On Monday, Cathie Wood-led Ark Invest executed significant trades, notably acquiring shares in CoreWeave Inc. (NASDAQ:CRWV), ARK 21Shares Bitcoin ETF (BTS: ARKB), Bullish (NYSE:BLSH), and Kodiak AI Inc. (NASDAQ:KDK). These trades reflect Ark’s strategic positioning in emerging technologies and digital assets.

The CoreWeave Trade

Ark Invest’s flagship fund, ARK Innovation ETF (BATS:ARKK) and ARK Next Generation Internet ETF (BATS:ARKW), made a substantial purchase of 437,345 shares in CoreWeave on Monday. This acquisition, valued at approximately $32.2 million, aligns with CoreWeave’s recent market momentum.

The company’s stock recently surged following Nvidia Corp.’s impressive earnings report, which sparked a rally in AI-related stocks. CoreWeave, known for its cloud infrastructure tailored for AI workloads, is benefiting from the heightened interest in AI technologies.

The ARK 21Shares Bitcoin ETF Trade

ARK Blockchain And Fintech Innovation ETF (BATS:ARKF) and ARKW funds collectively acquired 36,638 shares of ARK 21Shares Bitcoin ETF (BTS: ARKB) on the same day. The total transaction, worth around $1.08 million, comes amid a turbulent period for the cryptocurrency market.

ARKB is an exchange-traded fund that allows investors to gain exposure to Bitcoin (CRYPTO: BTC) prices without having to purchase the cryptocurrency themselves.

Bitcoin slid to around $87,000 as fear in crypto markets hit levels not seen since late 2022, with sentiment indexes dropping into extreme-panic territory. The apex cryptocurrency has fallen about 30% from its October peak near $126,000, pulling total crypto market cap down to roughly $2.9 trillion amid broad, market-wide selling.

The Bullish Trade

ARKK acquired 13,402 shares of Bullish (NYSE:BLSH), valued at approximately $556,183. This purchase comes after Bullish reported its third-quarter earnings last week.

The Peter Thiel-backed cryptocurrency exchange reported revenue of $76.5 million, surpassing estimates, and adjusted earnings of $0.10 per share, in line with forecasts. Digital asset sales fell to $41.6 billion from $54.2 billion a year earlier, while adjusted transaction revenue declined to $26.7 million. Bullish launched crypto options with 14 trading partners, saw strong liquidity growth, and guided fourth-quarter subscription and services revenue of $47–53 million.

Notably, Ark has been consistently purchasing Bullish stock through November, especially around the earnings release.

The Kodiak AI Trade

Ark Invest’s ARKQ fund purchased 35,329 shares of Kodiak AI, totaling approximately $215,507.

Kodiak, an autonomous trucking firm, went public via a SPAC merger in April, a move supported by Ark Invest and other prominent investors like George Soros. Kodiak secured over $110 million in financing from new and existing institutional investors, including Soros Fund Management, ARK Investments, and Ares, alongside roughly $551 million held in trust to support the transaction.

This strategic investment positions Ark to capitalize on the burgeoning autonomous vehicle market, estimated to be worth $4 trillion.

Other Key Trades:

- Sold 583,495 shares of GitLab Inc (GTLB) from ARKK and 63,416 shares from ARKW.

- Sold 138,456 shares of Iridium Communications Inc (IRDM) from ARKK, 31,848 from ARKQ and 9,274 from ARKX

- Sold 29,200 shares of Ibotta Inc (IBTA) from ARKW and 32,900 from ARKF.

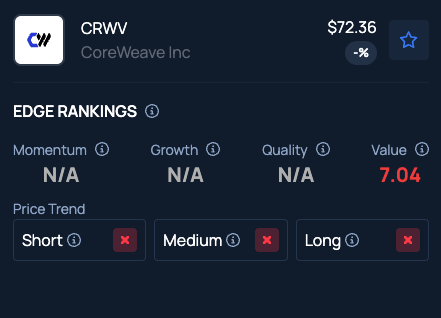

Benzinga Edge Stock Rankings indicate that CoreWeave stock has a Value in the 7th percentile. Here is how the stock measures up on other metrics.

Photo: ChrisStock82 / Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal