/Cboe%20Global%20Markets%20Inc_%20logo%20and%20phone-by%20Grey82%20via%20Shutterstock.jpg)

Chicago, Illinois-based Cboe Global Markets, Inc. (CBOE) is a financial exchange holding company with a market cap of $26.1 billion. It is best known for operating one of the world’s largest and most active derivatives and securities exchanges.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CBOE fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the financial data & stock exchanges industry. The company has expanded globally and now owns and operates a broad network of trading venues across equities, options, futures, foreign exchange (FX), exchange-traded products (ETPs), and digital asset markets.

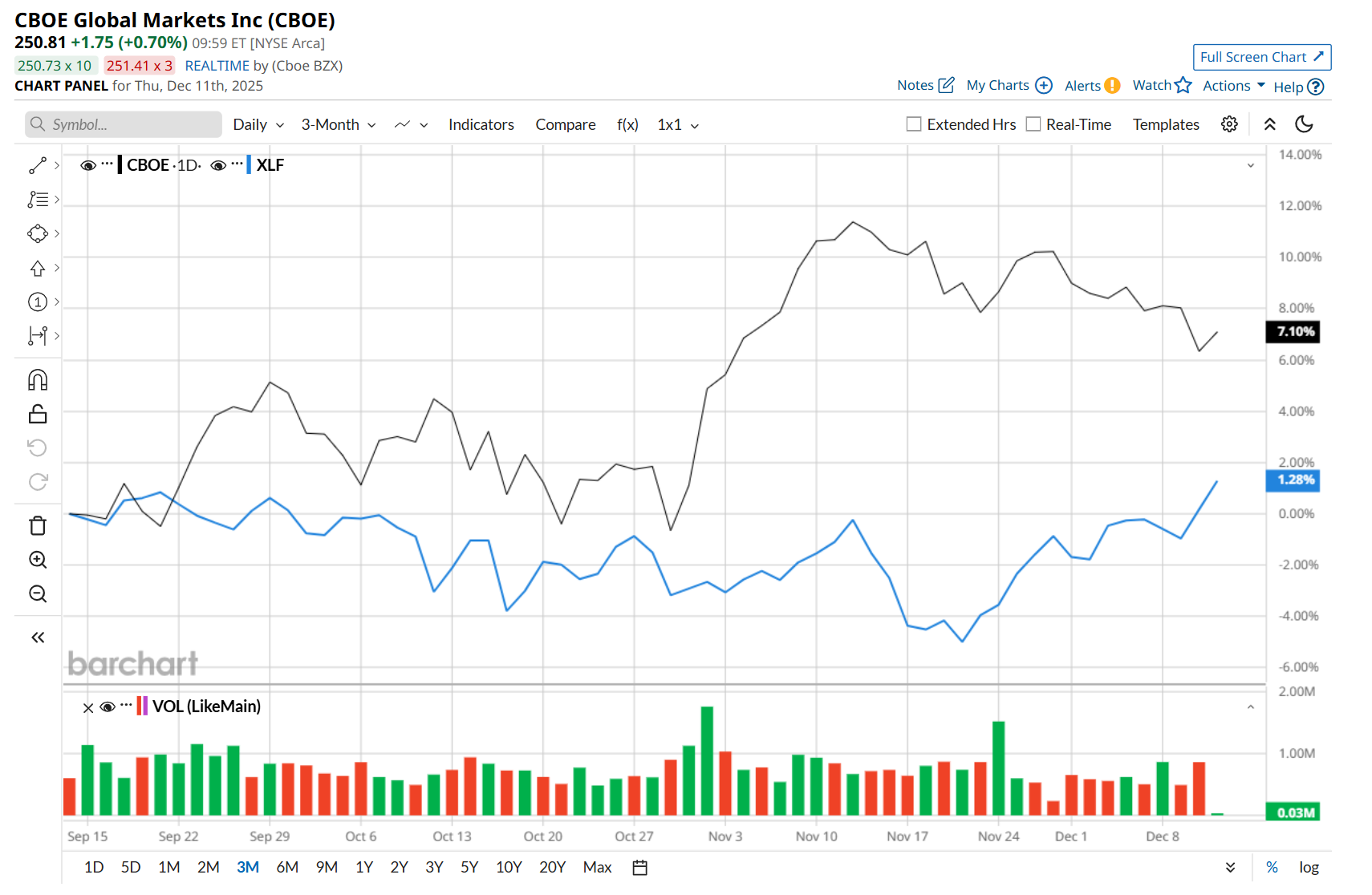

This financial company is currently trading 4.8% below its 52-week high of $262.98, reached on Nov. 12. Shares of CBOE have gained 5.7% over the past three months, outperforming the State Street Financial Select Sector SPDR ETF’s (XLF) marginal rise during the same time frame.

In the longer term, CBOE has soared 23.3% over the past 52 weeks, outpacing XLF’s 9.3% uptick over the same time frame. Moreover, on a YTD basis, shares of CBOE are up 27.8%, compared to XLF’s 12.6% return.

To confirm its bullish trend, CBOE has been trading above its 200-day moving average over the past year, with minor fluctuations, and has remained above its 50-day moving average since late October.

Shares of CBOE surged 3.7% after its impressive Q3 earnings release on Oct. 31. The company’s total revenue improved 8.1% year-over-year to a record $1.1 billion, driven by strong growth in revenues from its derivative market. Additionally, its adjusted EPS also reached a record high of $2.67, up 20.3% from the year-ago quarter and 5.5% above Wall Street estimates.

CBOE has also considerably outpaced its rival, Intercontinental Exchange, Inc. (ICE), which gained 2% over the past 52 weeks and 8.2% on a YTD basis.

Despite CBOE’s recent outperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 17 analysts covering it, and the mean price target of $256.86 suggests a 2.4% premium to its current price levels.