Some traders may not have noticed that travel stocks lately have been strong

Everything from Delta Air Lines (DAL), which recently rallied 15 days in a row, to Expedia (EXPE), Airbnb (ABNB) and more have traded quite well. That also includes the cruise stocks.

Names like Royal Caribbean (RCL), Carnival Cruise (CCL) and Norwegian Cruise Line (NCLH) have been moving higher. From the late-April low, they’re up 62%, 81.5% and 55%, respectively.

All three are also riding multiweek win streaks, and Royal Caribbean and Norwegian Cruise Line reported solid quarterly results in early May.

Don't Miss: Alibaba CEO Steps Down; Buy the Dip in the Stock?

With strong travel trends working in their favor, cruise stocks have been booming.

Of the cruise stocks, Royal Caribbean has made up the most ground from its 2020 decline, while Carnival has enjoyed the largest rally off the recent low. So let’s look at those two stocks now.

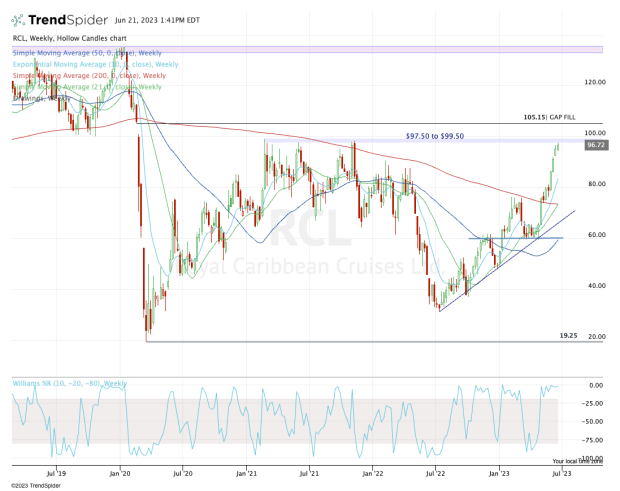

Trading Royal Caribbean Stock

Chart courtesy of TrendSpider.com

Royal Caribbean stock has rallied in eight of the past 10 weeks and is approaching a key resistance zone between $97.50 and $99.50.

The shares might burst through this area just as they did near the $75 area and the 200-week moving average. But the stock has come a long way since then, and a reset would not be a bad development for the bulls.

Don't Miss: Costco Stock Breaks Out. Bulls Take Note

On the downside, the bulls can look for support from short-term moving averages like the 10-day or 21-day. A dip down to the 10-week moving average should help set up another upside bounce if the bulls are truly in control.

On the upside, the bulls want to see a push through resistance and a close above $100. If the stock can do that, the $105 gap-fill is in play, followed by the 78.6% retracement near $110.50.

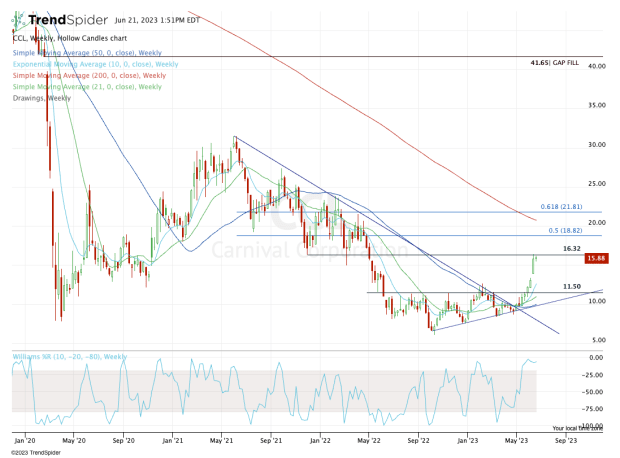

Trading Carnival Cruise Stock

Chart courtesy of TrendSpider.com

Carnival Cruise stock had been trapped in a brutal downtrend since it peaked in May 2021. The decline even sent the stock below its covid-19 low from March 2020. The stock broke out over the $11.50 to $12.50 area and is now riding a five-week win streak.

While Carnival is running into a bit of resistance near $16.50, the bulls have their sights set on the $20 area.

Don't Miss: Can AMD Stock Make New Highs? First, Here's Where Support Must Hold

There we have the 50% to 61.8% retracement zone (between $18.82 and $21.81), as well as the declining 200-week moving average.

The upside target is a reasonable one to shoot for, but after the stock’s latest surge, it wouldn’t be a bad idea to wait for a dip. At the very least, let’s see how the stock handles a dip to the 10-day or 21-day moving average.

On a larger correction, bulls want to see the 10-week moving average hold as support, along with the $11.50 to $12.50 zone. If we get a quick decline down to this area, it may be a reasonable risk/reward entry point for bulls who missed the current rally.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.