Mediterranean restaurant chain, Cava Group Inc. (NYSE:CAVA), is closely observing the behavior of its customers, as uncertainties continue to fog the near-term.

A Fluid Macro Environment

During its second-quarter earnings call on Tuesday, Cava’s CFO Tricia Tolivar highlighted the precariousness of the current macro backdrop. “We're operating in a fluid macroeconomic environment,” she said, adding that such a condition “creates a fog for consumers,” during which they often tend to “step off the gas.”

Despite the cautious tone, she notes that the company hasn't observed changes in premium purchases or other key buying patterns.

See Also: Sweetgreen Vs. Cava: Wilted Earnings Meet Mediterranean Muscle In Q2

“We didn't see changes in our premium attachments or incident rates or either other items driving the business overall. But, certainly, it's present in there, and it's something that we're not immune to in the space,” she says.

The company’s CEO, Brett Schulman, echoed similar sentiments, saying that the company hasn’t noticed any unusual sales patterns in any region, income group, or between urban and suburban areas. He says, “the fleet has been moving very consistently,” even as macro challenges weigh on operations.

Schulman further emphasizes that customer spending habits have remained stable, noting that there has been “no trade down, no check management,” but continues to watch the situation closely as it unfolds.

Tariffs Creating Anxiety Among ‘Low-Income’ Consumers

Other fast casual restaurant chains have highlighted similar behaviors among consumers in recent months, with growing anxiety related to the tariffs.

During its second-quarter results last week, McDonald’s CEO Chris Kemczynski warned that there was “a lot of anxiety and unease” among low-income consumers. He also pointed to a decline in visits from this income group, saying that visits were “down double digits versus the prior year period.”

According to Goldman Sachs economist Elsie Peng, consumers will begin shouldering a significant portion of the tariff costs starting in October, as businesses start to pass them along.

Cava released its second-quarter earnings on Tuesday, reporting $278.25 million in revenue, falling short of consensus estimates at $286.58 million. Profits during the quarter stood at $0.16 per share, which came in ahead of analyst estimates at $0.14 per share.

Shares of Cava were up 2.67% on Tuesday, trading at $84.50, but have since plunged 22.76% after hours, following the company’s decision to cut its sales outlook for the full year.

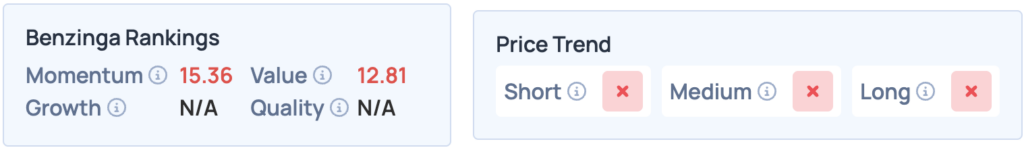

Cava Group scores poorly in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock