It might be time to resume a bullish stance.

Investors should go long the S&P 500, Cantor Fitzgerald Chief Market Strategist Peter Cecchini wrote in a note Tuesday, recommending options that will pay off if stock prices climb. His favored trade is to buy the SPDR S&P 500 ETF Trust (ticker SPY) March $275/$280 1-by-1 call spread with the sale of a March $240 put.

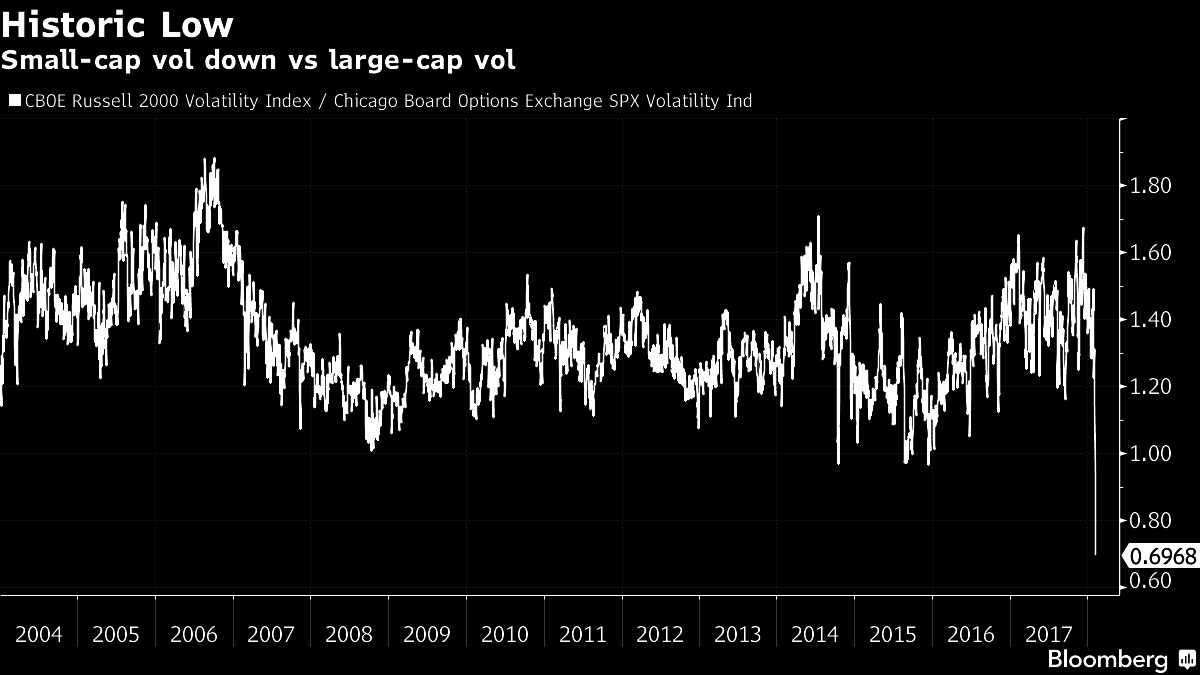

A look at S&P 500-based options shows some are “likely not reasonably priced,” Cecchini said, pointing to a straddle trade on Feb. 9-expiry options that implies a 3.3 percent move by Friday. He added that another indication of how dislocated volatility is can be found in the comparison of Russell 2000 volatility versus that of the S&P 500.

To contact the reporter on this story: Joanna Ossinger in New York at jossinger@bloomberg.net.

To contact the editors responsible for this story: Tracy Alloway at talloway@bloomberg.net, Brendan Walsh, Andrew Dunn

©2018 Bloomberg L.P.