/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

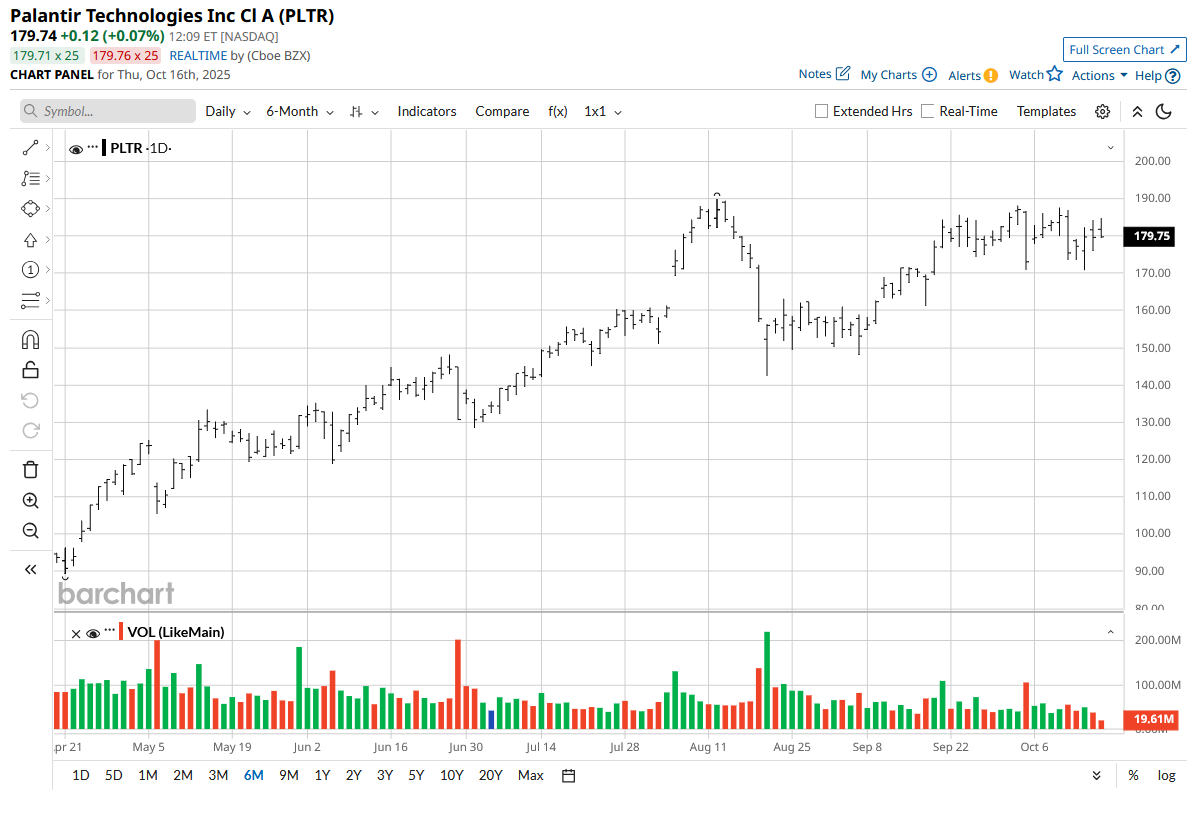

Palantir (PLTR) stock has been flying high with a rally of 330% in the last 12 months. The rally has been backed by strong fundamental developments. At the same time, positive sentiments for the technology sector have supported the upside.

After a massive rally, there appears to be some caution among investors, with Cathie Wood's Ark Invest selling 4,064 PLTR shares. Having said that, Ark funds still have an exposure of over $660 million in PLTR shares across their ETFs.

About Palantir Stock

Palantir’s business is focused on four principal software platforms: Gotham, Foundry, Apollo, and the Artificial Intelligence Platform (AIP). The customers pay to use these platforms with a general contract term of one to five years.

For Q2 2025, Palantir reported revenue of $1 billion. For the same period, the company had 849 customers from the commercial sectors and government agencies.

After a rally of almost 95% in the last six months, Palantir currently commands a market valuation of $426 billion.

Palantir is on a High-Growth Trajectory

For Q2 2025, Palantir reported revenue of $1 billion, which was higher by 48% on a year-on-year (YoY) basis. This growth was driven by continued acceleration in the company’s U.S. business.

It’s worth noting that even for Q3 2025, Palantir has guided for revenue of $1.1 billion. On a YoY basis, growth is expected at 50%. Besides the headline numbers, customer count also increased by 43% YoY. Therefore, with the growth momentum sustaining, there is a strong case for PLTR stock remaining in an uptrend.

If earnings estimates are considered, it’s expected that earnings will grow at 462.5% for the current financial year. Further, earnings growth is likely to remain healthy at 33.3% for FY 2026.

Another important point to note is that for the first six months of 2025, Palantir reported 72% revenue from the United States and 10% from the U.K. There seems to be ample headroom for growth in international markets in the coming years.

Strong Fundamentals to Support Growth

Palantir is also attractive considering the fundamentals. As of Q2 2025, the company reported cash and equivalents of $6 billion. Further, the company was debt-free, which implies robust financial flexibility.

It’s also worth noting that for FY 2025, Palantir has guided for adjusted free cash flow of $1.9 billion (mid-range). With healthy growth, it’s likely that free cash flows will continue to swell and further boost the company’s financial flexibility.

The upside in cash flows is also likely to be supported by continued margin expansion. For the first six months of 2025, Palantir reported an adjusted operating margin of 45%, which was higher by 800 basis points YoY.

For the first six months of 2025, Palantir reported research and development expenses of $206 million. Considering the financial flexibility, R&D expense is likely to remain high and will support innovation-driven growth.

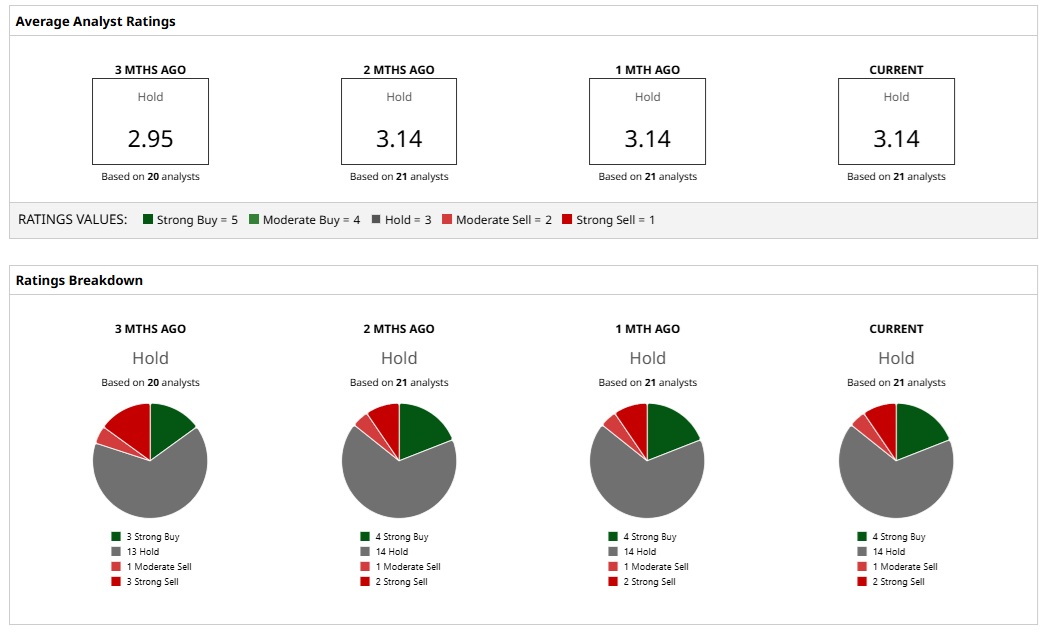

What Analysts Say About PLTR Stock

Based on the rating of 21 analysts, PLTR stock is a “Hold” at current levels. Even after the big rally, four analysts still recommend a “Strong Buy,” and 14 analysts opine that the stock is a “Hold.”

Further, a mean analyst price target of $158.78 implies a downside potential of 11% from current levels. For investors with a long-term investment horizon, a small correction is unlikely to be a concern. It’s also worth noting that the most bullish price target for PLTR stock is $215, and it would imply an upside of 20%.

Overall, Palantir is in a high-growth phase that’s associated with swelling free cash flows. Considering the industry momentum, it’s likely that the company’s AIP will continue to boost growth and create value.