/Carnival%20Corp_%20%20night%20cruise%20by-SeregaSibTravel%20via%20iStock.jpg)

Miami, Florida-based Carnival Corporation & plc (CCL) is a cruise company that provides leisure travel services. Valued at $35.5 billion by market cap, the company offers cruise vacations specializing in ocean-based vacations, offering a mix of luxury, premium, and budget-friendly cruise experiences. The cruise giant is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Monday, Sep. 29.

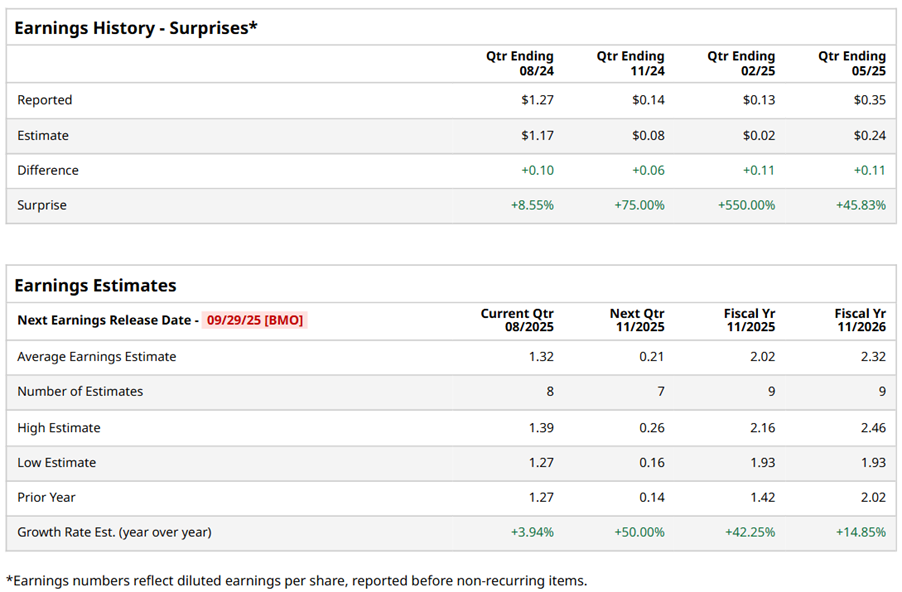

Ahead of the event, analysts expect CCL to report a profit of $1.32 per share on a diluted basis, up 3.9% from $1.27 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CCL to report EPS of $2.02, up 42.3% from $1.42 in fiscal 2024. Its EPS is expected to rise 14.9% year over year to $2.32 in fiscal 2026.

CCL stock has considerably outperformed the S&P 500 Index’s ($SPX) 15.4% gains over the past 52 weeks, with shares up 69% during this period. Similarly, it considerably outperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.3% gains over the same time frame.

CCL is gearing up for a competitive market by advancing its fleet strategy with targeted newbuilds and upgrades. The company has achieved success with AIDAdiva's refurbishment and is preparing for new ship launches, including Carnival Festivale and Carnival Tropicale, which will feature innovative amenities. With moderate capacity growth, Carnival aims to strengthen its market position, enhance guest experiences, and reduce debt, positioning itself to capture market share amidst increasing competition.

On Jun. 24, CCL shares closed up by 6.9% after reporting its Q2 results. Its adjusted EPS of $0.35 beat Wall Street expectations of $0.24. The company’s revenue was $6.3 billion, beating Wall Street forecasts of $6.2 billion.

Analysts’ consensus opinion on CCL stock is bullish, with a “Strong Buy” rating overall. Out of 25 analysts covering the stock, 18 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and six give a “Hold.” CCL’s average analyst price target is $34.39, indicating a potential upside of 12.8% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.