Cathie Wood’s ARK Invest manages a slate of active exchange-traded funds, but the $7.8 billion ARK Innovation ETF (ARKK) -) is the best-known of the bunch.

ARK Innovation’s returns took it on the chin last year because of recessionary worries and higher interest rates. However, the ETF has rebounded in 2023 thanks to returning interest in top holdings, including Tesla (TSLA) -).

Can the ARK Innovation ETF continue climbing, or has it seen its highs for this year.

It’s Been a Roller Coaster Ride for Ark Innovation Investors

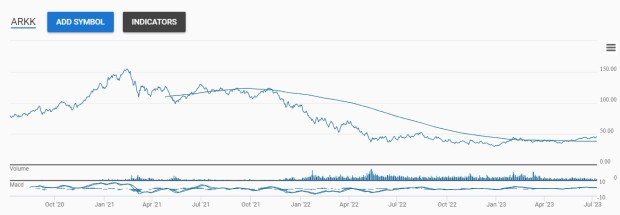

ARK Innovation’s focus on fast-growing technology companies was ideally suited to the post-covid easy-money era. A widespread embrace of technology that enabled work from anywhere, plus low interest rates that made it easier for unprofitable companies to fund their growth, helped the ETF return a remarkable 384% from its low in March 2020 to its peak in February 2021.

Don't Miss: Cathie Wood Is Hedging Her Bets on Two of Ark's Biggest Names

Those returns made Cathie Wood a household name among investors. Her stock picks were tracked daily, and her tendency toward bold predictions for the future of the stocks she owned, including Tesla, were widely reported in the financial news media.

Not everyone was convinced that ARK Innovation’s aggressive-growth approach would provide lasting returns, though. The post-covid run-up lifted the valuation on many of its holdings to frothy levels, exposing investors to significant losses when recessionary worry and rising interest rates caused a bear market in stocks last year. The ARK Innovation ETF tumbled nearly 82% from its 2021 high through December 2022.

While those losses still sting many investors, returning interest in top holdings, including Tesla, has caused the ARK Innovation ETF to rebound in 2023. Cathie Wood made waves earlier this year with new research suggesting that using Tesla vehicles as robotaxis could make Tesla worth as much as $2,000 per share.

Year-to-date, the ARK Innovation ETF is up over 36%.

More Tesla:

- Why Tesla Stock Is Going Through the Roof -- And Where It Could Go Next

- Elon Musk's Latest Tesla Announcement Could Shake Up the Entire EV Industry

- Elon Musk Has a 'Purity' Around Motivation For Game-Changing EV Deal

ARK Innovation’s Stock Chart Results In A New Price Target

Technical analysis provides insight into the aggregate sentiment of all market participants. For this reason, charting the price action of stocks helps investors spot trouble early on. Charts also help investors set price targets, particularly point-and-figure charts.

Recently, Real Money technical analyst Bruce Kamich, a technician who has helped professional investors for over 40 years, reviewed ARK Innovation’s charts for insight into what could happen next.

After considering the ETF’s price action, volume trends, and momentum, Kamich used point-and-figure charting to calculate a price target that investors may want to pay attention to.

“ARKK is trading above the bottoming 40-week moving average line. The OBV line has shown strength since November. The MACD oscillator has edged slightly above the zero line for an outright buy signal,” writes Kamich. “In this weekly Point and Figure chart of ARKK, I can see an upside price target in the $59 area.”

On-balance volume is a running total of up to down day volume while Moving Average Convergence Divergence uses various moving averages of share prices to gauge momentum.

If Kamich’s price target is correct, the ARK Innovation ETF could move another 30% higher. However, point-and-figure charts don’t provide a timeline for when that may happen. Stocks don’t rise or fall in a straight line forever, so at a minimum, a little backfilling is expected at some point, given ARK Innovation’s big returns so far.

Kamich suggests that ARK Innovation's charts will remain intact if shares stay above $41, so keep that in mind as a line in the sand if you’re long this ETF.