Nio Inc (NYSE:NIO) is trading slightly lower, while Xpeng Inc (NYSE:XPEV) is moving higher on Wednesday, after each printed an inside bar pattern in consolidation on Tuesday.

Both China-based electric vehicle manufacturers broke down from bearish head-and-shoulder patterns on Monday, but bulls came in and bought the dip when the SPDR S&P 500 (NYSE:SPY) bounced up from the $420 level. This caused Nio to print a hammer candlestick on the daily chart and Xpeng to form a dragonfly candlestick. Both candlesticks indicate that at least the temporary bottom may be in for the stocks.

It should be noted, however, that events affecting the general markets, negative or positive reactions to earnings reports and news headlines about a stock can quickly invalidate patterns and breakouts. As the saying goes, "the trend is your friend until it isn't" and any trader in a position should have a clear stop in place and manage their risk versus reward.

In The News: On Monday, Guangdong Hongtu Technology launched a 6,800-ton integrated die-casting unit that could supply to at least two U.S.-listed Chinese electric vehicle makers. Both Nio and Xpeng entered into Guangdong Hontu’s supply chain last year.

Tesla, Inc (NASDAQ:TSLA) currently uses the technology, known as its Giga-press, to manufacture its Model Y. The technology is viewed as the key to improving manufacturing efficiency for electric vehicle makers because it greatly reduces the number of individual parts required for the vehicle’s body.

See Also: Nio Said To Be Exploring Secondary Listing In Singapore Amid Hong Kong Delay

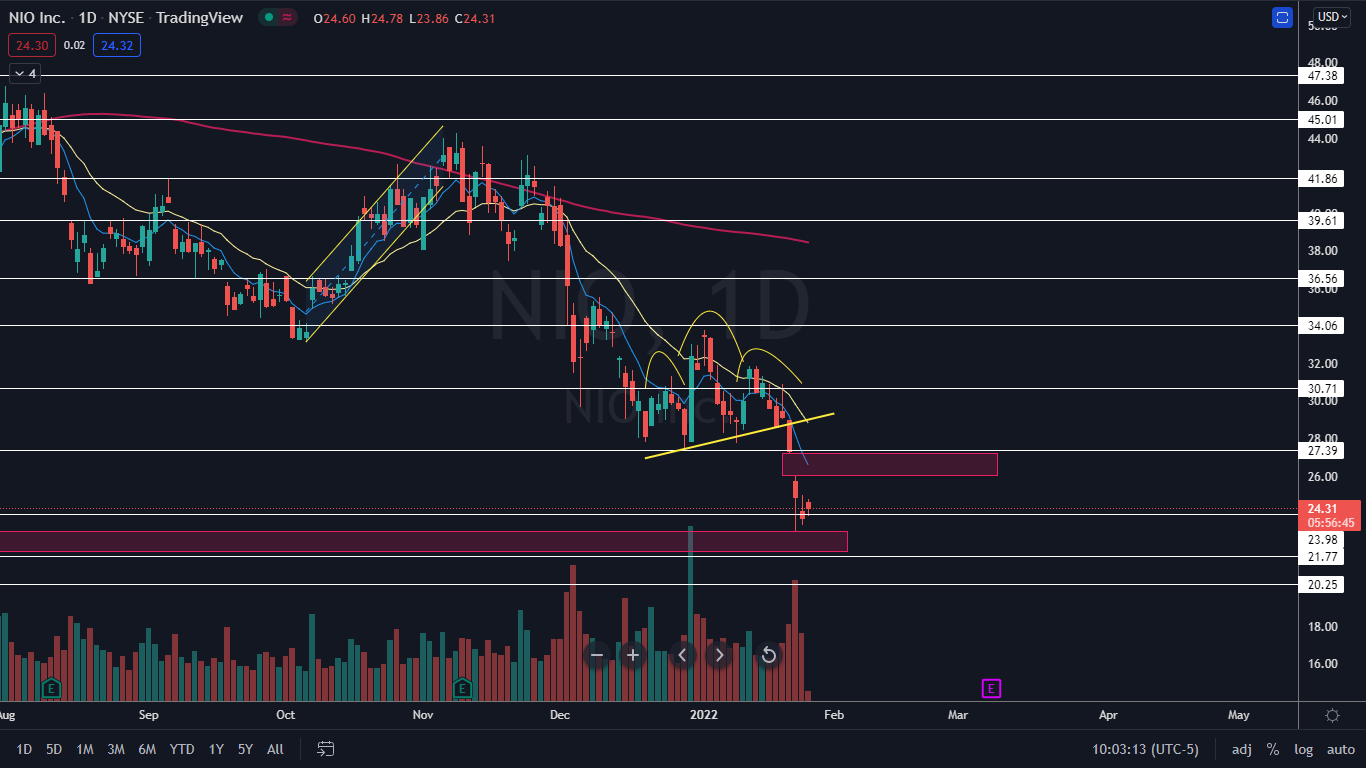

The Nio Chart: When the markets opened on Wednesday, Nio immediately ran into a group of sellers who knocked the stock down slightly. Nio may print a double inside bar pattern, if the stock isn’t able to break above or below Tuesday’s candlestick.

- Traders can watch for Nio to break up or down from the pattern intraday Wednesday or on Thursday to gauge the future direction.

- Nio has two gaps on its chart, one is below the current share price between $21.97 and $23.09 and the other is slightly above between the $25.98 and $27.22 range. Gaps on charts fill about 90% of the time, so it is likely Nio will trade into both ranges in the future. Many bulls would likely feel more comfortable if the stock drops to fill the lower gap before rebounding.

- Nio is trading well below the 200-day simple moving average (SMA), which indicates the stock is in a bear cycle.

- There is resistance above at 27.39 and $30.71 and support below at $21.77 and $20.55.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Xpeng Chart: Like Nio, Xpeng opened higher, ran into sellers and then looked to be printing another inside bar to create a double inside bar pattern.

- On Monday, Xpeng lost support at the 200-day SMA and the level will now likely act as heavy resistance.

- Xpeng has a gap above between $40.06 and $41.63 and if the stock is able to pop up into that range it will regain the 200-day SMA as support.

- Xpeng has resistance above at $42.40 and $45.75 and support below at $39.02 and $36.07.

Photo: Courtesy of nio.com and ir.xiaopeng.com