RDDT) stock fell by more than 10% on Wednesday after data revealed that ChatGPT's references to the platform have plummeted. The social media company was cited in just 2% of ChatGPT responses on Tuesday, down sharply from an average of 9.7% in August and a peak of over 14% in September. Despite an almost 4% rebound in today's trading, that's still a concerning drop for a stock trading at over 100 times earnings.

The decline matters because Reddit's business model is increasingly dependent on AI relevance. The company has struck lucrative data licensing deals with OpenAI and Google (GOOG) (GOOGL), reportedly exploring dynamic pricing where more frequent citations mean higher payouts. If ChatGPT mentions keep falling, Reddit's negotiating leverage weakens considerably.

While ChatGPT citations grab headlines, Google search drives the lion's share of Reddit's traffic. Any algorithm change could impact user growth, and at current valuations, Reddit can't afford that. Its advertising revenue, which accounts for 93% of the top line, relies on consistent increases in traffic.

Q2 saw ad revenue jump 84% to $465 million, marking the fastest growth in three years; however, that momentum requires Google's cooperation to continue.

How Did Reddit Perform in Q2?

Reddit's Q2 results tell a different story than the ChatGPT citation panic suggests. It posted its strongest quarter in years, with revenue jumping 78% to $500 million and daily active users growing 21% to 110 million.

More importantly, Reddit turned profitable with $89 million in net income and generated $111 million in free cash flow. Ad revenue surged 84% to $465 million, with the active advertiser count increasing by over 50% year-over-year (YoY). New products, such as Dynamic Product Ads, are delivering a 2x better return on ad spend compared to standard campaigns. Moreover, performance and brand advertising both grew over 80%, showing broad-based strength across the business.

During the earnings call, Reddit's CEO, Steve Huffman, noted that the company is the most cited domain across all AI models, not just ChatGPT. The platform's human-generated conversations remain essential for training AI models, which is why data licensing revenue reached $35 million, a 24% YoY increase.

Reddit is investing heavily in three areas: core product improvements, search expansion, and international growth. Reddit Answers has grown from one million to six million users in a single quarter. Machine translation is now live in 23 languages, opening up massive markets across Asia, Europe, and Latin America.

Management's focus on lifetime value over quarterly optimization means they're playing the long game. It is spending on marketing and product development while still expanding adjusted EBITDA margins to 33%, up nearly 1,900 basis points YoY. For Q3, Reddit guided to 54-56% revenue growth with EBITDA margins around 35%.

The ChatGPT citation drop is worth monitoring, but Reddit's fundamentals suggest the business is far more resilient than Wednesday's selloff implied.

What Is the RDDT Stock Price Target?

Analysts tracking RDDT stock forecast revenue to increase from $2 billion in 2024 to $5.6 billion in 2029. In this period, free cash flow is projected to improve from $648 million to $2.17 billion. If RDDT stock trades at 40 times forward FCF, which is reasonable, given its growth estimates, it could gain 135% within the next four years.

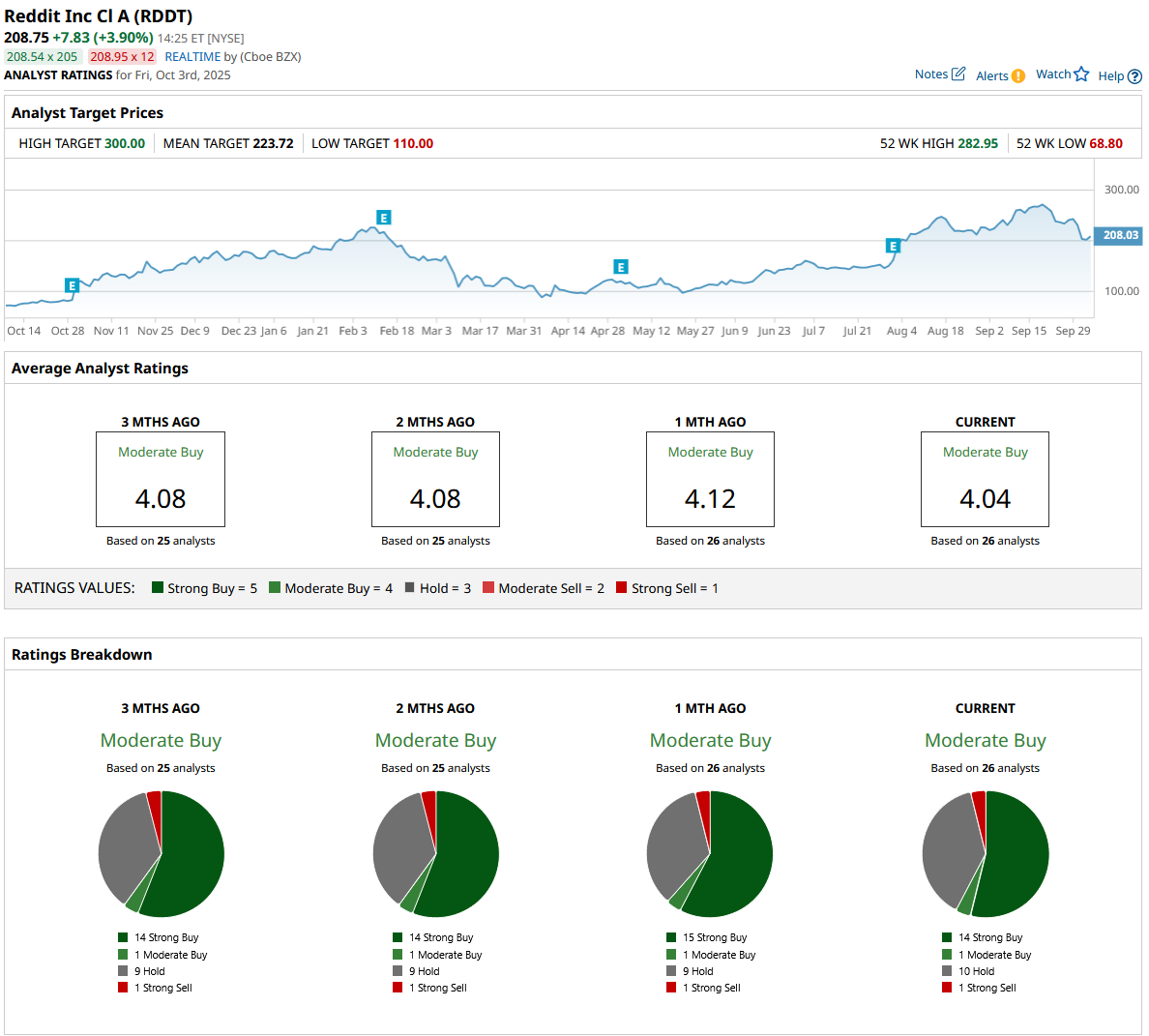

Out of the 26 analysts covering RDDT stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” 10 recommend “Hold,” and one recommends “Strong Sell.” The average Reddit stock price target is $224, above the current price of $208.