Canaan Inc – ADR (NASDAQ:CAN) is trading higher Thursday morning after the Bitcoin (CRYPTO: BTC) mining machine manufacturer announced a landmark sales order.

Shares of crypto-linked stocks are also trading higher amid a rise in Bitcoin. The digital token may be seeing strength due to the ongoing government shutdown. Here’s what investors need to know.

What To Know: The company has secured a purchase order from a U.S.-based bitcoin miner for more than 50,000 of its latest-generation Avalon A15 Pro mining machines, with delivery scheduled for the fourth quarter of 2025.

The order is Canaan’s largest single order in the past three years, signaling a resurgence in the U.S. market.

“This milestone order represents a significant win for Canaan,” said Nangeng Zhang, chairman and CEO. “It highlights not only the strength of our Avalon A15 Pro but also our deep commitment to serving customers worldwide.”

In a press release on Thursday, the company said the record-setting purchase order reinforces Canaan’s position as a trusted partner for institutional-scale mining operations.

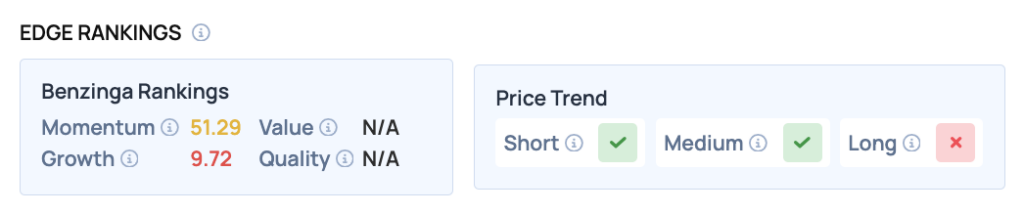

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock’s positive short-term price trend is quantified by a Momentum score of 51.29, though its long-term trend is viewed negatively.

CAN Price Action: Canaan shares were up 17.31% at $1.22 at the time of publication Thursday, according to Benzinga Pro.

Read Also: Why Tech Rallies In October: 5 Stocks With Strong Seasonal Edge

How To Buy CAN Stock

By now you're likely curious about how to participate in the market for Canaan – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock