On Wednesday, Cathie Wood-led Ark Invest executed significant trades involving Advanced Micro Devices Inc. (NASDAQ:AMD), Palantir Technologies Inc. (NASDAQ:PLTR), and Shopify Inc. (NASDAQ:SHOP). These trades reflect Ark’s strategic adjustments in response to recent market developments and earnings reports.

The AMD Trade

Ark Invest made notable acquisitions of AMD shares across several ETFs. The trades included 12,139 shares in Ark Fintech Innovation ETF (BATS:ARKF), 129,610 shares in ARK Innovation ETF (BATS:ARKK), 23,990 shares in ARK Autonomous Technology & Robotics ETF (BATS:ARKQ), 64,387 shares in ARK Next Generation Internet ETF (BATS:ARKW), and 4,866 shares in ARK Space Exploration & Innovation ETF (BATS:ARKX). The total purchase amounted to approximately $38.3 million, based on AMD’s closing price of $163.12.

This move comes as AMD’s stock experienced a decline of 6.42% on Wednesday, following mixed second-quarter results. While AMD’s revenue of $7.69 billion surpassed expectations, its earnings per share of 48 cents fell short. Despite this, the company remains optimistic about AI-driven growth in the latter half of the year.

The Palantir Trade

Ark Invest reduced its holdings in the Alex Karp-led company, selling 54,034 shares in ARKK and 9,245 shares in ARKW. This sale, valued at approximately $11.4 million, follows Palantir’s stock reaching an all-time high of $180.58. The stock closed at $179.54 for the day.

The surge was driven by the company’s impressive earnings, marking the eighth consecutive quarter of surpassing analyst expectations. Palantir reported second-quarter revenue of $1.004 billion, exceeding estimates, with adjusted earnings of 16 cents per share.

The Shopify Trade

Ark Invest also trimmed its position in Shopify, selling 44,259 shares in ARKF, 63,476 shares in ARKK, and 10,860 shares in ARKW. The total sale was valued at approximately $18.4 million. Shopify’s stock surged by 21.97% on Wednesday, driven by strong second-quarter results. It ended the day at $154.90.

The company reported a 31% year-over-year revenue increase to $2.68 billion, surpassing analyst estimates. Shopify’s adjusted earnings per share of 35 cents also exceeded expectations, highlighting its global momentum and merchant growth.

Other Key Trades:

- Sold 92,781 shares of Roblox Corp. — Pre-Reincorporation (RBLX) in ARKK and 19,022 via ARKW.

- Sold 90,113 shares of Kratos Defense and Security Solutions Inc (KTOS) in ARKQ.

- Bought 186,013 shares of Aurora Innovation Inc (AUR) in ARKQ.

- Bought 254,632 shares of Personalis Inc (PSNL) in ARKG.

- Sold 170,339 shares of Adaptive Biotechnologies Corp (ADPT) in ARKG.

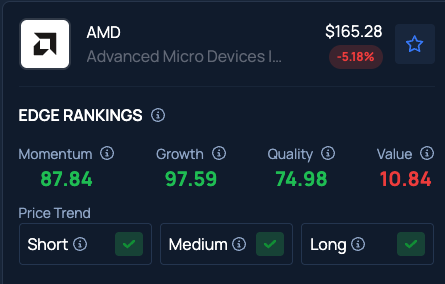

Benzinga’s Edge Stock Rankings show that AMD stock has a Value in the 10th percentile. Here is how perennial rival Nvidia compares in terms of value with this chip giant.

Read Next:

Photo Courtesy: ChrisStock82 on Shutterstock.com

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal