Nearly one-third of small and medium-sized enterprises (SMEs) in the manufacturing sector are at risk of failure if they fail to adapt to a changing business landscape, says an economist at the Bank of Thailand.

Some 29% of SME operators in the manufacturing sector are likely to fail, though they can access bank loans now to adjust their business, said Tita Phekanonth, an economist in the structural economic policy department at the central bank.

"This group is at risk if they don't adjust to the digital era. If their sales fall and they face a liquidity crunch, a shutdown will be unavoidable," she said.

The central bank conducted a survey of 2,400 SMEs who are commercial bank customers nationwide. Of the total, 25% are mid-sized SMEs, with the remainder small companies.

Some 43% of the surveyed SMEs are engaged in trading, 24% in service, 22% in manufacturing, 7% in construction, with the remainder in the farming sector.

Adjustment means upgrading production processes, selling online, and offering products in response to customer demand. Two major barriers for SMEs are operating cost and strong competition, said Ms Tita.

Most SMEs have adopted a pricing strategy rather than developing service quality to draw customers. The survey found 70% of those using this strategy face a sales decline.

SMEs that can maintain their competitive edge use machinery to boost production efficiency or as a substitute for labour, adopt IT in management, develop unique products, and go online to expand their market and widen distribution channels, she said.

The digital channel can strengthen SMEs' competitiveness if they use it to enter international markets. Without adopting digital technology, SMEs face higher operating costs over the longer term, said Ms Tita.

Entrepreneurs who sharpen competitiveness should be able to slim down operating costs, improve earnings, and ease financial costs.

"For SMEs that can adjust, only 31% consider financial cost a problem. For SMEs that are not considering adjustment, some 64% saw funding cost as a barrier," she said.

Sarawan Angklomkliew, assistant director in the structural economic policy department at the Bank of Thailand, said both the government and private sector can help SMEs improve through infrastructure base development, legal equality, ease of doing business, and training.

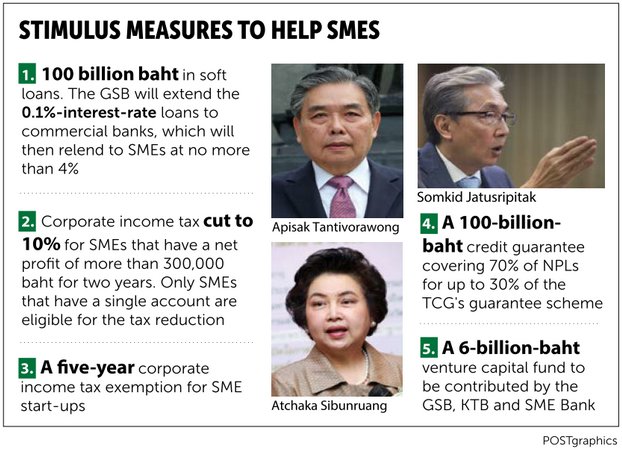

The warning comes exactly a year after government announced generous aid to SMEs, many of which were already struggling.

The central bank supports SME business development through the digital payment platform, access to funding, and improving regulations. It plans to implement information-based lending in the beginning next year, after PromptPay and QR payment were launched earlier.

The Bank of Thailand encourages digital payment to build up SMEs' track record, while an information base enables easier access to bank loans.

"Information-based lending shows consumer comments, rates, and reviews on social media for SME businesses, lowering interest rates for them," Ms Sarawan said.