Valued at $25.8 billion by market cap, CenterPoint Energy, Inc. (CNP) is a public utility company that delivers electricity and natural gas to residential, commercial, and industrial customers across several states. Headquartered in Houston, Texas, the company operates through Electric Transmission & Distribution and Natural Gas segments.

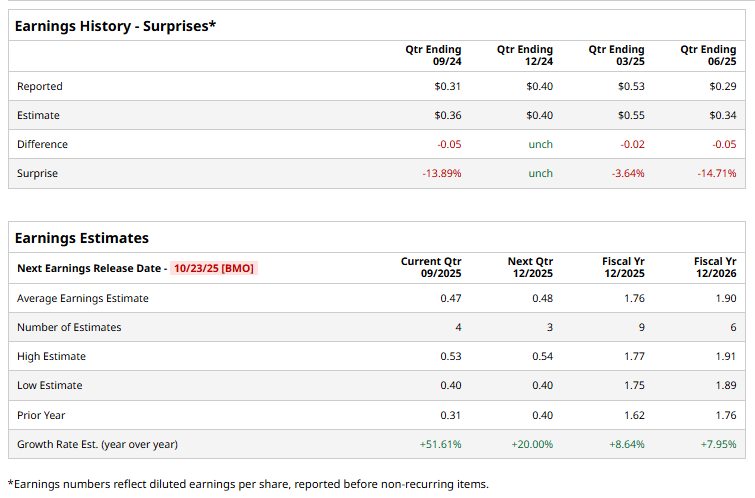

The leading energy delivery company is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect CNP to report a profit of $0.47 per share on a diluted basis, up 51.6% from $0.31 per share in the year-ago quarter. However, the company has missed the consensus estimates in three of the last four quarters while matching the forecast on another occasion.

For the current year, analysts expect CNP to report EPS of $1.76, up 8.6% from $1.62 in fiscal 2024. Its EPS is expected to rise 8% year over year to $1.90 in fiscal 2026.

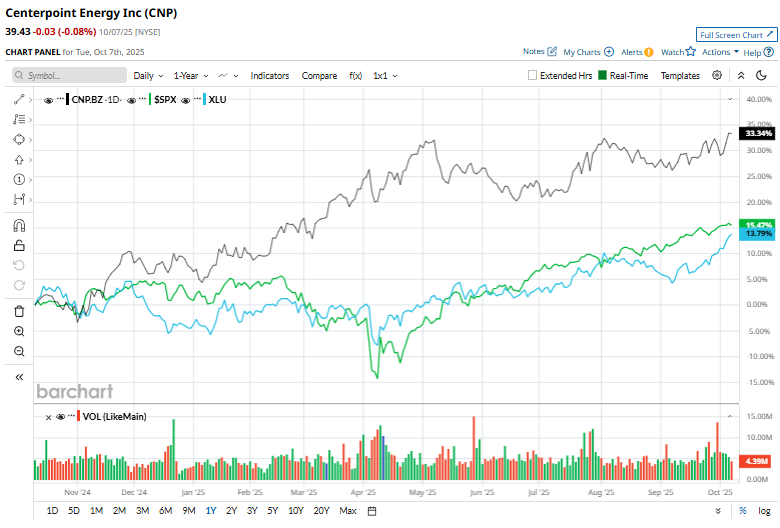

CNP stock has delivered an impressive performance over the past year, surging 33%, outperforming the S&P 500 Index’s ($SPX) 17.9% gains and the Utilities Select Sector SPDR Fund’s (XLU) 13.5% gains over the same time frame.

As the utility sector gains renewed attention amid economic uncertainty, CNP’s steady growth and operational efficiency have helped it stand out as one of the top performers in its space.

On September 25, CenterPoint Energy announced that its Board of Directors had declared a regular quarterly cash dividend of $0.22 per share on its common stock, payable on December 11, 2025. While the news initially prompted a 1.8% dip in CNP’s share price, likely due to short-term market reactions, the stock bounced back by 1.3% in the following session as investors regained confidence in the company’s financial stability and long-term growth outlook.

Analysts’ consensus opinion on CNP stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 17 analysts covering the stock, six advise a “Strong Buy” rating, and 11 give a “Hold.” CNP’s average analyst price target is $41.17, indicating a potential upside of 4.4% from the current levels.