/Capital%20One%20Financial%20Corp_%20credit%20card-by%20David%20Cardinez%20via%20Shutterstock.jpg)

McLean, Virginia-based Capital One Financial Corporation (COF) operates as a bank holding company focusing on consumer and commercial lending as well as deposit origination. With a market cap of $140.3 billion, Capital One operates through Credit Card, Consumer Banking, and Commercial Banking segments.

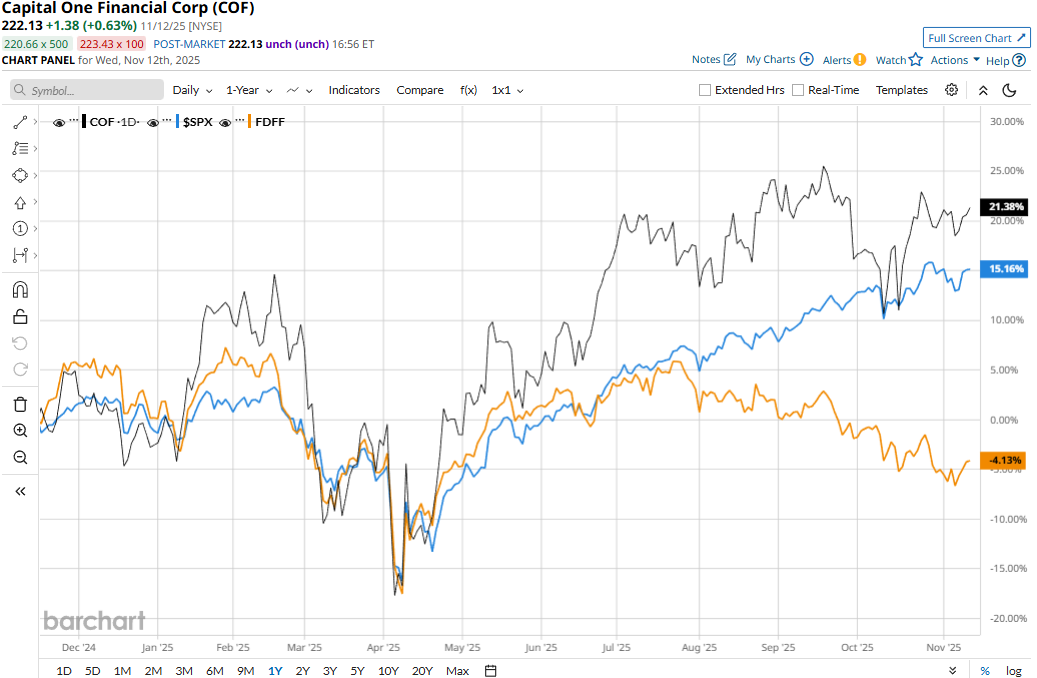

Capital One has significantly outperformed the broader market over the past year. COF stock prices have soared 24.6% on a YTD basis and 18.9% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 14.5% returns over the past year.

Narrowing the focus, Capital One has also outpaced the industry-focused Fidelity Disruptive Finance ETF’s (FDFF) 4.3% decline on a YTD basis and 5.5% drop over the past 52 weeks.

Capital One Financial’s stock prices gained 1.5% in the trading session following the release of its impressive Q3 results on Oct. 21. The company’s interest income from loans has continued to soar, increasing 44.4% year-over-year to $15.2 billion. After considering other interest income, non-interest income, and interest expenses, the company’s overall topline increased by a solid 23% year-over-year to $15.4 billion, beating the Street’s expectations by 3.1%. Meanwhile, its adjusted EPS came in at $5.95, exceeding the consensus estimates by a staggering 41.7%.

For the full fiscal 2025, ending in December, analysts expect COF to deliver an adjusted EPS of $18.58, up 33.1% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

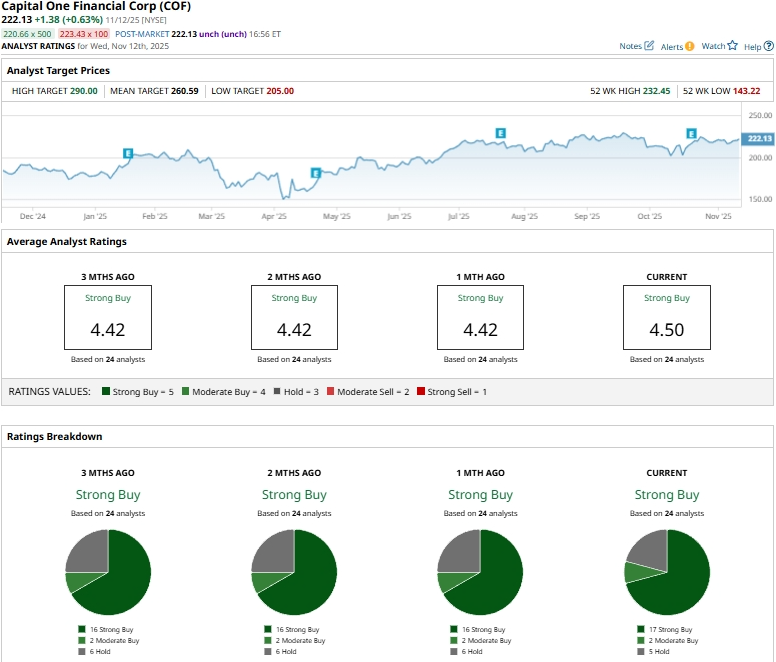

Among the 24 analysts covering the COF stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buys,” two “Moderate Buys,” and five “Holds.”

This configuration is slightly more optimistic than a month ago, when 16 analysts gave “Strong Buy” recommendations.

On Oct. 22, Morgan Stanley (MS) analyst Betsy Graseck maintained an “Overweight” rating on COF and raised the price target from $267 to $272.

COF’s mean price target of $260.59 represents a 17.3% premium to current price levels. Meanwhile, the street-high target of $290 suggests a 30.6% upside potential.