Healthcare and telemedicine stocks have delivered some of the market’s biggest winners in recent years, as investors bet on the growing demand for virtual care, wellness, and weight-loss solutions. Companies like Hims & Hers Health (HIMS) became investor favorites thanks to their aggressive expansion into telehealth and new treatment categories, including the booming GLP-1 weight-loss market.

However, the narrative took a sharp turn this week after CEO Andrew Dudum sold about $11 million worth of stock, sending shares tumbling more than 10%. The timing of the sale, amid regulatory worries and pricing pressure on GLP-1 generics, has raised eyebrows on Wall Street.

So, with Hims & Hers facing renewed volatility, investors are left asking the key question: if the CEO is selling, should you be, too? Let's find out

About HIMS Stock

Founded in San Francisco, Hims & Hers Health is a leading name in digital healthcare. The company connects millions of users to licensed medical professionals through its telehealth platform, offering personalized treatments in mental health, sexual wellness, dermatology, and hair care. It is redefining accessibility and affordability in modern, subscription-based healthcare delivery.

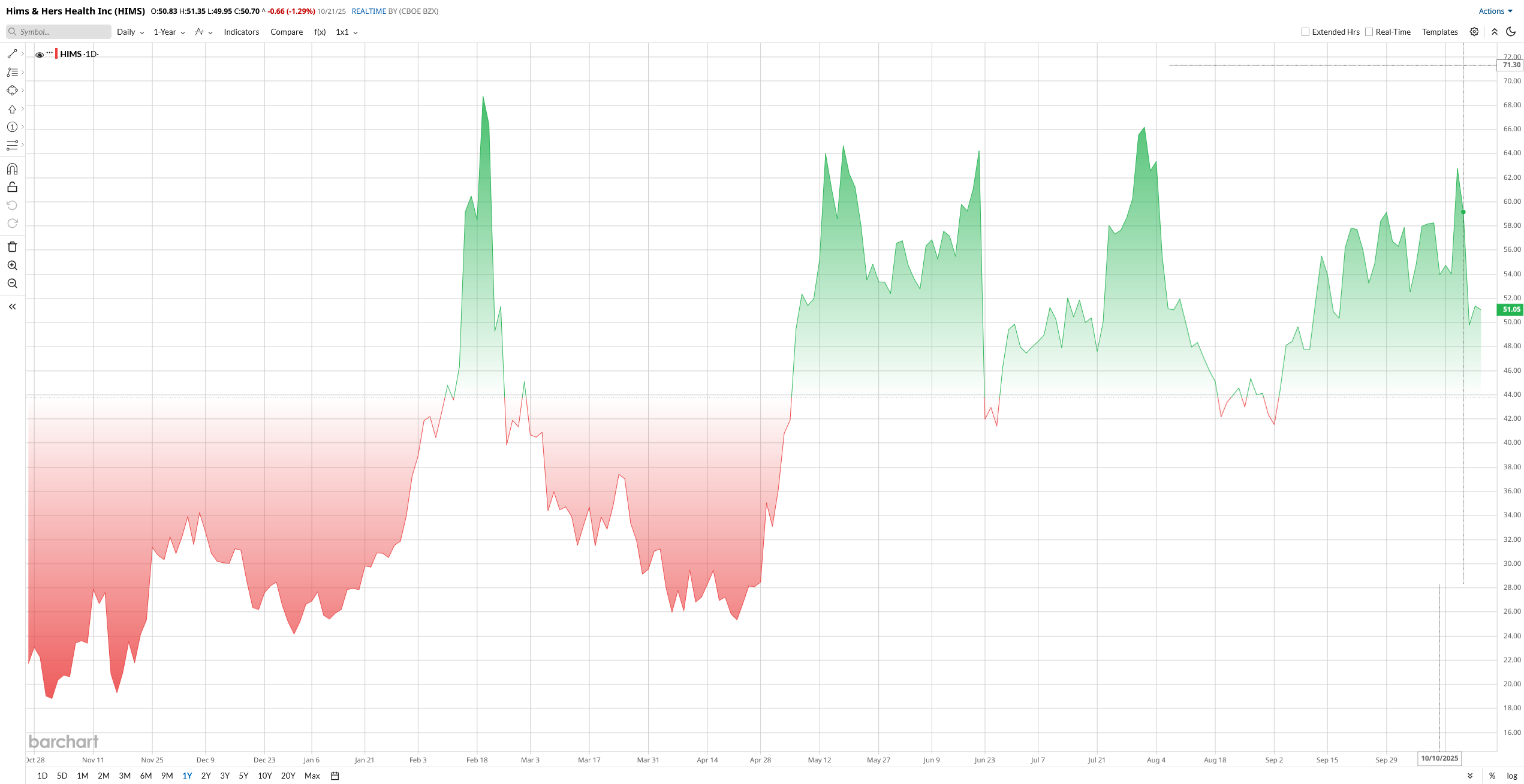

Hims & Hers has been one of 2025’s best performers. HIMS has surged triple-digit growth, gaining 109% year-to-date (YTD). The surge is driven mainly by internal momentum, stronger execution, and product expansion. Plus, in mid-October, for example, announcing its expanded women’s health offerings ignited a double-digit rally that pushed HIMS’s market cap to about $11 billion.

After an immense rally, HIMS now shows a challenging valuation, with its price-to-book (P/B) ratio at 22, far higher than the sector median of 3, indicating that the stock is quite expensive. Additionally, its EV/EBITDA ratio of 76 is well above the sector median of 14, suggesting that it continues to trade at a significant premium.

Hims & Hers Eyes Growth Through New Menopause Segment

Hims & Hers Health recently unveiled a Menopause and Perimenopause specialty within its growing “Hers” division. The company expects this new focus to drive “Hers” revenue past $1 billion by 2026, accounting for more than a third of total sales. The timing is significant; shares have traded sideways following a dip in Q2 revenue and the end of its Novo Nordisk (NVO) partnership. Still, demand for personalized treatments remains resilient. With heavy short interest and management projecting far stronger long-term growth than analysts anticipate, this launch could serve as a key catalyst for renewed momentum.

At the same time, Hims has benefited from the broader GLP-1 (weight-loss drug) frenzy. It offers cheaper, personalized versions of GLP-1 drugs (initially compounded semaglutide), as well as generics and branded therapies.

In April 2025, the company announced it would sell Eli Lilly’s tirzepatide (the active ingredient in weight-loss drug Zepbound/Mounjaro) on its platform. It also plans to launch a generic version of Novo Nordisk’s diabetes/weight-loss drug liraglutide (Victoza) in 2025. These moves broaden HIMS’s weight-loss arsenal, which Leerink Partners’ Michael Cherny calls “positive, although we note that Zepbound is being sold at a fairly expensive price point.” In short, Hims is beefing up its GLP-1 and weight-management catalog at a time when traditional compounding advantages have faded.

HIMS Q2 Earnings Highlights

On Aug. 4, Hims reported its Q2 2025 results, which showed continued rapid growth. Revenue hit $544.8 million, up 73% from a year ago, with net income at $42.5 million and adjusted EBITDA at $82.2 million. Subscribers rose to over 2.4 million, about 31% growth year-over-year (YoY), and average revenue per subscriber climbed sharply.

Importantly, the company affirmed its full-year 2025 guidance for revenue of $2.30 to $2.40 billion and adjusted EBITDA of $295 to $335 million, reflecting confidence in its model. Management noted that Q2 growth was driven by more subscribers on personalized care plans and that the firm is investing in deeper personalization infrastructure and lab testing to support long-term growth.

That said, not every metric is perfect. Hims admitted Q2 revenue per subscriber dipped slightly because it shifted toward lower‑cost “personalized” GLP-1 scripts (which earn less per order). In fact, GLP-1 revenue in Q2 was down about $40 million from Q1. Some analysts flagged this as expected, but the big stock run-up had left lofty expectations.

Nevertheless, Hims ended Q2 with net cash, strong gross margins of 77%, and little debt, putting it in a flexible financial position as it rolls out new products.

Wall Street Opinion on HIMS Stock

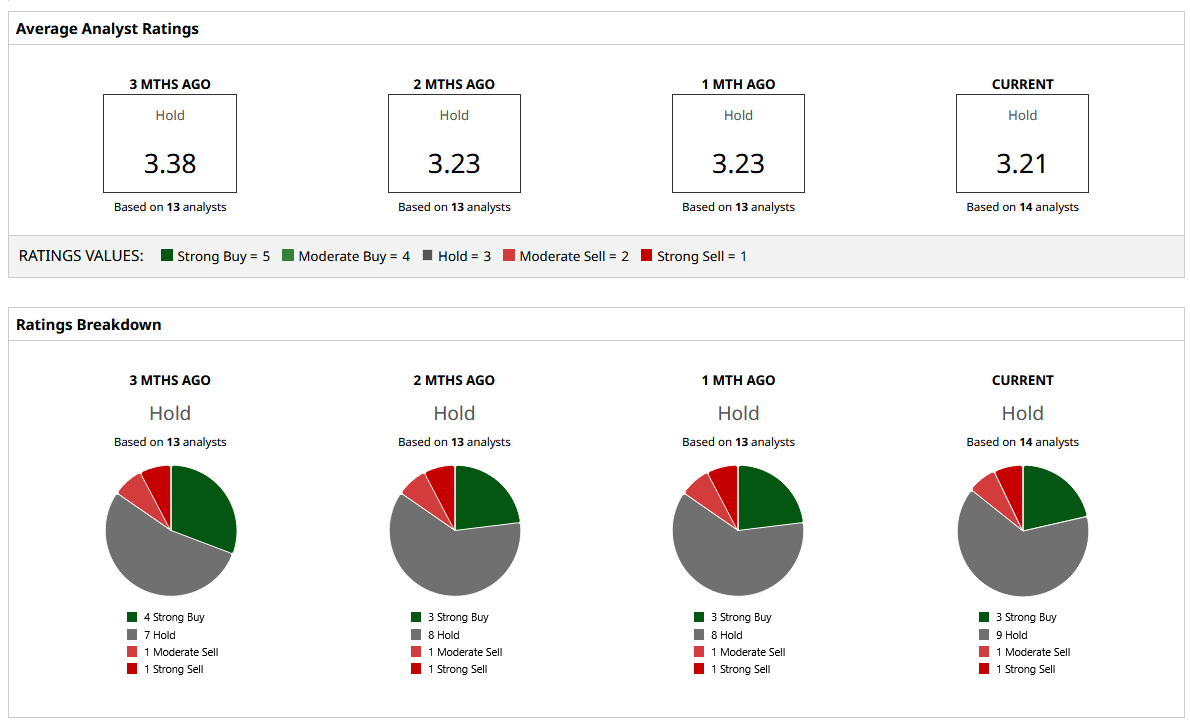

Wall Street is split on HIMS stock. The consensus is “Hold,” with analysts divided among three "Strong Buy," nine “Hold,” one “Moderate Sell,” and one “Strong Sell.”

The stock has surprised, trading at an average 12-month price target of around $48.7. However, its street-high target of $85 suggests that the stock could still climb 70% from here.

Should You Be Worried About Insider Sales?

CEO Dudum’s $11 million stock sale is a headline-grabber, but by itself it needn’t spell doom. Insiders often liquidate holdings under pre-set plans for diversification or for tax reasons. The critical question is whether HIMS' underlying growth can sustain the rally. On the positive side, Hims & Hers is executing on multiple fronts, telehealth subscriptions are growing, new products like GLP-1 generics, branded weight-loss drugs, and menopause care are rolling out, and key financial metrics have stayed strong.