/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Rocket Lab (RKLB) has been on a tear lately, soaring to new all-time highs and cementing its position as one of the hottest space stocks of 2025. But while investors continue to pile in, one of the company’s most prominent backers—Cathie Wood—is quietly heading the other way. Notably, Wood is one of the most closely watched investors on Wall Street. As the founder and CEO of ARK Invest, she’s renowned for making bold, forward-looking investments in companies shaping the future, often well before the market recognizes their potential.

The ARK Invest founder has recently trimmed her RKLB holdings across various funds over multiple rounds, even as the stock’s momentum remained strong. The moves immediately caught investors’ attention. So, is Cathie Wood simply taking profits after a massive run—or does she see warning signs on the horizon? Let’s break down what her latest moves mean for investors and whether RKLB stock is still worth holding after hitting new highs.

About Rocket Lab Stock

Rocket Lab operates as a fully integrated end-to-end space company. It offers reliable launch services, spacecraft components, satellites, and on-orbit management solutions designed to make space access faster, easier, and more cost-effective. The company is best known for its Electron launch vehicle, a small orbital rocket engineered to carry payloads of up to 300 kg into low Earth orbit. RKLB is also working on the Neutron launch vehicle, a medium-lift rocket designed for deploying large constellations, conducting interplanetary missions, and potentially supporting human spaceflight. It has a market cap of $32.1 billion.

Shares of the space infrastructure company have rallied 172.2% on a year-to-date (YTD) basis. The stock’s rally was driven by robust growth in launch operations, progress and anticipation surrounding the larger Neutron rocket, rising demand across commercial and national security space markets, and a series of new launch contracts.

Cathie Wood Trims Rocket Lab Stake, But There’s No Cause for Concern

Rocket Lab has recently seen multiple rounds of trimming by ARK. On Monday, Oct. 6, ARK Invest sold 86,326 shares of Rocket Lab across its ARK Autonomous Technology & Robotics ETF (ARKQ) and ARK Space Exploration & Innovation ETF (ARKX), with the total transaction valued at about $5 million. Last Tuesday, the ARKX fund sold 53,917 shares of Rocket Lab. With RKLB stock closing at $68.03, the transaction was valued at roughly $3.7 million. And last Friday, both ARKQ and ARKX cut their holdings in Rocket Lab, offloading 66,070 shares worth approximately $4.43 million.

Despite the recent round of selling, Rocket Lab remains the largest core holding in ARKX’s portfolio. Notably, the ARK Space Exploration & Innovation ETF currently holds 789,732 shares of the company, representing 10.25% of its portfolio. Meanwhile, the ARK Autonomous Technology & Robotics ETF owns 1,489,851 shares, representing 5.97% of its portfolio and making it the fund’s fourth-largest holding.

With that, there are no apparent red flags in Wood’s recent moves on RKLB. I see it as a smart move to take partial profits when the stock reaches all-time highs and reallocate capital to names with a more attractive risk-reward profile. And recent purchases by Wood appear to confirm my view.

Analysts Say You Don’t Need SpaceX; Buy RKLB Instead

Rocket Lab is currently receiving strong support from Wall Street analysts. They say that Rocket Lab offers an appealing alternative for investors who wish they could invest in Elon Musk’s SpaceX, arguably the highest-profile company in the space industry. Baird analyst Peter Arment joined the growing chorus last week, calling the company “SpaceX 2.0.”

Last Friday, KeyBanc Capital Markets analyst Michael Leshock raised his price target on RKLB to $75 from $50 and reaffirmed an “Overweight” rating after meeting with CEO Peter Beck and CFO Adam Spice during a visit to the company’s Long Beach, CA, headquarters. Leshock pointed to robust growth in the company’s Space Systems division and production of the new Archimedes engine, which will power the Neutron rockets. He believes Rocket Lab is establishing itself as a national security asset through its reliable space access and hypersonics initiatives, adding that the company’s solid cash position supports continued growth investments, potential acquisitions, and future space projects.

Last Wednesday, Baird’s Arment initiated coverage of RKLB stock with an “Outperform” rating and $83 price target, making him the most bullish analyst currently covering the stock. Arment noted that the company’s position as a reliable space launch provider is “firmly established,” supported by its 94% mission success rate. He also made a bold long-term prediction that the stock could eventually exceed $200, assuming sustained growth in the launch schedule and progress with the company’s upcoming Neutron reusable rocket.

Early last week, Morgan Stanley analyst Kristine Liwag said that Rocket Lab is emulating SpaceX in several ways, including expanding its rocket lift capacity, adopting booster reusability, and building a satellite constellation comparable to Starlink. Liwag noted that following Rocket Lab’s strong rally in 2025, investors have increasingly been asking how to assess its valuation properly. “Elevated interest in space and a scarcity of high-performing pure plays in public markets have together, in our view, helped support RKLB’s valuation. RKLB today is the market’s clear small-launch leader with a new medium-class launcher nearing entry into service at a time when supply of launch capacity is constrained,” wrote Liwag. With that, the firm lifted its price target on RKLB to $68 from $20 while maintaining an “Equal-Weight” rating.

How Did Rocket Lab Perform in Q2?

On Aug. 7, Rocket Lab released its financial results for the second quarter of fiscal 2025. The company’s total revenue stood at a record $144.5 million, up 36% year-over-year (YoY) and beating Wall Street’s consensus by $9.1 million. The top-line figure also exceeded the high end of the company’s guidance. The Space Systems segment, which accounts for most of the company’s revenue, posted 27% YoY growth to $97.9 million, driven by contributions from solar arrays, satellite buses, and contract manufacturing. The company’s other segment, Launch Services, is the key driver of its future growth potential. The segment’s revenue climbed 59% YoY to $46.6 million, mainly driven by a higher launch cadence, with five Electron missions completed during the quarter. Notably, Electron solidified its status as the most frequently launched small orbital rocket, achieving its 70th successful mission in August.

On the profitability front, GAAP gross margin for the quarter came in at 32.1%, exceeding the company’s previous guidance range of 30% to 32%. Gross margin also improved sequentially from 28.8%. The sequential improvement in gross margins was mainly driven by a higher average selling price (ASP) for Electron and a favorable mix within the Space Systems segment. RKLB reported a GAAP loss per share of $0.13, missing expectations by two cents.

Meanwhile, the company ended the quarter with a total backlog of about $1 billion, with roughly 41% coming from Launch Services and 59% from Space Systems. The launch backlog continued to grow, supported by strong underlying trends as the company converts a robust pipeline of Neutron, Electron, and HASTE opportunities. Management expects approximately 58% of the current backlog to be converted into revenue within 12 months.

Rocket Lab also has a strong balance sheet, holding a net cash position of $251 million. RKLB utilizes its cash to expand research and development and pursue strategic acquisitions such as Geost and Mynaric AG, strengthening its position as a comprehensive space solutions provider.

Looking ahead, management expects third-quarter revenue to come in between $145 million and $155 million, with GAAP gross margin projected to improve further to a range of 35%-37%.

RKLB Valuation and Analysts’ Estimates

According to Wall Street estimates, the company’s GAAP net loss is expected to widen by 2.63% YoY to $0.39 per share in fiscal 2025. Still, the company is anticipated to reach non-GAAP profitability within the next two years. Meanwhile, RKLB’s full-year revenue is projected to grow 35.36% from the previous year to $590.47 million.

When it comes to valuation, determining a fair value for growth companies in rapidly expanding industries is always difficult. At first glance, RKLB’s forward EV/sales multiple of 53.89x may appear lofty and dependent on perfect execution. However, when I wrote about RKLB back in June, the company already looked rich from a traditional valuation perspective, but that didn’t stop the stock from climbing from $27 to over $70 in a short period of time. That said, with many analysts dubbing the company “SpaceX 2.0” and continued progress on Neutron, I believe the premium can be justified.

What Do Analysts Expect for RKLB Stock?

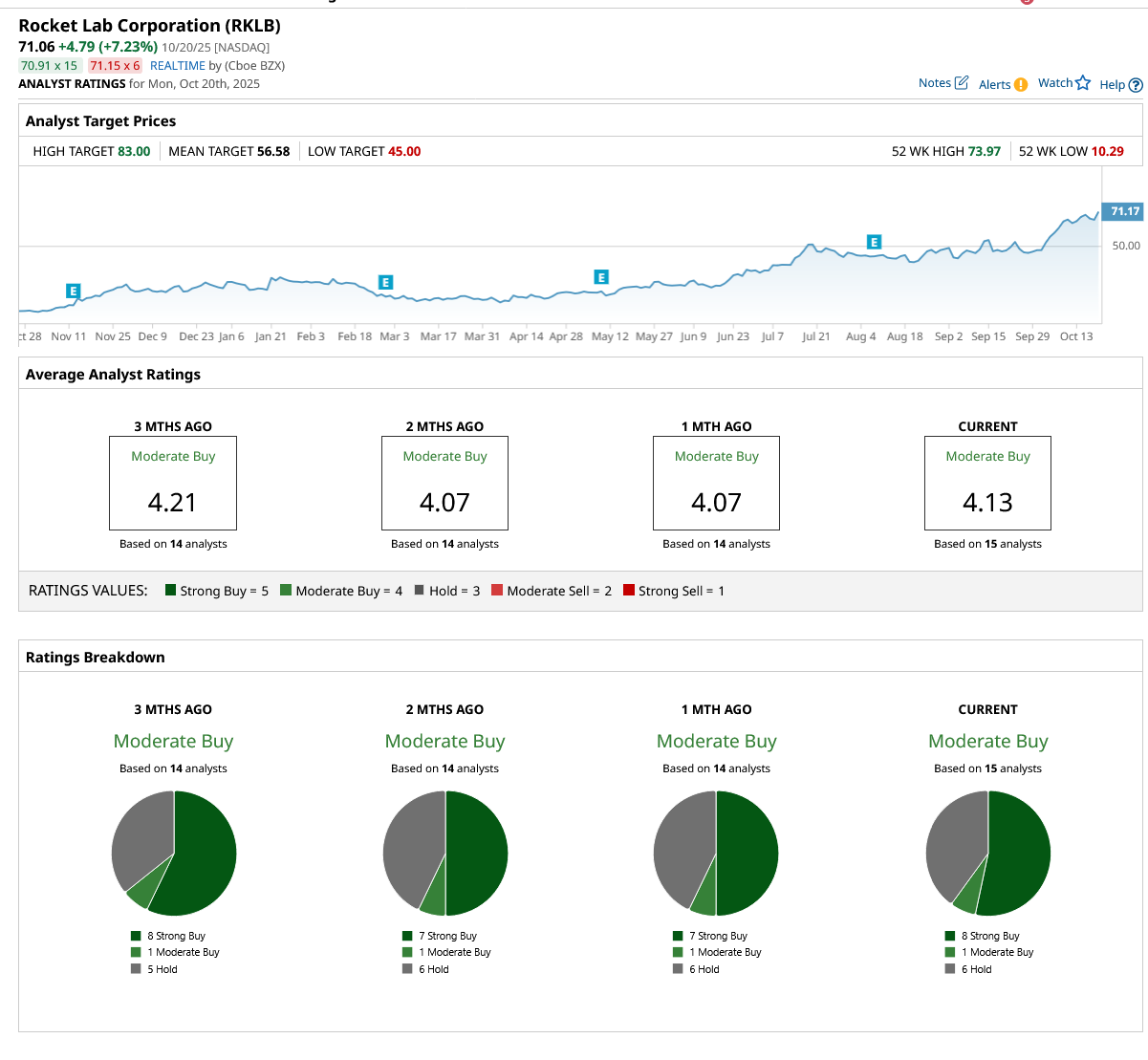

Wall Street analysts remain bullish on Rocket Lab, awarding the stock a “Moderate Buy” consensus rating. Of the 15 analysts covering the stock, eight assign it a “Strong Buy” rating, one a “Moderate Buy,” while the remaining six recommend holding. Unsurprisingly, after such a strong rally, the stock now trades above its average price target of $56.58 but still presents a 25.2% upside to the Street-high target of $83.

Now we can move to a very interesting question—should you follow Cathie Wood’s lead and take partial profits on RKLB? Well, I believe the answer ultimately depends on each investor’s individual risk tolerance. If you’re a risk-seeking investor, holding RKLB makes sense, as its sizable positions in Wood’s ARKQ and ARKX funds reflect her confidence in the company and expectation of further upside. If you’re a risk-averse investor, you may want to take partial profits and reallocate them to safer corners of the market.