Renowned investor Cathie Wood, chief executive of Ark Investment Management, traded a number of her familiar names Monday.

Purchases included a health-care company and an e-commerce company, while sales included a fintech and a defense contractor.

All valuations below are as of Monday’s close.

Ark funds bought 44,940 shares of online health services company Teladoc (TDOC), valued at $2.7 million.

Ark Fintech Innovation ETF (ARKF) snagged 3,808 shares of e-commerce platform Shopify (SHOP), valued at $1.7 million.

Ark Fintech also snatched 9,430 shares of Twilio (TWLO), which provides software to developers, valued at $1.2 million.

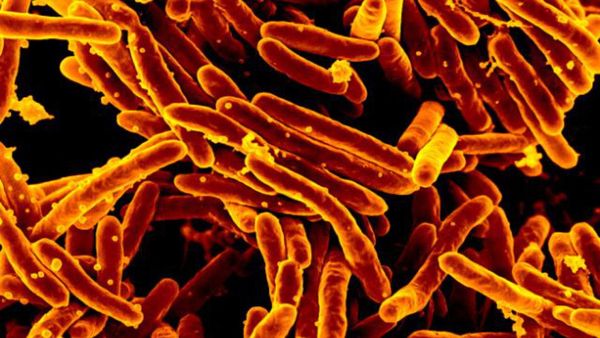

And Ark funds snapped up 232,562 shares of biotechnology company Ginkgo Bioworks (DNA) , valued at $902,341.

Selling: Tesla, LendingClub, L3Harris

On the selling side, Ark funds dumped 8,295 shares of electric-vehicle titan Tesla (TSLA), valued at $8.3 million. Wood has said that her selling of Tesla represents profit-taking and that she still believes in the company. Tesla remains the biggest holding in Wood’s flagship Ark Innovation ETF (ARKK).

Meanwhile, Ark Fintech sold 281,302 shares of online lending marketplace LendingClub (LC), valued at $4.1 million.

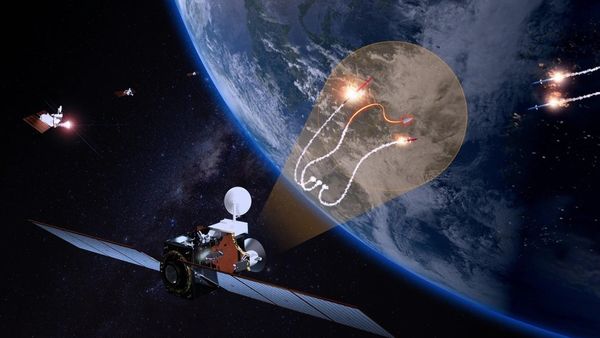

And Ark Space Exploration & Innovation ETF (ARKX) sold 3,046 shares of L3 Harris (LHX), valued at $739,934. The defense contractor's shares were off 10% over the seven weeks through Monday's close.

Ark Innovation has slumped 40% this year, as Wood’s younger technology stocks have hit the skids. But many investors continue to believe in her.

The fund saw an inflow of $658 million this year through Thursday, including $59 million in the latest week, according to FactSet, as cited by The Wall Street Journal. Ark Innovation has total assets of $9.9 billion, according to Morningstar.

Five-Year Return Horizon

Wood says she targets five-year returns. And indeed Ark Innovation has outperformed the S&P 500 over the past five years -- posting an 19% annualized total return compared with 14.5% for the S&P 500. But Ark Innovation has dropped more than 65% from its February 2020 high.

Meanwhile, on March 29, Morningstar analyst Robby Greengold issued a scathing critique of Ark Innovation.

“ARKK shows few signs of improving its risk management or ability to successfully navigate the challenging territory it explores,” he wrote. “Wood’s reliance on her instincts to construct the portfolio is a liability.”

Wood countered his points in a recent interview with Magnifi Media by Tifin. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she said.

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”