You want to talk about challenging CEO gigs?

Not only did veteran Cisco Systems executive Michael Glickman assume the reins in July from the only CEO Casa Systems has ever known, the founder himself, the retired Jerry Guo, he did at so at a low point for cable broadband technology vendors in general, with operators’ mouths full chewing on inventories frantically amassed during high pandemic usage levels.

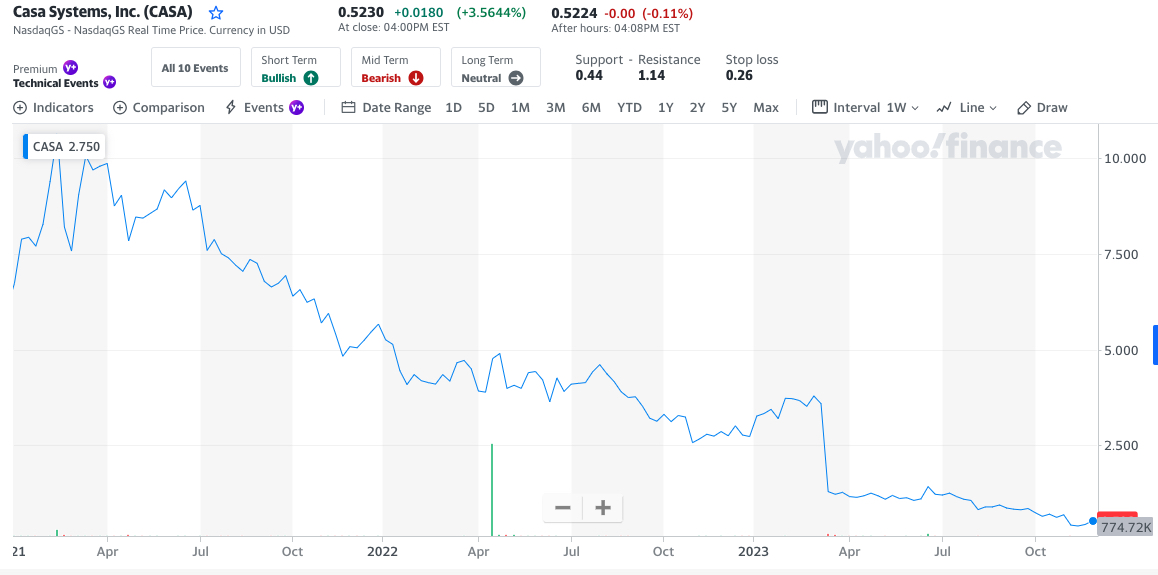

In fact, when Glickman officially took over the Andover, Massachusetts-based tech company in July, its stock was a third of what it had been in March, when Guo announced his retirement … and Casa revealed to investors that a major cable operator, widely believed to be Charter Communications, would not be using its products in its major network overhaul.

All that said, when Next TV caught up with Glickman for a Zoom chat on Wednesday, he seemed bullish. Casa's engineering team, he believes is right on time ± or even ahead of schedule -- on the broadband industry's transition to software-driven, virtualized network infrastructures.

He thinks inventory levels will start sorting themselves out sometime later next year, and Casa will effectively compete with Harmonic and other vendors for that virtualized DOCSIS 4.0 future.

Next TV: So why leave the sunny shores of San Jose, California, to run Casa Systems at such a challenging time?

Michael Glickman: I spent almost 20 years at Cisco running the service provider business there before joining a startup and then ended up here at Casa about 100 days ago. We’ve been talking about virtualizing platforms for probably five to 10 years. And what I would tell you is, I'm starting to see now, this actually occurring. It's fair to say it started really in the hyper-scalar space and has now permeated into the wireless space, specifically with technologies like packet core, which powers the data services and for that matter, the voice services to those end-user customers. And now it’s even moving into the cable space with virtual CCAP. And specifically virtual CMTS, the core of that architecture. And that's really fundamentally one of the main reasons I came to Casa is because the company is really well positioned in those virtualized network functions. We're not only a leader in the in the cable space around virtualized core, but also in the wireless and telco space with virtualized packet core, virtualized security gateway, and virtualized BNG [Broadband Network Gateway], which is used for subscriber management for fiber installations. Even some wireless technologies, as well. And so coming over and being able to see that kind of portfolio of virtualized functions, many of which are cloud-native, which also has some really important aspects to it is really compelling, because I think we're hitting the market at the right time.

Next TV: This is a company that's only known one CEO?

Michael Glickman: Yes, it’s always interesting taking over the helm from another leader, but also the founder of the company. On the positive side, what I had expected to see from an engineering and innovation, leadership is there. For a technology company, that is the most critical aspect of success moving forward, because you can build upon or change or restructure things like your go-to-market and sales and marketing. You could do the same maybe even on the product management side, the support. Those are all those are all things that can be fixed, made more effective or efficient. But if you do not have a core set of engineers who have demonstrated the ability to innovate, that’s a real tough one to build from scratch. So that is the heritage of Casa, and I spent a good amount of two months traveling literally around the world, meeting with our top customers and making sure that they knew me. And luckily, I know many of them already. We started to talk about what we want to do with this company moving forward. And I always asked each of them, ‘Why do you do business with Casa?’ And they would always answer the same way. It’s innovation. And not only that, it’s how nimble Casa is from an engineering standpoint, in responding to what the customer's needs are. It’s just foundational.

Next TV: It seems like the competitive response to Harmonic, which is an early leader in network virtualization, must consume a lot of your bandwidth.

Michael Glickman: I see it similarly. There are only two vendors today that have demonstrated a virtualized CMTS, or virtualized core: Harmonic and Casa. I think CommScope has now announced that they have one, but they haven't delivered it yet. Harmonic did a nice job of going to Comcast and structuring a very interesting deal, which had to do with sharing of intellectual property and ownership and all kinds of other things. That put them on the map with not only the largest cable provider in the world but also one that is at the forefront of pushing things like DOCSIS [4.0] and high-speed services. So, that absolutely is their heritage. But we have done a very nice job of competing against them and winning. We’ve gone up against Harmonic for many carriers around the world, some of which have been announced publicly. And the reason is really twofold. The first is that we had the benefit of having a real CMTS. We took the code off of that fully functional CMTS and moved it into a virtualized and cloud-native environment. Harmonic built it from the ground up. There’s nothing wrong with that, but you do get advantages when you actually have a fully functioning system, especially from an operations provisioning and support standpoint. And secondly, we have an architecture that doesn’t force you to buy layer 3 switches when you actually go and put a virtualized stack of hardware together to run the software. And that has great advantage, especially in geographies where power consumption — and certainly price — is very important. So think about parts of Europe, Latin America, certainly, all the developing countries — that is a huge advantage for us. So we feel very good about our position and in that space.

Next TV: Just how consolidated do you think cable tech is going to get?

Michael Glickman: I've been working with service providers, especially tier 1s, for many, many years, and something that tends to be in the in the DNA is dual-vendor strategy. And it's not just to drive pricing down. It’s supply chain; it’s risk mitigation around engineering capabilities and feature sets that are required. There are all kinds of things that drive that. I’m not saying can't be done, I’ve done it right myself as a vendor with service providers. But most of them have been burned for some reason, based on that, and so I don’t see that going away. You do need a couple or three vendors in this space to be able to be effective for the industry.

Next TV: What’s going on with Casa and Wall Street right now?

Michael Glickman: Most of the damage, so to speak, to the market cap of Casa, unfortunately, was done in the March timeframe. And it certainly hasn't gotten any better. You just have to do more right to get out in front of investors, potential investors and the community. That’s going to help you drive the market cap back up over time. But the main thing is to be focused on execution, because if you can bring the metrics back to what the market is expecting, and you're setting the right expectations with regard to top line and bottom-line, and even exceeding those, I think typically the market pays you back. And, unfortunately, up to this point, to be very frank, we haven't done that. When you're missing expectations over and over again, there are always typically good reasons for it. But at the end of the day, nobody cares. You have to be at your best to deliver on the expectations you set. And you have to be able to read these markets. But I would tell you, if you look across the cable space, it's not just us and Harmonic, but also CommScope and Vecima. All these guys, they’re all saying kind of the same thing that I said in our last quarterly earnings call, right? To me, it's a combination of the pandemic overhang, where we had a really interesting situation during which not only was a supply chain constrained to the point where every customer was kind of forced to make some pretty significant purchases to make sure that they had what they needed … which is now getting delivered. Not only that, in the cable space, in the broadband space, all of us were going home and doing work from home, and thereby probably upgrading the speeds of our broadband to be able to do so. So you take that and you say, ‘Wow, that was a great, probably 18 to 24 months for the for the industry, both for the customers as well as the vendors serving them. But now we're going to pay the price on the other end.’

Next TV: When do you think this inventory glut will be over with?

Michael Glickman: Anybody’s guess is as good as the other’s. I mean, the only data that would be really meaningful for that is to have a very good understanding of the inventory that our customers have. We do understand that it’s very difficult for most of our customers to share this data because it gets into privacy. Most of these customers are public companies. What’s the uptake or future uptake of your broadband services, either by speed or by net new subscribers? They can't really share that with you. Even if you sign an NDA, it’s in essence violating regulatory law to do that. So you have to kind of read the tea leaves and kind of figure things out based on trends and what’s going on. I certainly don’t have any data that would refute this — I believe the second half of next calendar year is what most people are saying, we should expect for that bubble to work its way out, so to speak.

Next TV: What most excites you about Casa right now?

Michael Glickman: What’s exciting is this movement to these virtualized platforms. Because again, I think that puts us front and center. And it’s not a crowded space. Where I give my predecessor a lot of credit is, he started working on a virtualized cloud-native packet core solution eight years ago. He hired some really brilliant engineers from a startup network right down the road in Massachusetts. And that startup was actually purchased by Cisco. When I was over there at Cisco, we were able to take a huge amount of packet-core market share from the likes of Ericsson, Nokia, and all the rest. That is a very exciting space to be in. With all due respect to the legacy players like Nokia, Samsung, Ericsson and the rest, they basically have taken their code, their packet-core code, and they moved it into a Kubernetes, or whatever, virtualized stack. But the problem with that is it runs very fat, right? In other words, you need to stack servers up to the ceiling of your data center to be able to run that in a virtualized mode. Cloud native says that you run that in a very small footprint. And you have the ability to push that much further out into your network, which gives you benefits. And I can take you through several use cases.