/Charles%20River%20Laboratories%20International%20Inc_%20chart%20and%20logo-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $8.1 billion, Charles River Laboratories International, Inc. (CRL) is a leading full-service, early-stage contract research organization. The company supports global pharmaceutical, biotechnology, government, and academic clients with research models, drug discovery, safety assessment, and manufacturing solutions to accelerate drug development.

Shares of the Wilmington, Massachusetts-based company have underperformed the broader market over the past 52 weeks. CRL stock has dipped nearly 20% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.1%. Moreover, shares of the company have decreased 11.3% on a YTD basis, compared to SPX's 9.9% rise.

Looking closer, CRL stock has posted a steeper decline than the Health Care Select Sector SPDR Fund's (XLV) 11.7% drop over the past 52 weeks.

Despite posting better-than-expected Q2 2025 adjusted EPS of $3.12 and revenue of $1.03 billion, Charles River’s shares dropped 10.3% on Aug. 6. The decline was driven by investor concerns over a higher number of client order cancellations, particularly from cash-constrained biotech companies. Although the company raised its 2025 adjusted profit forecast to $9.90 per share - $10.30 per share, demand uncertainty overshadowed the strong results.

For the fiscal year ending in December 2025, analysts expect CRL's adjusted EPS to decline 1.1% year-over-year to $10.21. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

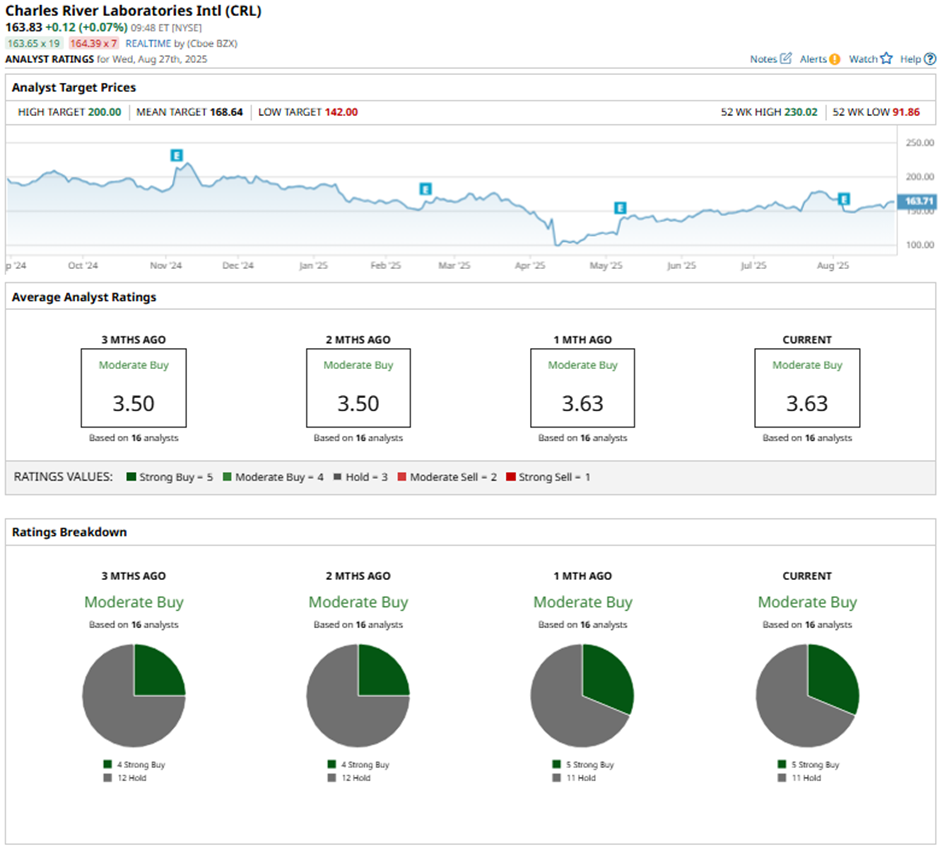

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings and 11 “Holds.”

This configuration is slightly more bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Aug. 7, Barclays analyst Luke Sergott raised Charles River’s price target to $165 while maintaining an “Equal Weight” rating.

The mean price target of $168.64 represents a 2.9% premium to CRL’s current price levels. The Street-high price target of $200 suggests a 22.1% potential upside.