Capital One Financial Corp (NYSE:COF) shares are trading in the red on Thursday afternoon, swept up in a broader sell-off impacting the financial services sector. Here’s what investors need to know.

- COF stock is showing notable weakness. Stay ahead of the curve here.

What To Know: The decline is occurring within a cautious market environment where traders are rotating out of riskier assets and into safe havens such as gold, which surged to a record high of $4,270 per ounce.

The banking industry is facing particularly intense pressure as concerns over credit quality mount on Wall Street. Regional bank stocks tumbled after Zions Bancorp revealed it was taking a provision for approximately $60 million to cover potential losses from defaulted commercial and industrial loans.

Although Zions characterized the matter as an “isolated situation,” the news has amplified investor anxiety about the health of loan portfolios across the industry. This combination of a general risk-off sentiment and specific fears over souring loans is creating significant headwinds for major financial institutions such as Capital One.

Read Also: Regional Banks Suffer Worst Drop Since Trump’s Tariff Shock: Are Credit Fears Back?

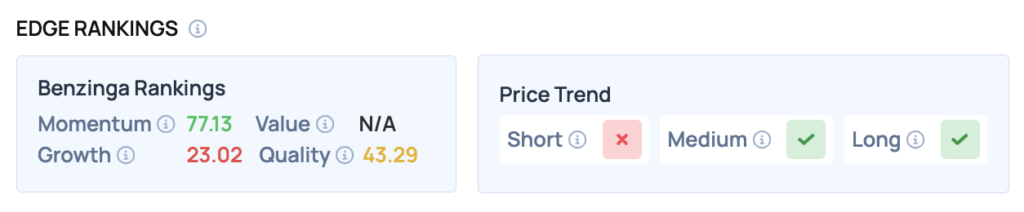

Benzinga Edge Rankings: Despite the day’s decline, Benzinga Edge stock rankings show Capital One has a strong Momentum score of 77.13.

COF Price Action: Capital One shares closed down 5.49% at $203.15, according to data from Benzinga Pro. The stock is trading within its 52-week range of $143.22 to $232.45.

The 50-day moving average stands at $218.76, suggesting that the stock is currently trading 7.4% below this level. This gap could indicate a bearish sentiment in the short term, especially as the stock struggles to regain momentum after the recent decline.

How To Buy COF Stock

By now, you're likely curious about how to participate in the market for Capital One — be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Capital One, which was trading at $201.59 at one point on Thursday, $100 would buy you 0.5 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

• Read Also:

S&P 500 Is Trading Like It’s 2000—History Shows What Happens Next Isn’t Pretty

Image: Shutterstock