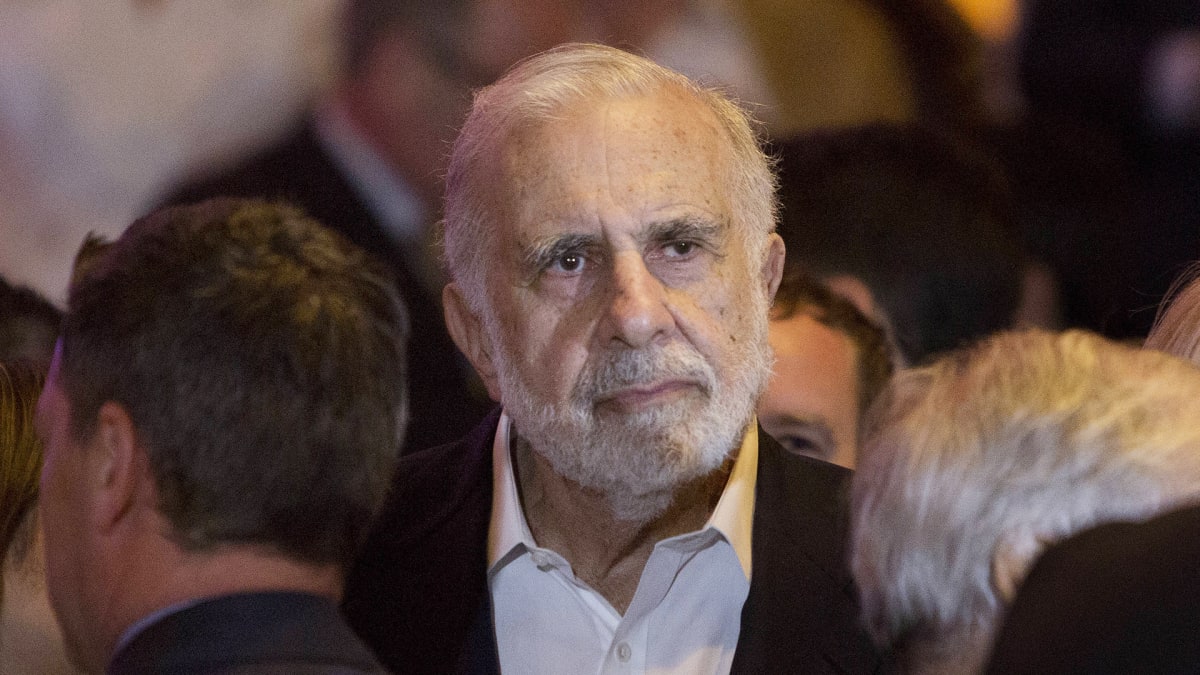

It’s been a difficult few years for billionaire Carl Icahn, and he’s finally facing the reality publicly.

In an interview with the Financial Times, Icahn admitted that he’s made several mistakes that have cost him $9 billion since 2017.

“I’ve always told people there is nobody who can really pick the market on a short-term or an intermediate-term basis,” Icahn told the Financial Times. “Maybe I made the mistake of not adhering to my own advice in recent years.”

DON’T MISS: Billionaire Carl Icahn Loses $10 Billion in 24 Hours

Icahn, who heads Icahn Enterprises -- ((IEP)), bet big on market collapses in the wake of the 2008 recession. In recent years, he began to start taking riskier strategies including shorting different stocks, commercial mortgages and debt securities.

His risky change ultimately led to a massive loss he believes wouldn’t have happened if he just continued on his previous path.

“You never get the perfect hedge, but if I kept the parameters I always believed in . . . I would have been fine,” Icahn said.

Icahn has also been in the heat over the last month after being accused of having an inflated market value and providing unsustainable dividends by short seller Hindenburg Research.

Icahn Enterprises’ stock has fallen nearly 40% since the report was published. Icahn has already put nearly $4 billion of his own money into his firm to keep it stable, but added on top of a margin loan he took from Morgan Stanley last year, he is left in a very precarious position.

But while Icahn has publicly admitted his business errors, his statement earlier this month disputed the claims of Hindenburg.

"We believe the self-serving short seller report published by Hindenburg Research today was intended solely to generate profits on Hindenburg's short position at the expense of IEP's long-term unitholders," Icahn said in a statement. "We stand by our public disclosures and we believe that IEP's performance will speak for itself over the long term as it always has."

.jpg?w=600)