/A%20corporate%20sign%20for%20Baidu%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Cathie Wood is a well-respected name in the world of institutional investors. She made a real name for herself coming out of the pandemic, with various hyper-growth bull markets across most of the technology sphere driving the value of many of her early-stage (and often pre-revenue) companies to all-time highs in 2020 and 2021.

Since then, things have clearly simmered down. However, Wood has done a decent job of rotating out of some of her more speculative picks and into companies I'd consider more long-term buy-and-hold stocks.

The good news for investors looking to track Cathie Wood and mimic some of her portfolio moves in her core Ark Innovation ETF (ARKK) is that this fund posts its daily trades for all to see.

Let's dive into one of her more intriguing recent additions in Baidu (BIDU), and why this is one stock I think makes sense for long-term growth investors to consider right now.

Momentum Is Back for Chinese Tech Stocks

One of the unfortunate realities for investors who have put capital to work in many top Chinese tech stocks over the past decade is that there hasn't been much in the way of upside momentum over this time frame.

Shares of BIDU stock have been volatile but mostly trending lower over this span. However, this dynamic has clearly started to shift recently, with shares of the Chinese tech giant absolutely rocketing higher as investors look outside the U.S. for growth.

What's interesting about this particular move is just how sideways BIDU stock has trended lately outside this recent surge. While many on the Street, such as Cathie Wood, may certainly have reason to believe this rally can continue, it's also true that previous spikes have been met with significant selling pressure as investors look to take profits and continue to be wary of how the Chinese government will treat its tech sector.

Unlike the U.S. tech sector, which has allowed for mega-cap giants to get as big as they want, the Chinese government appears to have put at least some form of a glass ceiling in place for companies that may be getting too large (to become a net negative for society as a whole). With the government, on paper at least, focused on the health of the consumer and very against anything that may be perceived as anti-competitive, Baidu is among the top names that have been hit hard in recent years by various government-induced crackdowns.

With these headwinds seemingly out of the way and greater investor demand for global growth stocks, this recent rally is certainly compelling, and I can see why Cathie Wood wants to step into this trend.

Let's Look at Baidu's Fundamentals

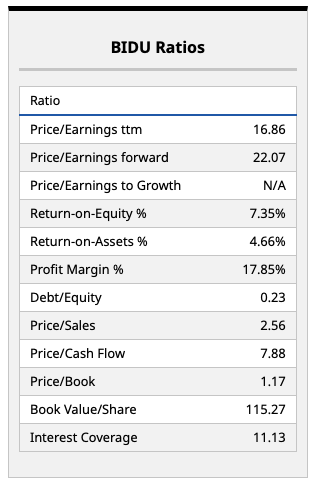

From a fundamental standpoint, I think it's fair to say that most U.S.-listed Chinese stocks are much more favorably valued than their American counterparts. In the case of Baidu, I'd posit that this thesis certainly holds true.

Looking at the company's ratios above, a trailing price/earnings multiple of less than 17 times is one I'd consider to be dirt cheap. That's for a company with a profit margin near 20% and a solid growth rate (which many believe could accelerate if the company's AI investments pay off).

Of course, we'll have to see how any sort of AI implementations ultimately result in improved revenue and earnings growth moving forward. But simply based on what the company has done in the past, its current price/sales multiple of around 2.5 times does look very attractive to me right now. Cathie Wood seems to agree.

What Does Wall Street Think?

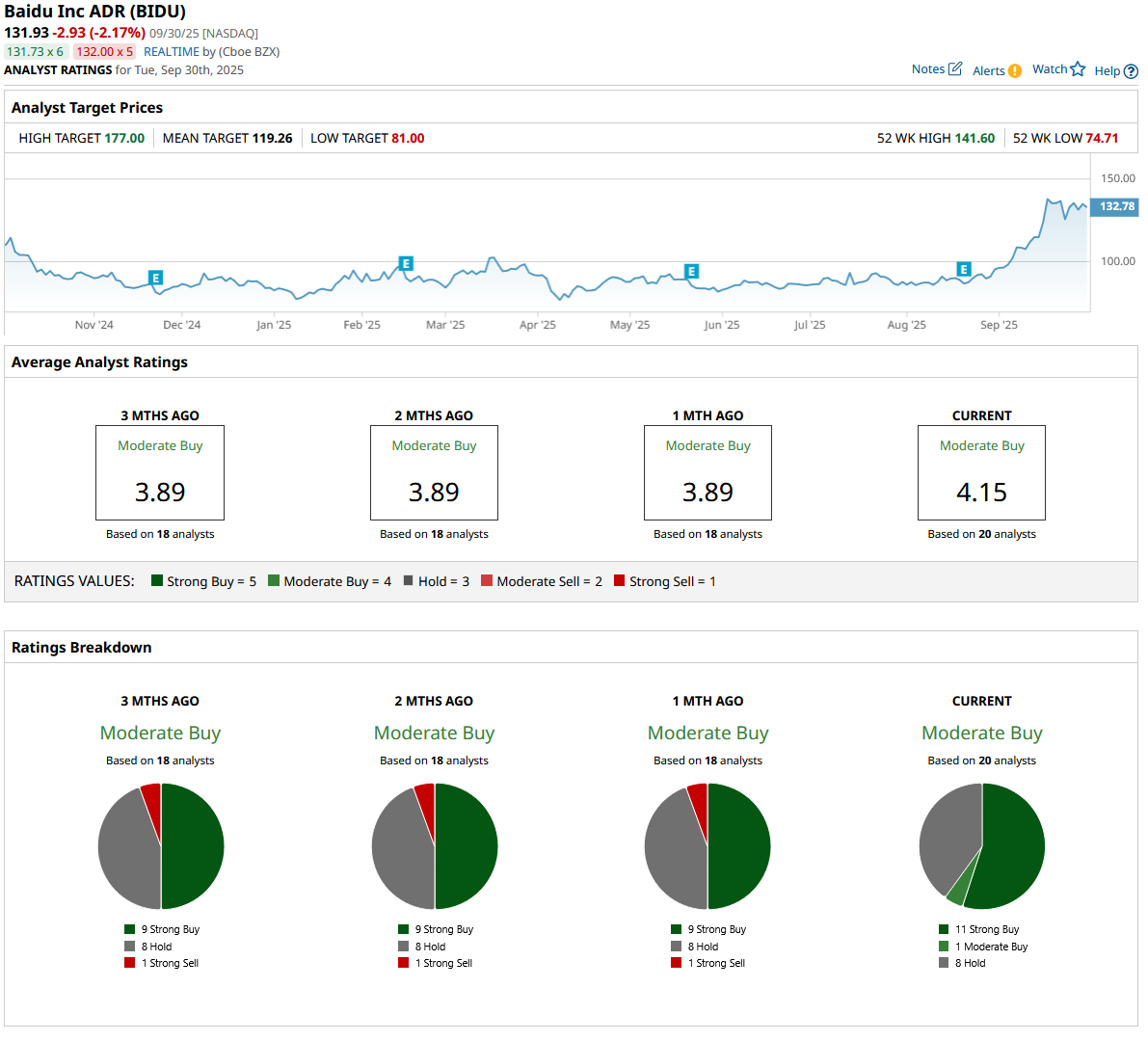

Other analysts on Wall Street appear to be just on the fence regarding where BIDU stock is headed from here.

With a consensus price target of just $118.89 per share, there's about 12% downside currently implied by the average analyst for Baidu. Now, the high price target on Wall Street sits at $177 per share, so it's entirely possible this stock could surge as much as 30% or more from here. But the lower end of the price target spectrum also calls for similar downside over the next years. Also, despite the consensus “Moderate Buy” rating, almost half of those analysts say "Hold." Indeed, the jury is out on this one.

I'm of the view that Baidu has been cheap for a long time. Like other major Chinese tech giants, the market has priced in a risk discount to this stock, given the stance the Chinese government has taken to this sector in the past. On those fronts, little has changed in my view.

While I do think Baidu's overall growth rate could accelerate, and there are some solid AI-related tailwinds around this company for investors to consider, just because Cathie Wood buys a stock with strong momentum doesn't mean I have to. I will eagerly watch this stock from the sidelines, and it will certainly be interesting to see how Baidu performs over the next year (and if Cathie Wood holds for a year or chooses to sell out before then).

We'll see.