Valued at a market cap of around $36 billion, Charter Communications, Inc. (CHTR) is a major U.S. telecommunications company. The Connecticut-based operator of the Spectrum brand provides broadband internet, cable television, mobile, and voice services to residential and business customers across 41 states.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CHTR fits the label perfectly. As one of the nation’s largest broadband and cable providers by subscriber base, Charter serves tens of millions of customers and maintains a major presence in the domestic communications and entertainment market.

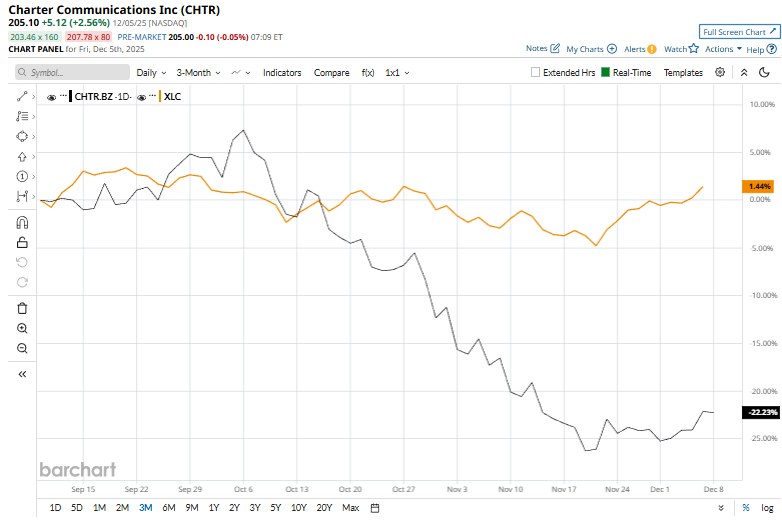

Despite its notable strength, shares of the broadband connectivity provider have slipped 53.1% from its 52-week high of $437.06, reached on May 16. Moreover, shares of CHTR have declined 21.6% over the past three months, significantly underperforming the Communication Services Select Sector SPDR ETF Fund’s (XLC) 2.1% gains during the same time frame.

In the longer term, CHTR stock has fallen 49.3% over the past 52 weeks, lagging behind XLC’s 17.1% uptick over the same time period. Moreover, on a YTD basis, shares of CHTR are down 40.2%, compared to XLC’s 21% return.

To confirm its bearish trend, the stock has been trading below its 200-day moving average since late July, and has remained below its 50-day moving average since mid-July.

On Oct. 31, CHTR reported its Q3 results, and its shares slumped 5% in the following trading session. The company reported earnings per share of $8.34, below the Wall Street consensus of $9.32, reflecting margin pressure and higher operating costs. Revenue for the quarter reached $13.67 billion, slightly under analysts’ estimates of $13.74 billion, driven by softer subscriber trends across broadband and video services.

CHTR stock has also lagged behind its rival, Comcast Corporation (CMCSA), which declined 36.2% over the past 52 weeks and 27.2% on a YTD basis.

The stock has a consensus rating of "Hold” from the 24 analysts covering it, and the mean price target of $336.31 suggests a 64% premium to its current price levels.

.jpg?w=600)