/Carrier%20Global%20Corp%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

With a market cap of $50.8 billion, Carrier Global Corporation (CARR) is a leading U.S. provider of HVAC, refrigeration, and energy-efficient climate solutions headquartered in Palm Beach Gardens, Florida. With operations in about 160 countries, the company has been reshaping its portfolio to focus on sustainable heating and cooling technologies.

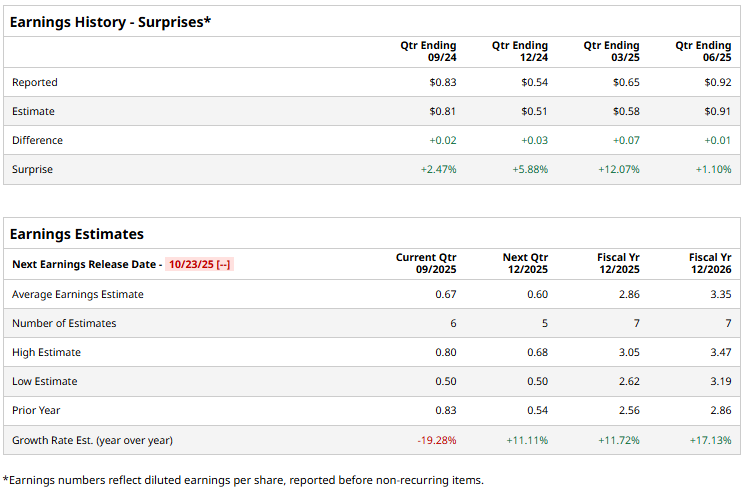

CARR is poised to report its fiscal 2025 Q3 earnings soon. Ahead of this event, analysts expect the company to report a profit of $0.67 per share, down 19.3% from $0.83 per share in the year-ago quarter. The company has surpassed the Street’s bottom-line projections in each of the past four quarters, which is impressive.

For fiscal 2025, analysts expect CARR to report a profit of $2.86, up 11.7% from $2.56 in fiscal 2024. Furthermore, its EPS is expected to grow 17.1% year over year to $3.35 in fiscal 2026.

CARR stock has dipped 26% over the past 52 weeks, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 14.5% surge and the S&P 500 Index’s ($SPX) 17.2% uptick during the same time frame.

Carrier Global shares sank nearly 11% on July 29 after releasing its fiscal 2025 second-quarter earnings. Revenue grew 3% year over year to $6.1 billion, driven by 6% organic growth, and adjusted EPS climbed 26% to $0.92, both surpassing the Street expectations. However, investors focused on the underlying weakness in demand and margin pressures amid a challenging macro environment. Soft U.S. residential and commercial volumes, sluggish European boiler sales, and China’s housing slowdown weighed on performance, while high interest rates continued to curb construction activity.

Wall Street analysts are somewhat bullish about CARR’s stock, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, 13 recommend "Strong Buy," one suggests a “Moderate Buy,” and ten suggest a “Hold.” CARR’s average analyst price target of $78.81 indicates a potential upside of 31.8% from the current levels.