Circle Internet Group's (CRCL) meteoric rise since its June IPO has been nothing short of spectacular, with shares skyrocketing over 300% from its $31 debut price. However, CEO Jeremy Allaire and other insiders are now cashing in, launching a secondary offering of 10 million shares that's raising $1.4 billion.

Just two months after going public, Circle announced that eight million shares would come from existing shareholders, including CEO Allaire, while the company would offer two million shares. This move triggered a 5% after-hours decline, raising questions about management's confidence in the stock's current valuation.

Despite the insider selling, Circle's business momentum remains solid. In Q2 of 2025, Circle reported revenue of $658 million, an increase of 53% year over year, driven by USDC stablecoin circulation growing 90% year-over-year (YOY) to $61.3 billion.

Management projects USDC will grow at a 40% compound annual rate, positioning Circle to capture significant market share in what analysts believe could become a trillion-dollar stablecoin market.

The Trump administration's crypto-friendly policies have created unprecedented opportunities for Circle. The recently passed GENIUS Act represents the first U.S. crypto law, and Allaire noted that major financial institutions are now actively engaging with Circle for banking, payments, and capital markets applications.

While insider selling might raise a few eyebrows, it's common for founders and early investors to diversify after successful IPOs. Circle's strong fundamentals, dominant USDC position, and favorable regulatory environment suggest the selling may simply reflect profit-taking rather than fundamental concerns. Investors should focus on the company's execution and market opportunity, rather than temporary selling pressure from insiders looking to realize gains after a remarkable run.

Evidence of this can be seen at CRCL's current price action. It has already bounced back almost 2% today.

Is Circle Stock a Good Buy Right Now?

During its earnings call, Circle announced Arc, a groundbreaking Layer 1 blockchain that uses USDC as a native gas currency. This eliminates the complexity of paying transaction fees in volatile tokens. Arc positions Circle to capture transaction fee revenue streams while providing the purpose-built infrastructure that traditional finance demands for stablecoin adoption.

While USDC circulation grew 90% YOY, transaction volume surged an astounding 5.4x to nearly $6 trillion in Q2. This velocity increase demonstrates USDC's evolution from a trading instrument to a genuine payment infrastructure. July alone generated $2.4 trillion in transactions, indicating accelerating adoption momentum that could drive sizable network effects.

The newly launched Circle Payments Network (CPN) has attracted over 100 financial institutions to its pipeline across four active corridors (Hong Kong, Brazil, Nigeria, Mexico). The expansion provides an opportunity to transform international money movement by building an on-chain native payments network that moves money faster and more efficiently than traditional rails.

Other revenue streams grew 3.5x YOY to $24 million, primarily from subscription services and transaction fees. These high-margin revenue sources provide operating leverage and reduce dependence on reserve income. Management expects other revenue to reach $75-85 million for 2025, which diversifies the revenue base.

Post-GENIUS Act, Circle is experiencing unprecedented inbound interest from major financial institutions across every sector. Partnerships with infrastructure providers like Fiserv (FI), FIS (FIS), and Corpay (CPAY) integrate Circle technology into platforms serving tens of thousands of banks, creating scalable distribution channels that could dramatically expand USDC adoption.

What Is the CRCL Stock Price Target?

Analysts tracking Circle stock forecast revenue to rise from $2.58 billion in 2025 to $7.28 billion in 2028. Moreover, the stablecoin issuer is projected to end 2029 with a free cash flow (FCF) of $1.42 billion, compared to an outflow of $30 million in 2025.

If CRCL stock is priced at 40x forward FCF, which is not too steep given its expanding margins, the company will be valued at a market cap of $57 billion, indicating an upside potential of 84%.

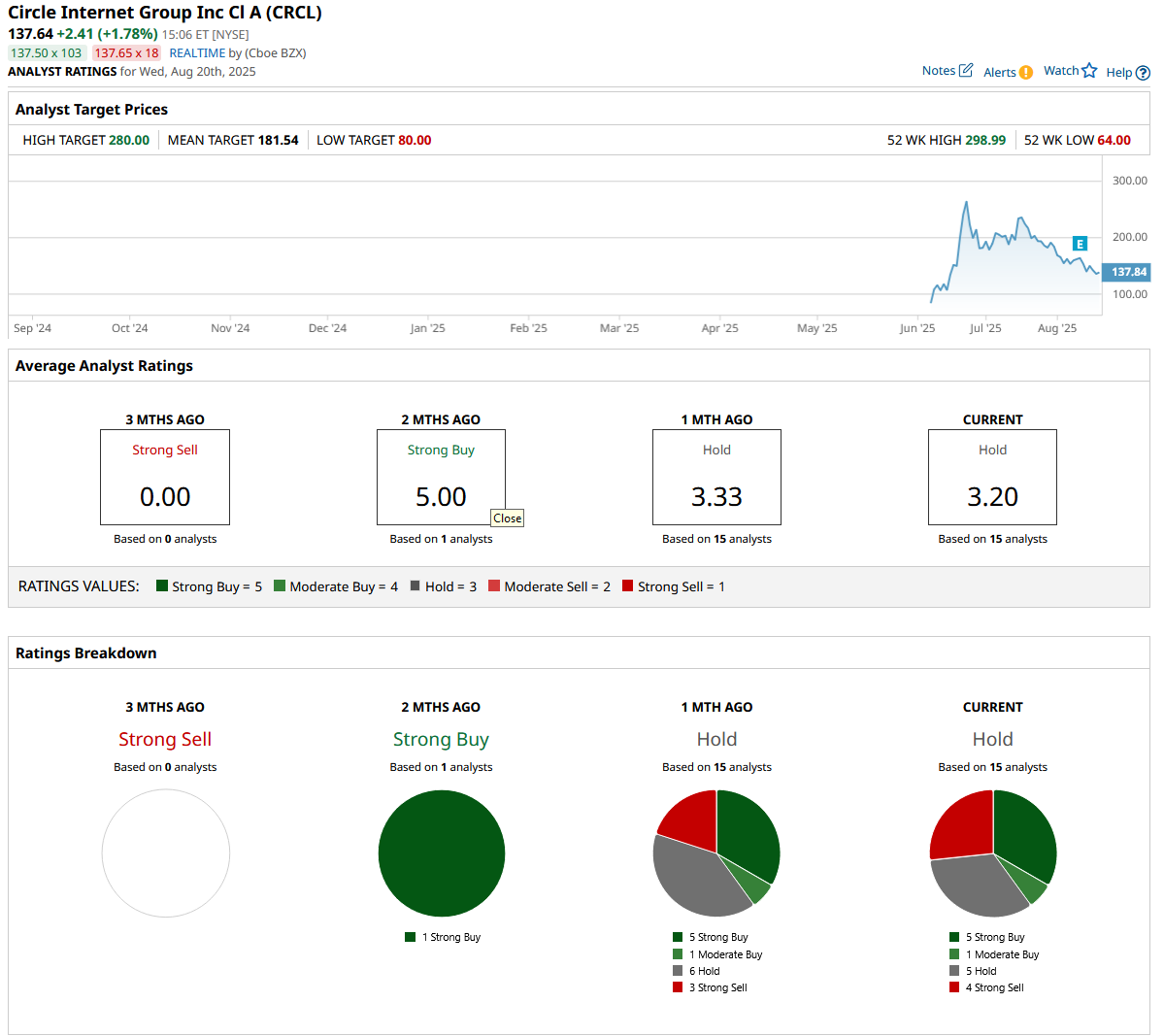

Out of the 15 analysts covering CRCL stock, five recommend “Strong Buy,” one recommends “Moderate Buy,” five recommend “Hold,” and four recommend “Strong Sell.” The average CRCL stock price target is $181.54, above the current price of $137.64.