Money isn’t just math—it’s deeply emotional. When sadness hits, brains can start treating spending like comfort food. A tough breakup, job loss, or even just a bad week can send someone straight into retail therapy territory.

Emotions can hijack rational thought, making financial decisions impulsive rather than practical. The result is often spending money faster than it can be earned, leaving a bigger mess behind.

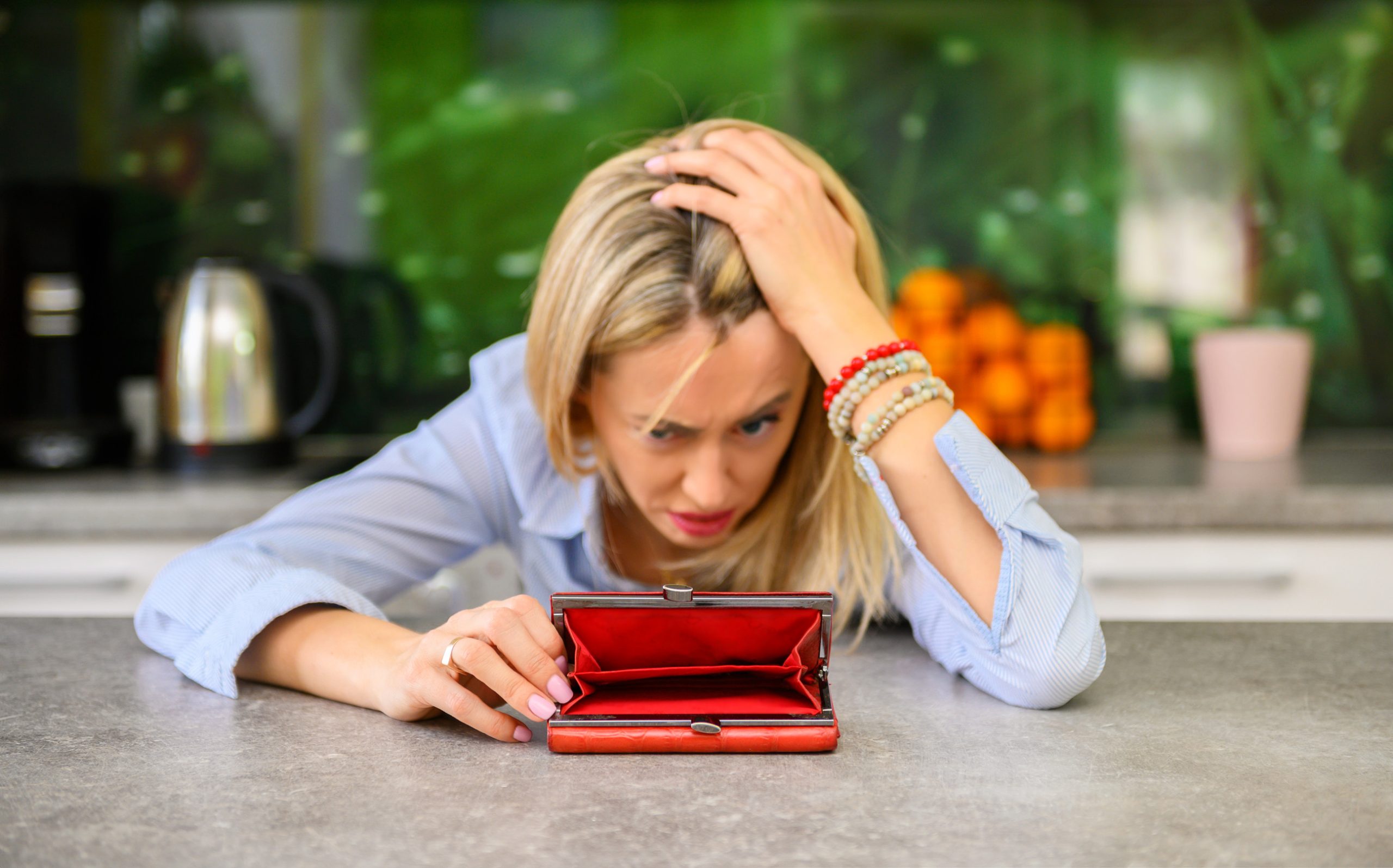

When Stress Turns the Wallet Inside Out

Stress creates a powerful urge to spend in search of relief. Swiping a card or clicking “buy now” can trigger dopamine, a chemical linked to temporary happiness. Unfortunately, the relief usually fades faster than the credit card bill arrives. Sadness or anxiety can make even cautious people reckless with their budgets. What feels like control in the moment often turns into regret later.

Shopping as a Distraction Strategy

Sadness pushes people to look for distractions, and shopping is one of the easiest. Bright new things provide a momentary escape from heavy feelings. Online stores and quick deliveries make that escape accessible at any hour. But the emotional boost is short-lived, while the debt lingers far longer. What seemed like a “treat” becomes another stressor stacked on top of the sadness.

The Hidden Link Between Loss and Overspending

Major life events—like losing a job or ending a relationship—often spark spending surges. The urge to “take control” by buying something new can feel empowering, even if it’s self-sabotage. Sadness clouds the ability to prioritize necessities over wants. Instead of saving for recovery, funds get funneled into temporary pick-me-ups. That hidden link between emotional loss and financial loss keeps many people stuck in cycles.

Why Emotions Hijack Financial Logic

The brain processes emotional pain in ways similar to physical pain. To soothe it, quick solutions like shopping or eating out seem irresistible. Financial logic takes a backseat to instant comfort. When sadness is intense, even small decisions—like skipping a bill to fund a night out—feel justifiable. But those “just this once” moments pile up into larger money troubles.

The Vicious Cycle of Regret Spending

Spending to escape sadness often leads to guilt and regret. That guilt creates even more emotional stress, which can trigger further spending. The cycle repeats, making it harder to escape both sadness and financial strain. What started as an innocent comfort purchase can spiral into ongoing overspending. Breaking this cycle requires awareness of how emotions fuel financial habits.

How Financial Habits Collapse Under Pressure

Even disciplined savers can lose grip when emotions run high. Sadness weakens the routines that normally keep budgets balanced. Meal prepping gets skipped, and takeout orders pile up instead. Little lapses add up quickly, draining funds without much notice. The collapse doesn’t happen overnight, but it accelerates under prolonged emotional strain.

The Sneaky Role of Social Media

Scrolling through social media while sad can be dangerous for wallets. Ads target people at their most vulnerable with promises of instant joy. Seeing friends post luxury buys or vacations adds pressure to keep up. That pressure often translates into spending beyond means. What began as harmless scrolling can end in a shopping spree.

Emergency Spending That Isn’t an Emergency

During sad moments, almost anything can be labeled an “emergency.” A fancy dinner feels like therapy; a new outfit feels like a necessity. Redefining wants as needs is an easy trap in low moods. Money meant for real emergencies can vanish on temporary comforts. Later, when an actual crisis hits, the safety net is gone.

The Silent Impact of Financial Avoidance

Sadness makes people want to avoid stress, and money is stressful. Ignoring bills, skipping budget checks, or refusing to open bank apps feels easier. Unfortunately, avoidance usually amplifies the problem. Missed deadlines rack up fees and penalties, digging the hole deeper. The silence of avoidance is often louder than any actual bill.

Breaking Free from Emotional Spending

Awareness is the first step to stopping sadness-driven overspending. Recognizing emotional triggers makes it easier to pause before purchases. Simple tactics, like delaying checkout for 24 hours, can help break impulsive habits. Replacing shopping with healthier coping methods also keeps cash safe. While emotions can’t always be controlled, responses to them can.

Rebuilding Confidence After a Financial Slip

Losing control of money during sad times doesn’t mean recovery is impossible. Small wins, like sticking to a budget for a week, rebuild confidence. Tracking progress shows that even minor changes make a difference. Emotional resilience grows alongside financial responsibility. Over time, the feeling of control returns stronger than before.

Sadness Doesn’t Have to Control Your Cash

Sad financial moments are real, and they can hijack even the most disciplined budget. Emotions push logic aside, making money choices more about relief than responsibility. But awareness, healthier coping habits, and small wins can stop the cycle before it spirals. Cash control comes back when emotions are acknowledged, not ignored.

Share your thoughts below—has sadness ever shaped the way money moved in your life?

You May Also Like…

5 Emotional Triggers That Ruin a Stackable Savings Routine

7 Quiet Moments When Your Spending Habits Reveal Deep Money Anxiety

10 Reward Systems That Penalize High-Spending Users

10 Smart Ways to Use Your Savings Apps Without Being Exploited

8 Phrases That Signal You’re Being Emotionally Manipulated

The post Can You Lose Control of Your Cash During a Sad Financial Moment? appeared first on Everybody Loves Your Money.