Northbrook, Illinois-based CF Industries Holdings, Inc. (CF) manufactures and sells hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities. Valued at a market cap of $13.5 billion, the company is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Wednesday, Nov. 5.

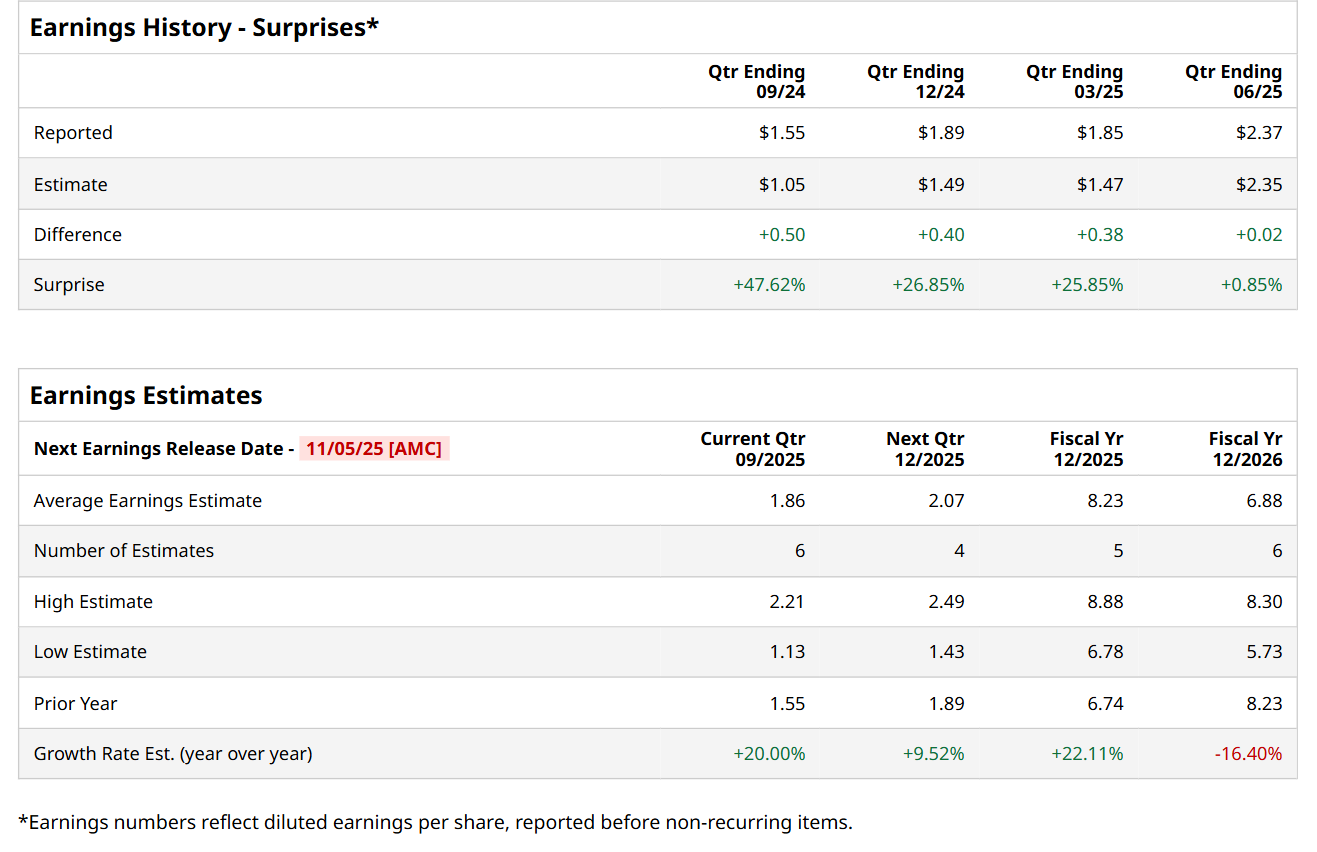

Before this event, analysts expect this agricultural fertilizer manufacturer to report a profit of $1.86 per share, up 20% from $1.55 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.37 per share in the previous quarter topped the consensus estimates by a slight margin.

For fiscal 2025, analysts expect CF to report a profit of $8.23 per share, representing a 22.1% increase from $6.74 per share in fiscal 2024. However, its EPS is expected to decline by 16.4% year-over-year to $6.88 in fiscal 2026.

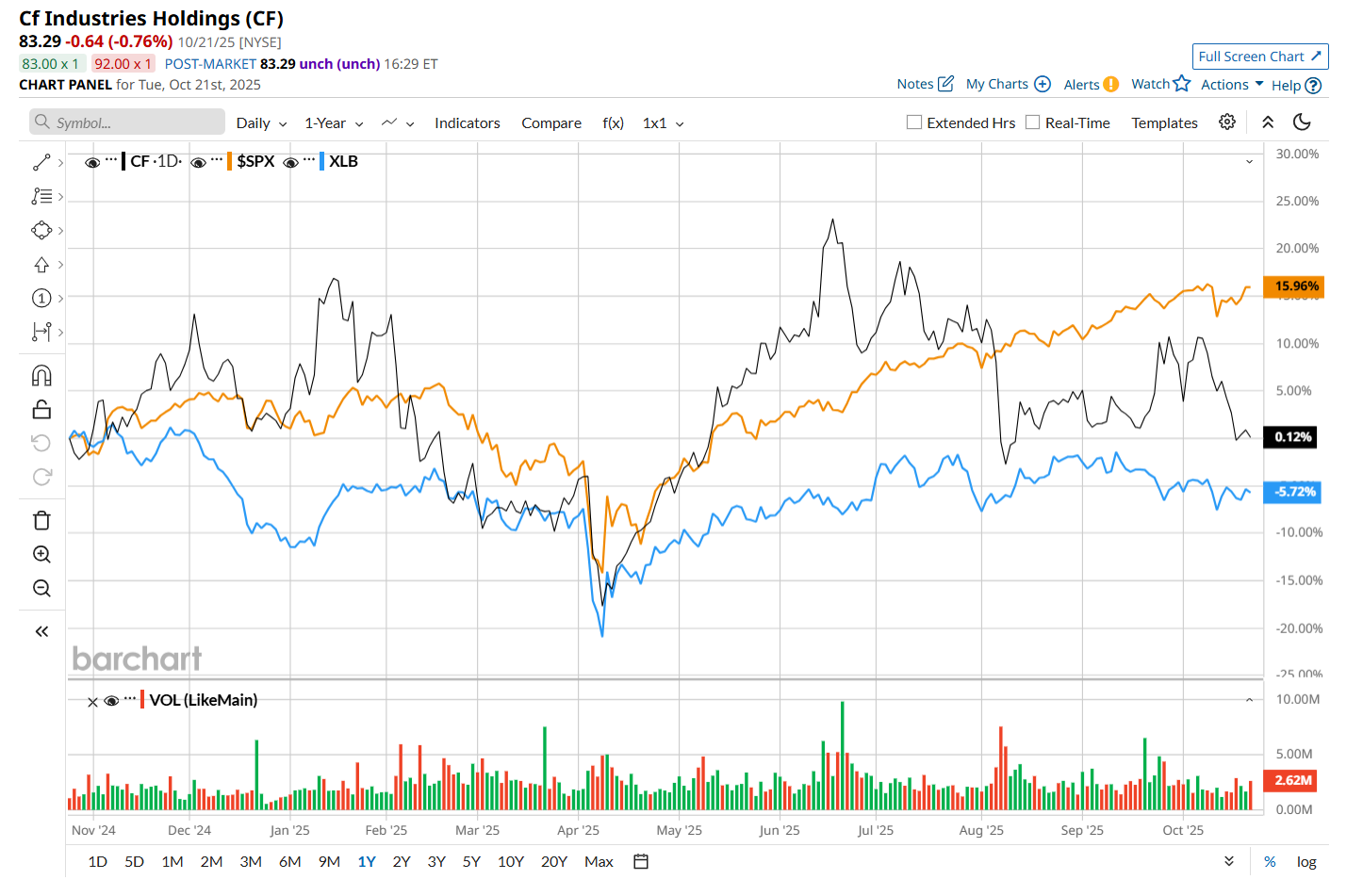

CF has declined 1.1% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 15.1% uptick over the same time frame. However, it has outpaced the Materials Select Sector SPDR Fund’s (XLB) 8.6% drop over the same time period.

CF posted better-than-expected Q2 results on Aug. 6, yet its shares plunged 7.8% in the following trading session. Due to higher sales volume and average selling prices, the company’s net sales grew 20.2% year-over-year to $1.9 billion, surpassing consensus estimates by a notable margin of 9.2%. Meanwhile, its EPS grew 3% from the year-ago quarter to $2.37, exceeding analyst expectations of $2.35.

Wall Street analysts are cautious about CF’s stock, with an overall "Hold" rating. Among 17 analysts covering the stock, three recommend "Strong Buy," 13 suggest "Hold,” and one indicates a "Moderate Sell” rating. The mean price target for CF is $93.53, implying a 12.3% potential upside from the current levels.