Cathie Wood‘s ARK Invest is betting on Shopify Inc.‘s (NASDAQ:SHOP) strategic focus on “agentic AI” because the firm believes it is paving the way for a new era of e-commerce.

Check out SHOP’s stock price here.

What Happened: In a recent X post, Wood stated, “Based on its earnings report last night, $SHOP seems to be seizing the agentic AI moment in retail.”

This sentiment is backed by a detailed note from ARK Invest analysts Nicholas Grous and Varshika Prasanna, who argue that artificial intelligence is set to fundamentally reshape online commerce.

The ARK note, titled “Are Marketplaces Defensible In The Age Of AI Purchasing Agents?”, posits that AI purchasing agents will soon handle product discovery, comparison, and transactions on behalf of consumers.

To compete, retailers will need to adapt to a new paradigm of Agent-Oriented Optimization (AOO), similar to how Search Engine Optimization (SEO) was crucial for the early internet. According to the research, a new protocol called the Model Context Protocol (MCP) will be foundational for these AI agents.

This is where Shopify shines, as the ARK note explicitly highlights that Shopify natively supports MCP endpoints, a critical move that allows its merchants’ product data to be easily accessed by AI agents.

The analysts state, “Just as the rise of Google's Search Engine Optimization (SEO) transformed digital publishing, AI agents should give rise to Agent-Oriented Optimization (AOO).”

Why It Matters: Shopify’s partnerships with AI leaders like OpenAI and Microsoft Corp. (NASDAQ:MSFT) further solidify this view.

For instance, the note mentions that Shopify is providing the foundation for OpenAI’s in-app checkout functionality, directly linking its platform to the agents that will drive future commerce.

As a result, Wood and her team see Shopify not just as an e-commerce platform, but as a key piece of infrastructure in the coming AI-driven retail landscape.

Shopify delivered a mixed second quarter with a revenue growth of 31% year-over-year to $2.68 billion, beating the analyst consensus estimate of $2.55 billion. Whereas, the e-commerce platform reported adjusted EPS of 35 cents, up 34.6% year-on-year, but missed the analyst consensus estimate of 29 cents.

Price Action: SHOP stock was up 0.14% in premarket on Thursday, but it was up 44.05% year-to-date and 142.45% over the past year.

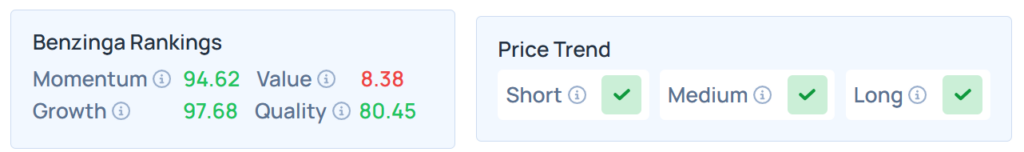

Benzinga's Edge Stock Rankings indicate that SHOP maintains a strong price trend in the long, short, and medium terms. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Thursday. The SPY was up 0.59% at $636.49, while the QQQ advanced 0.76% to $571.61, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Shutterstock