Bed Bath & Beyond, Inc (NASDAQ:BBBY) and Wayfair, Inc (NYSE:W) are both trading higher on Monday although Bed Bath & Beyond gapped up a whopping 85% off Friday’s closing price, while Wayfair was trading up a more conservative 2%.

Both stocks have plummeted from their all-time highs, with Bed Bath & Beyond trading down about 70% from its Jan. 3, 2014, all-time high of $80.82 and Wayfair currently trading down about 65% from its Jan. 14, 2021, all-time high of $36. The stocks are both showing signs the bottom may be in and sentiment may be changing.

Wayfair may have less risk versus reward in the shorter term from a charting perspective because it has developed into a bullish pattern on its daily chart. Bed Bath & Beyond has garnered the attention of a billionaire investor, however, which may mean there is a higher opportunity for growth over the long term.

It should be noted, however, that events affecting the general markets, negative or positive reactions to earnings prints and news headlines can quickly invalidate patterns and breakouts. As the saying goes, "the trend is your friend until it isn't" and any trader in a position should have a clear stop set in place and manage their risk versus reward.

In The News: Chewy, Inc (NYSE:CHWY) co-founder and GameStop Corporation (NYSE:GME) chairman Ryan Cohen took a 9.8% stake in Bed Bath & Beyond while advising the company that he believes the retail chain “needs to narrow its focus to fortify operations and maintain the right inventory mix to meet demand.”

Wayfair may need to consider adjusting its inventory as well because when the company printed its fourth-quarter and full-year 2021 earnings on Feb. 24, the company reported a sales decline of 11.4% year-over-year and a loss of 92 cents per share, which missed the consensus estimate of a 69-cent loss per share.

See Also: Chewy, GameStop, Bed Bath & Beyond: How Have Ryan Cohen's E-Commerce Bets Performed?

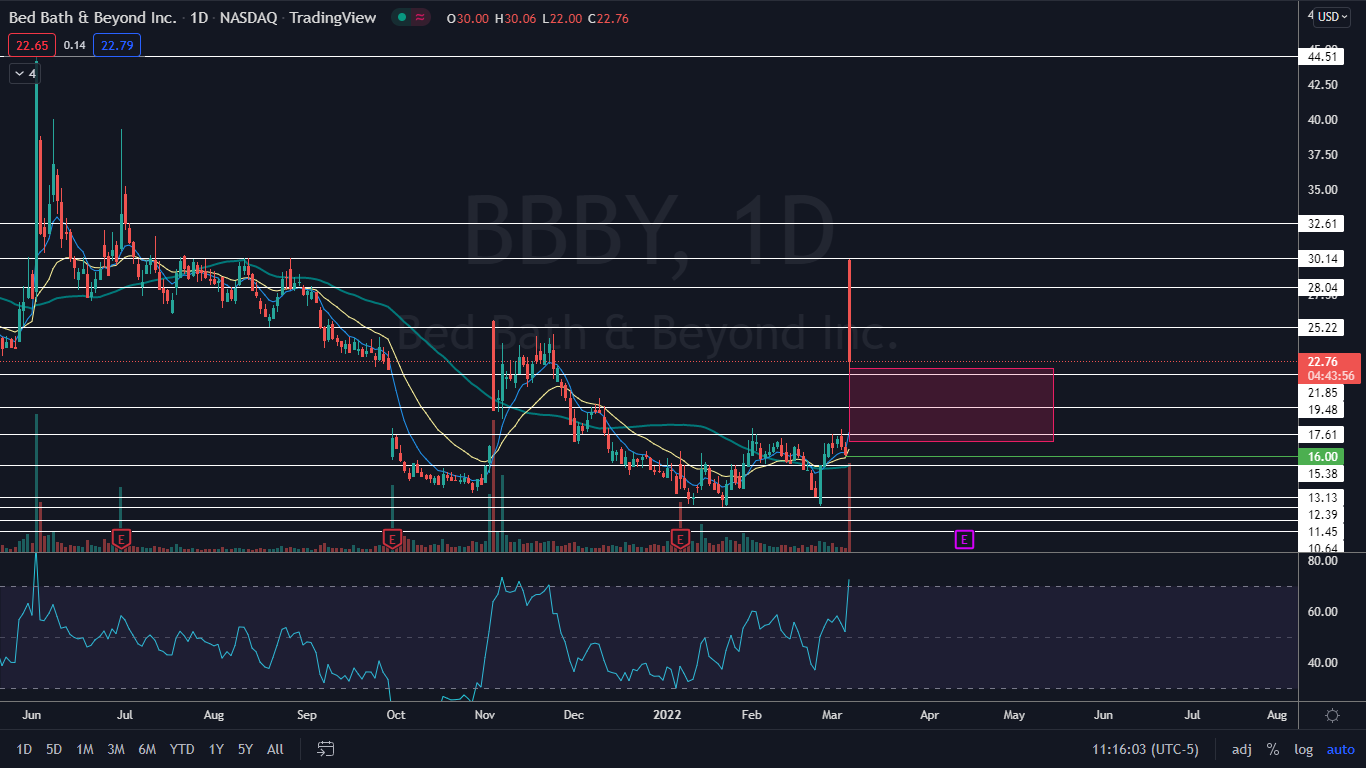

The Bed Bath & Beyond Chart: When Bed Bath & Beyond gapped up to the $30 level on Monday the stock immediately ran into a group of sellers who dropped Bed Bath & Beyond down about 25% off the open. Gaps on charts fill about 90% of the time, which makes it likely the entire gap down to the $17 level will fill in the future.

- Bulls would prefer to see the gap fill quickly and then for big bullish volume to come in and drive the stock back up.

- Bed Bath & Beyond has been trading in a confirmed uptrend since Feb. 24 and has made one higher low and one higher high within the pattern. The most recent higher low was printed on Friday at the $16 level and if the stock doesn’t fall below the area when it prints its next low, the uptrend will continue.

- The stock’s relative strength index (RSI) reached the 73% level on Monday, which indicates the next higher low is likely to come soon. When a stock’s RSI reaches or exceeds the 70% level it becomes overbought, which can be a sell signal for technical traders. Bullish traders may consider entering a position on the next higher low.

- Bed Bath & Beyond has resistance above at $25.22 and $28.04 and support below at $21.85 and $19.48.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Wayfair Chart: Wayfair fell about 18% after printing earnings, but bulls came in and bought the dip and the stock rallied 26% higher to close the Feb. 24 trading session just above the $127 level.

- Wayfair may be settling into an inverted head-and-shoulder pattern on the daily chart with the left shoulder formed between Feb. 1 and Feb. 14, the head created between Feb. 15 and Feb. 28 and the right shoulder being formed over the trading days that have followed.

- Traders can watch for Wayfair to break up from the descending neckline of the pattern on higher-than-average volume to gauge whether the pattern was recognized. If so, the measured move is about 47%, which indicates Wayfair could rally up toward the $216 level in the future.

- If Wayfair can break above the neckline of the head-and-shoulders, the stock will also print a higher high above the March 1 high of $143.40, which would confirm Wayfair is now trading in an uptrend.

- Wayfair has resistance above at $139.93 and $166.40 and support below at $120.43 and $101.76.

.png?w=600)