BigBear.ai Holdings (BBAI) is an artificial intelligence company that provides national security, supply chain management, biometrics solutions, and more.

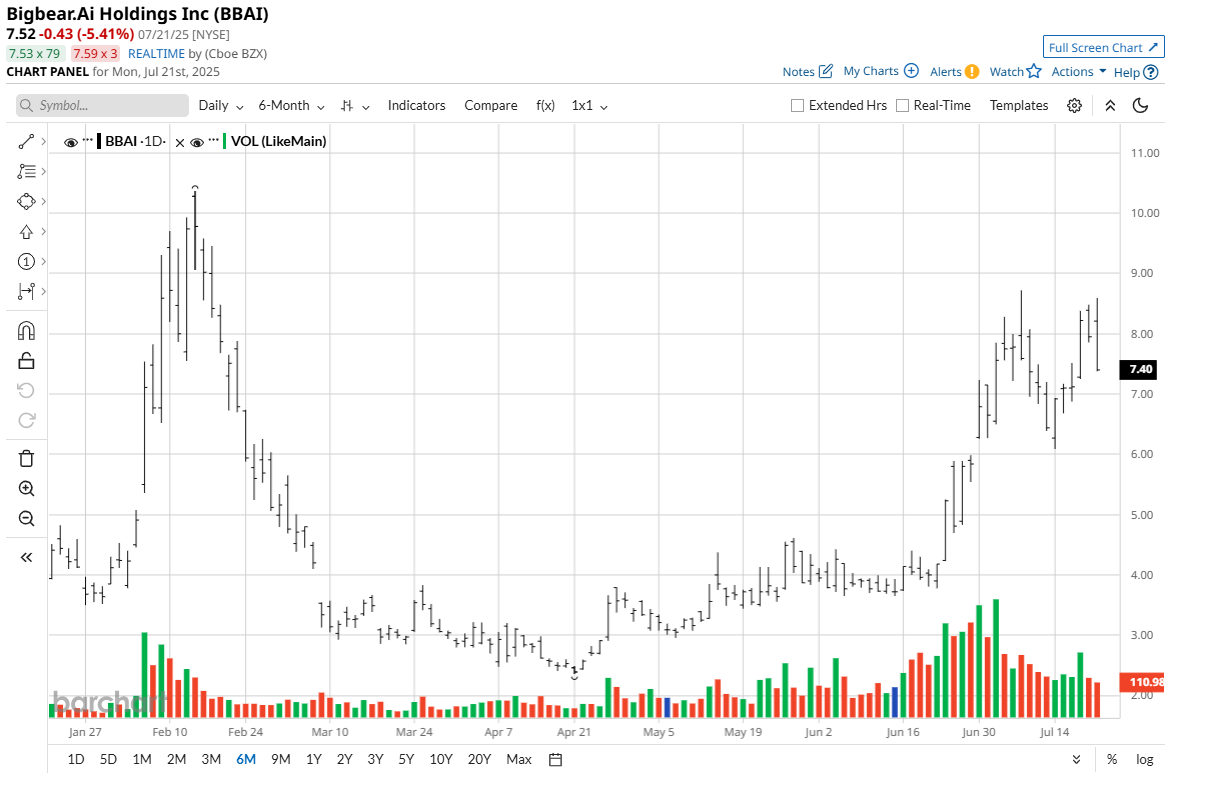

BigBear.ai’s stock has outperformed the broader market by a longshot, as shares have rallied 399% over the past year and nearly 66% in the year to date. In just the past month, shares are up 85% as Wall Street is increasingly turning its attention back to the underdog AI stock.

BigBear Posts Weak Results

BigBear.ai posted its first-quarter results on May 1, with a loss of $0.10 per adjusted share, wider than analysts’ $0.06 per share estimate. On the revenue side, BigBear generated $34.76 million, missing Wall Streets’ $35.88 million estimates despite growing 5% annually.

Gross margin during the quarter came to 21.3%, a slight improvement from 21.1% posted in the same quarter last year.

Now, despite missing estimates, BigBear AI reiterated its full-year 2025 guidance. For the full year, the company expects revenue between $160 million and $180 million.

Why BBAI’s Stock Continues to Rally

BigBear.ai is continuing its upward surge in the market, fueled by growing investor enthusiasm around artificial intelligence applications in the defense sector.

Several converging factors are contributing to the bullish sentiment. The broader macroeconomic environment has turned supportive, helped in part by expectations that the Federal Reserve may cut interest rates due to signs of economic cooling, such as the unexpected loss of 33,000 private sector jobs reported by ADP. Additionally, President Donald Trump continues to make progress on trade deals, also supporting investor sentiment.

BigBear.ai’s momentum also appears to be reinforced by fresh analyst coverage and product demonstrations. Notably, H.C. Wainwright recently reiterated a bullish stance on the stock, upgrading its one-year price target from $6 to $9 per share, reflecting 22% upside potential despite recent gains. The firm believes BigBear.ai is well-positioned to capitalize on upcoming defense-related contract wins and expects operational improvements in the second half of the year.

While excitement is high, the company still has hurdles ahead. Last quarter’s modest revenue growth of just 5% indicates that BigBear.ai will need to deliver stronger financial performance to justify its current valuation, with a price-sales ratio at 15x, and maintain investor confidence. Still, the confluence of defense tailwinds, market optimism, and favorable analyst outlooks is painting a compelling near-term picture for BBAI stock.

Should You Buy BBAI?

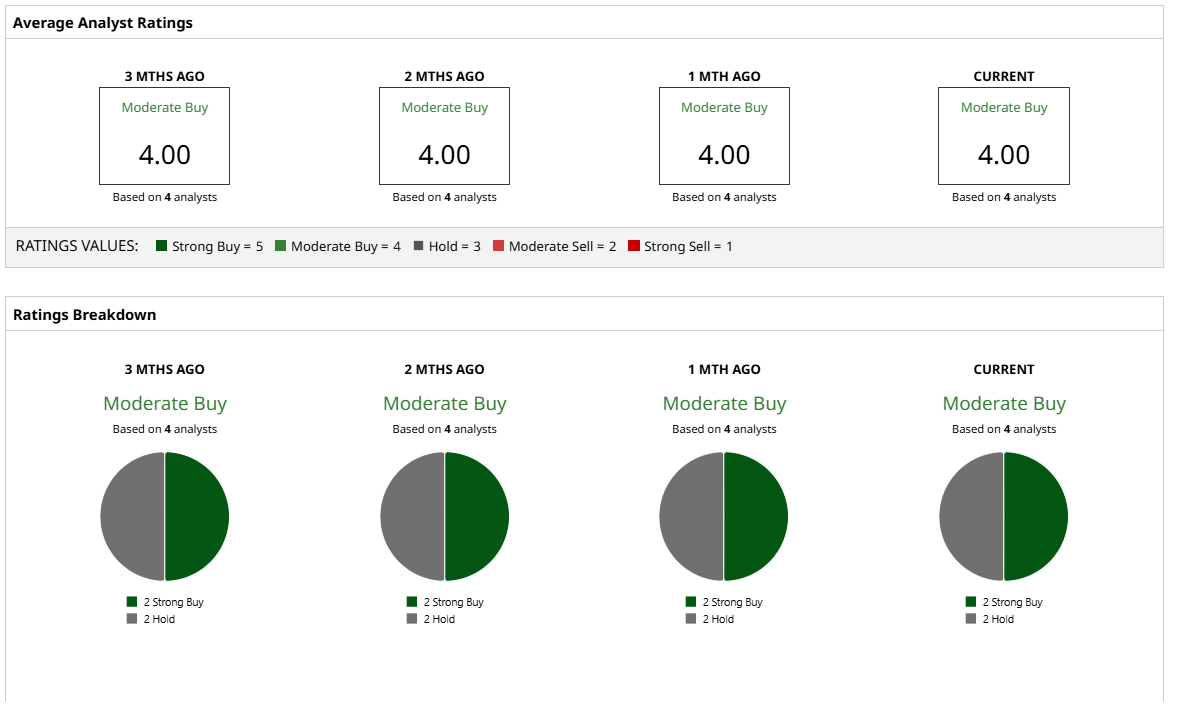

Analysts have a consensus “Moderate Buy” rating alongside a mean price target of $5.83, which is below its current market price. The stock has four analysts in coverage with two “Strong Buy” ratings and two “Hold” ratings total.