/Cencora%20Inc_%20HQ-by%20JHVEPhoto%20via%20iStock.jpg)

Conshohocken, Pennsylvania-based Cencora, Inc. (COR) sources and distributes pharmaceutical products. Valued at $58.7 billion by market cap, the company offers end-to-end pharmaceutical commercialization solutions, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to healthcare providers.

Companies worth $10 billion or more are generally described as “large-cap stocks.” COR effortlessly fits that bill, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical distribution industry. Cencora's strengths stem from its strategic positioning in the healthcare value chain, diversified portfolio, and scale-driven bargaining power. It leverages cross-business synergies, strong brand equity, and a healthy balance sheet to drive innovation and operational excellence. With its technological capabilities in supply chain management and data analytics, Cencora delivers high operational efficiency, consistently achieving fill rates exceeding 99%, while aligning with industry trends such as value-based care and personalized medicine.

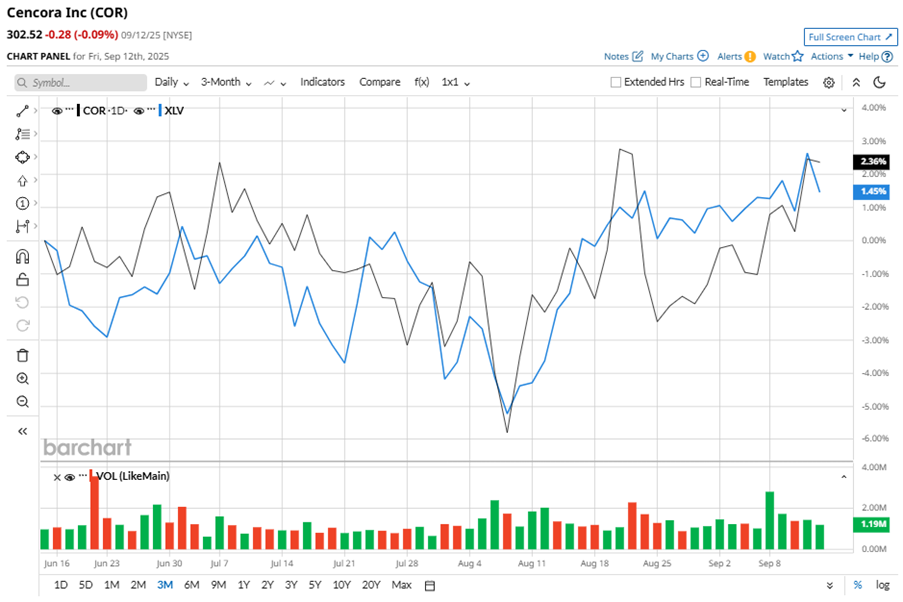

Despite its notable strength, COR slipped 2.2% from its 52-week high of $309.35, achieved on May 7. Over the past three months, COR stock has gained 2.5%, outperforming the Health Care Select Sector SPDR Fund’s (XLV) 1% gain during the same time frame.

In the longer term, shares of COR rose 34.6% on a YTD basis and climbed 27.3% over the past 52 weeks, outperforming XLV’s YTD marginal gains and 11.4% dip over the last year.

To confirm the bullish trend, COR has been trading above its 200-day moving average over the past year, with some fluctuations. The stock has been trading above its 50-day moving average since mid-October 2024, experiencing some fluctuations.

Cencora released its Q3 results on Aug. 6, exceeding expectations, with revenue rising 8.7% year-over-year to $80.7 billion and adjusted EPS increasing 19.8% from the year-ago quarter to $4. The company also raised its fiscal 2025 adjusted EPS guidance to $15.85 to $16. Despite the strong performance, Cencora's shares dropped 2.9% following the release of its earnings.

In the competitive arena of medical distribution, McKesson Corporation (MCK) has taken the lead over COR, showing resilience with a 39.2% uptick over the past 52 weeks but lagging behind the stock with 24.8% gains on a YTD basis.

Wall Street analysts are bullish on COR’s prospects. The stock has a consensus “Strong Buy” rating from the 15 analysts covering it, and the mean price target of $336.21 suggests a potential upside of 11.1% from current price levels.