/AI%20(artificial%20intelligence)/businessman%20using%20technology%20AI%20for%20working%20tools%20by%20Deemerwha%20studio%20via%20Shutterstock.jpg)

Popular among the investing community for her outsized bets on high-growth technology companies, one would expect that if there is a company at the confluence of AI and mobility, the CIO of ARK Invest, Cathie Wood, would place her bets on Tesla (TSLA). And she has done that in the past, too, quite vocally, reposing faith in the abilities of CEO Elon Musk time and again to make the EV leader one of the most seminal companies of this generation.

However, this time, it is not the company led by the world's richest man that Wood has given her backing. As a matter of fact, it is a company that is co-headquartered in Silicon Valley and China; the latter country's EV competitors have surely led to many a sleepless night for Musk.

About Pony AI

Founded in 2016, Pony.ai (PONY) is a global leader in autonomous mobility solutions, specializing in full-stack self-driving technologies for robotaxis, autonomous trucks, and personally owned vehicles. Publicly listed in late 2024, it's now commercializing mass-produced, cost-efficient L4 robotaxis and expanding globally into the Middle East and Europe.

Valued at a market cap of $7.4 billion, the PONY stock is up 33.3% on a year-to-date (YTD) basis, outperforming the Nasdaq's ($NASX) rise of 16.8% in the same period by a wide margin.

Notably, Wood's ARK Autonomous Technology & Robotics ETF (ARKQ) purchased 10,000 shares of the company last week.

So, one of the most celebrated fund managers is placing her bets on this “pony.” Does that make it a good bet now as an investment? Let's find out.

Decent Financials

Pony AI has a limited available financial history, thanks to its relatively recent listing in 2024. Yet, for a company operating in a rapidly growing and capex-heavy space such as autonomous mobility, its financials seem quite stable and on the path of improvement.

In the most recent quarter, Q2 2025, this improvement was noticed. Revenues went up by a substantial 75.9% on an annual basis to $21.46 million. The licensing and applications segment saw the most remarkable leap in sales to $10.41 million from just $1.04 million in the previous year, while the robotaxi services segment saw its revenues jump to $1.53 million from $592,000 in the year-ago period.

Losses narrowed as well to $0.14 per share from $0.29 per share in the same period a year ago, while also coming in smaller than the consensus estimate of a loss of $0.26 per share.

However, net cash used in operating activities widened to $25.41 million from $18.05 million as the company closed the quarter with a cash balance of $318.53 million. This was much higher than its short-term debt levels of $5.57 million. It must also be noted that the company is expanding its operations and investing in R&D ($49 million in Q2 2025, +69% YOY) considerably. In that context, Pony's cash outflow from operations remains within reasonable levels.

Notably, during the quarter, Pony became the only company in China to have commercially launched fully driverless robotaxi services across all four tier-one cities while operating in extreme weather conditions such as typhoons and torrential downpours. Along with that, the registered users on the platform surged by 136% yearly in Q2 2025.

Low-Cost Technology to Drive Growth

Like many Chinese autonomous vehicle companies, Pony is also adept at the art of crafting cost-effective AV kits that fuse AI with hardware, enabling seamless incorporation into production lines at its OEM collaborators. Moreover, its multifaceted tech stack, coupled with a commanding foothold in fast-expanding AV sectors and a wide footprint spanning robotaxi services, robotruck deployments, and IP licensing streams, positions it firmly to consolidate leadership in China's robotaxi landscape before extending its reach abroad.

Further, Pony's trove of operational data, accumulated from hands-on deployments, affords it a significant edge over rivals. Per its second-quarter disclosures, the Robotaxi segment had racked up nearly 30 million miles of autonomous mileage, with roughly 5.6 million miles achieved in fully unmanned mode, without any safety operator. Meanwhile, in the Robotruck domain, the firm reports accumulating approximately 3.9 million miles, a substantial benchmark.

Notably, as highlighted in the financials section, Pony's licensing arm is building meaningful momentum. Leveraging its core AI prowess and bundled proprietary hardware, the company stands poised to harvest supplementary income by granting access to its innovations for any entity venturing into robotic applications.

Finally, on the partnership front, Pony AI boasts alliances with marquee players that promise to streamline the ramp-up of commercial activities. For one, it has teamed up with Uber (UBER) to roll out robotaxi operations across the Middle East, with both sides signaling openness to broader geographic rollout down the line. Beyond that, a strategic joint venture with Toyota (TM) aims to churn out self-driving vehicles en masse; given Toyota's status as the globe's top automaker, this tie-up could deliver Pony AI pronounced efficiencies on costs.

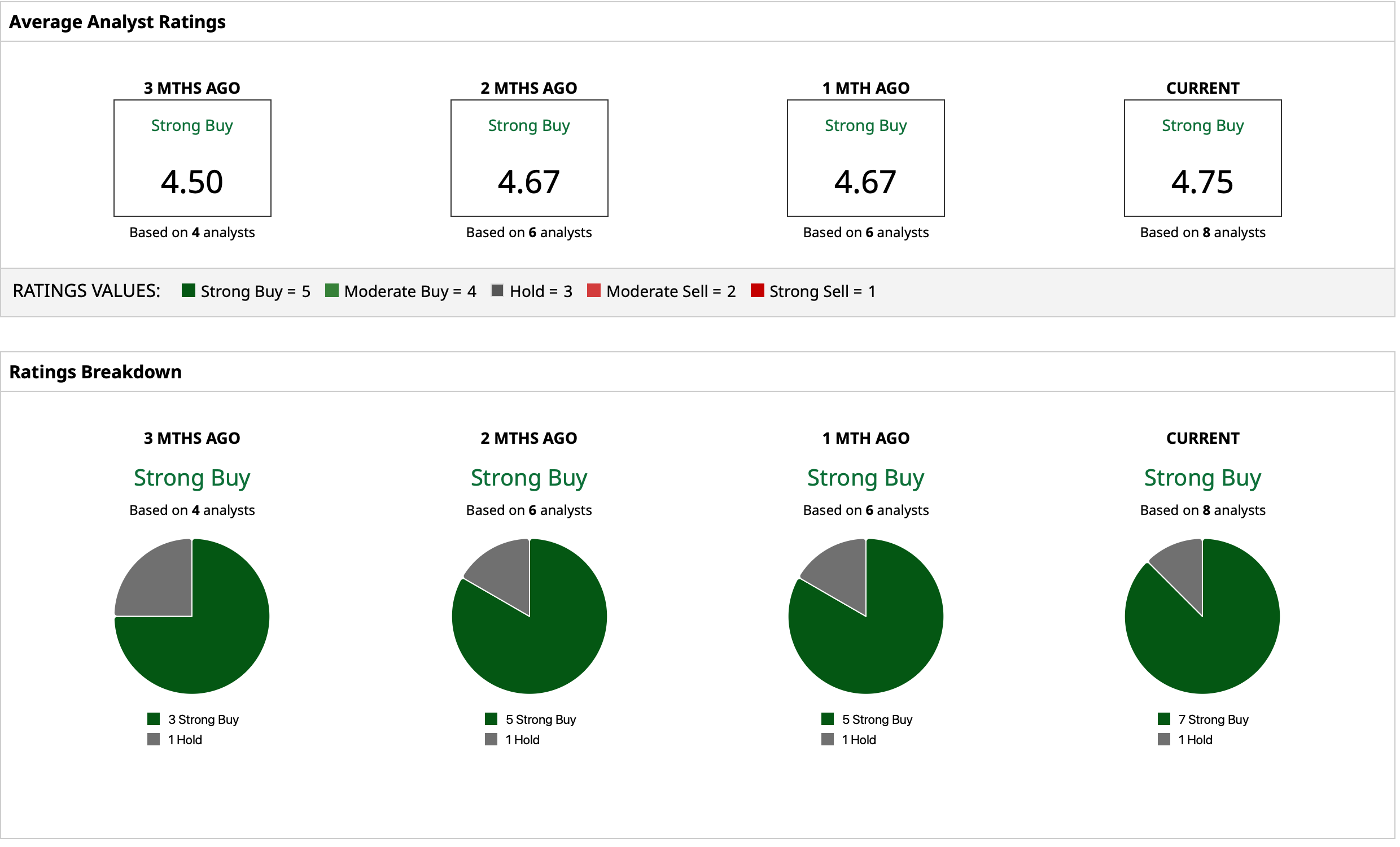

Analysts on PONY

Overall, analysts have attributed a rating of “Strong Buy” for the stock, with a mean target price of $25.52. This indicates an upside potential of about 25% from current levels. Out of eight analysts covering the stock, seven have a “Strong Buy” rating, and one has a “Hold” rating.